-

[경제] (Bloomberg) Gaza Won't Hamper Markets — Unless Israel Strikes Iran2023.10.09 PM 03:00

블룸버그 기사 요약

이번 이스라엘-팔레스타인 분쟁이 이란으로 확전되지 않는다면 금융시장에 미치는 영향은 제한적일 것

원유 공급 차질 우려로 유가의 하방은 제한되겠지만, 사태가 더 이상 악화되지 않는다면 급등은 없을 것

미국 공화당은 이스라엘을 강력하게 지지하는 경향, 따라서 예산안 통과를 계속 미루기는 어려울 것

→ 우크라이나/이스라엘 지원 예산 패키지 처리 예상

→ 방위산업 주식, 미국 국채(안전 자산)에 유리

미국 국채 금리, 단기 정점 가능성

화요일 JOLTs, 금요일 노동부 고용 보고서가 예상보다 강했지만, 국채 금리는 4.88%를 두 번 찍고 하락

이중 천정형 (기술적 분석) : 적어도 단기 고점은 지났을 가능성

이번 사태로 인해 국채 금리 단기 정점 가능성은 더 높아졌음

미국 국채 금리 단기 정점 (=미국 국채 가격 단기 바닥)

투자자들이 미국 국채를 매수하려면 주식을 매도해야 함

다만 미국의 재정적자는 국채 매수에 부담 요인

→ 미국의 GDP대비 국가 부채는 심각한 수준

→ 2008년 금융위기 이후 불황이 닥쳤던 2009년과 유사

→ 대규모 재정적자는 보통 불경기에 발생 (세금 수입 ↓, 실업 급여 ↑)

9월 비농업 고용이 예상치를 2배 가까이 초과했음에도 국채 금리가 급등하지 않은 이유

→ 임금 상승률이 예상치를 하회

→ 여전히 연준 목표치 대비 높은 수준이나 하락 추세 지속

→ 그럼에도 임금 상승률은 CPI보다 높음 = 실질 임금 상승 = 소비자 구매력 상승

→ 고용 증가, 물가 하락, 실질 임금 증가 = 골디락스?

이것이 의미하는 바는

① 국채 금리는 곧 상승을 멈출 것

→ 5%대 금리는 충분히 제약적인 수준

② 인플레이션이 통제되고 있음

이-팔 분쟁이 확전되지 않는다면, 시장의 관심은 목요일 발표될 9월 CPI로 이동할 것

========================================

This is as much Tet 1968 as 9/11. Either way, the statement Hamas just made rips down the frontiers of the game Israel thought it was playing.

2023년 10월 9일 오후 1:39 GMT+9

By John Authers

John Authers is a senior editor for markets and Bloomberg Opinion columnist. A former chief markets commentator at the Financial Times, he is author of “The Fearful Rise of Markets.”

Israel must come to terms with a radically new situation. Above: A resident in the border town of Sderot.

Photographer: Kobi Wolf/Bloomberg

An Elusive End Game in Gaza

Real life isn’t chess. What happened over the weekend in Israel and the Gaza Strip has involved bloodshed and death for innocent civilians in their hundreds. It’s nothing like a game played on a board with pieces shaped like knights and castles and the rest. All can agree that another human tragedy is unfolding in the Middle East.

However, it appears that there is a direct line from the geopolitical chess game, with each move made after thinking through the likely response, to the horrors of naked women being dragged along the street. Therefore, unfortunately, we need to look at this like a chess player. What Hamas has done in the last two days was far more extreme than anything it had done before. By deliberately targeting women and children so visibly and on such a scale and taking hostages, they’ve made it more or less impossible for Israel not to respond in a big way.

Given Gaza’s geographical p-osition, surrounded by an Israel that has vastly superior weaponry, this would seem to be bordering on the irrational. They have brought upon themselves the wrath of the Israeli Defense Force. What could possibly motivate Hamas to do this (other than abiding hatred, which is a constant)?

Hamas will be hoping for a much bigger response.Photographer: Ahmad Salem/Bloomberg

That is where the analogy of geopolitical chess comes in. This was unmistakably a move designed to provoke a response, and ideally an overreaction. The two best comparisons I can think of came in 1991, when Saddam Hussein fired missiles into Israel after the US-led allied forces began bombing Iraq. His aim was to provoke Israel into joining the conflict, and thereby bring other Arab nations into the war on Iraq’s side. The second came a decade later with the terrorist attacks of 9/11, an assault on the US so horrible that some response was certain.

Saddam’s gambit didn’t work. Israel refrained from getting involved, showing impressive restraint. Al-Qaeda’s stratagem in 2001 was all too successful, eventually prompting the US into its disastrous invasion and occupation of Iraq. Where Israel’s move this time falls on a continuum between those two reactions will determine how much this matters to the world of money.

As a general rule, outbreaks of conflict between Israel and the Palestinians in this century have had minimal impact on the oil price. This chart from Marko Papic of the Clocktower Group takes the average performance of oil over the period from 150 days before the outbreak of conflict until 150 days after:

Thankfully none of these extended beyond Israel and its immediate neighbors. That, it’s fairly clear, is what the backers of the Hamas offensive are hoping to change. There is no particular reason to believe that this time will have any significant impact on the oil price — unless Israel decides that it has to draw its security boundary much wider than its current borders. This chart from Independent Strategy expresses this as a series of concentric circles:

At this point, an Israeli response involving Gaza is inevitable, and further conflict involving Lebanon looks very likely. That opens the way to much loss of life; it would have very little impact on either the politics or the finances of nations further afield. Should Israel choose to involve Iran, that would be different; and any extension to involve Russia could change the world.

Why would this be the time for Hamas to attack? A high oil price will always embolden those who benefit from it. More to the point, the US is in the midst of diplomacy to try to coax Israel and Saudi Arabia into an alliance, probably in return for defensive guarantees. That would be great for the US and Israel, and terrible for Iran, which would thereby be isolated from the Arab world. Thus, this is the moment to provoke Israel into taking on Iran and disrupt the diplomacy with the Saudis. And indeed, the Wall Street Journal is already reporting that Iran helped plan the attack and gave the go-ahead for it last week — a story that makes escalation that much harder to avoid.

US diplomacy is put in a difficult spot.

Photographer: Yuri Gripas/Abaca/Bloomberg

The obvious historical parallel with the Yom Kippur War of 1973 that precipitated the Arab oil embargo might not be helpful in a world far less reliant on oil from the Middle East. According to Tina Fordham of Fordham Global Foresight, the worst-case scenario would an all-out confrontation between Israel and Iran:

"A return to the risk of direct military tensions — specifically the risk of Israeli attacks on Iran’s nuclear facilities — would likely have systemic impact, and could not be ruled out in the event the conflict widens. There is no danger of a repeat of the 1970s oil price embargo for all kinds of reasons, primarily the onset of US energy independence. But higher-for-longer oil prices would clearly feed into inflation concerns. Conflict is by nature inflationary; conflict in the Middle East, even more so."

What we should expect for now is that oil prices should rise somewhat, to recognize that risk of a major interruption to supply (caused by a war) has just increased. This should tend to put a “floor” under the price of crude, but little more than that for now. The way markets opened in the Asian morning is in line with this interpretation. Brent Crude bounced by about 4%, but that should be viewed in the context of the brutal selloff that preceded it. This conflict makes it harder to push the oil price down further; but the turmoil needs to escalate much further before it pushes oil up.

Within Israel, the accurate historical comparison might be with the North Vietnamese Tet Offensive in 1968. That was ultimately a military victory for the US — just as Israel is prohibitively likely to assert its dominance before this conflict is over. But by catching the Americans cold, and demonstrating that they didn’t have the control over South Vietnam that they claimed, it irrevocably shook politics back home. The Israeli intelligence failure here is unfathomable. That is bound to have an impact on its already dysfunctional politics, making its behavior harder to predict, and the situation more dangerous.

The situation could also have a perversely positive effect on the dysfunctional politics of the US. Republicans in Congress, who have just fired their House Speaker, tend to be strongly supportive of Israel. Former President Donald Trump even took the step of moving the US embassy from Tel Aviv to Jerusalem. This makes it politically much harder for the Republicans to shut down the government and block a budget deal when the next political deadline arrives Nov. 17, as explained here by Jason De Sena Trennert and colleagues at Strategas Research Partners:

"The folly of removing a Speaker of the House without cause is now showing its cost with a House of Representatives that cannot move forward until a new Speaker is selected. At the very least, the events of this week should prevent a government shutdown. The main fight in Republican politics will be over Ukraine funding. We can easily see a scenario where more Republicans argue for less Ukraine funding given other needs. But the more likely outcome, at least our gut says right now, is for a joint Ukraine/Israel funding package that is needed. Under the debt ceiling deal, the base Defense budget is set to increase more than 3%. If no budget agreement is reached, Defense could see a 1% cut. That cut seems unlikely to us today."

At this point, the problem of getting the embarrassingly badly behaved Congressional Republicans to sort themselves out seems almost as intractable as the Israeli-Palestinian conflict. It is just about possible that Hamas has now forced them to stop playing legislative games.

Being cold-blooded, this adds to the reasons to believe that defense stocks are a “buy” from here. As for the broader economics, uncertainty like this can reliably create some demand for Treasury bonds as a safe haven, particularly when they look cheap. The latest moves of Treasury bond futures, at the time of writing, suggest that this shock pushed up prices (and therefore pushed down yields), but within about an hour the market was back where it was before the US employment data for September was published Friday morning:

As it stands, the shock from Gaza has almost exactly counterbalanced the shock from very strong US employment data. And on that note...

Bonds. Sold Bonds.

Now for a race through what had occurred in the global bond market before the Middle East commanded our attention. Last week, surprisingly strong data on US employment, on Tuesday and again on Friday, pushed up 10-year Treasury yields to their highest since 2007. That prompted the Bank of Japan to buy bonds, after the country had intervened to keep its currency from weakening too much.

The point for traders may have been that the yield twice made big highs and appeared to be moving toward 5%, but then subsided. For technicians, this might imply that the yield won’t go higher for now, and the new dose of geopolitical uncertainty will strengthen their confidence:

This continues to be almost entirely about real yields (after expected inflation), rather than about any expectation that inflation will rise. This is true both of the US and of Germany, where real yields had been deeply negative until very recently. The tightening is real, and global:

However, there is one slightly nerve-wracking sign that inflation isn’t slain yet. Inflation breakevens for the next five years have subsided and are now almost perfectly in line with the Fed’s 2% target. This is significant as last year they broke 3%. However, the so-called five-year/five-year breakeven, predicting average inflation for the five years that start five years from now, is rising, having been quiescent for much of the inflation scare to date. This isn’t cause for any great terror, but it does suggest that the market is slowly adjusting to a scenario in which price rises will settle in at a higher level in future:

What was an investor to do about this? To an extraordinary extent, the winning play has been to buy US stocks relative to bonds. Using the most popular exchange-traded funds that track the S&P 500 (SPY), and Bloomberg’s aggregate index of long Treasuries (TLT) as a proxy, betting on stocks to beat bonds has been the trade that kept giving, almost without interruption, ever since the worst of the pandemic in March 2020:

Falling bond prices don’t necessarily mean higher share prices. Correlations between the two vary widely over time, but higher yields are problematic for many companies. So, just as the bond market might show some signs of having gone as far as it can for now, the same looks to be true of stocks. If bonds are a buy at this point, it’s probably necessary to sell some stocks to buy them.

And then there’s the issue of whether bonds really are a buy. The US deficit, as a proportion of gross domestic product, is now almost as severe as it was in 2009, during the recession that followed the financial crisis. This is unusual at a time of low unemployment, as big deficits are generally driven by the lower tax receipts and higher welfare payments that come with high joblessness:

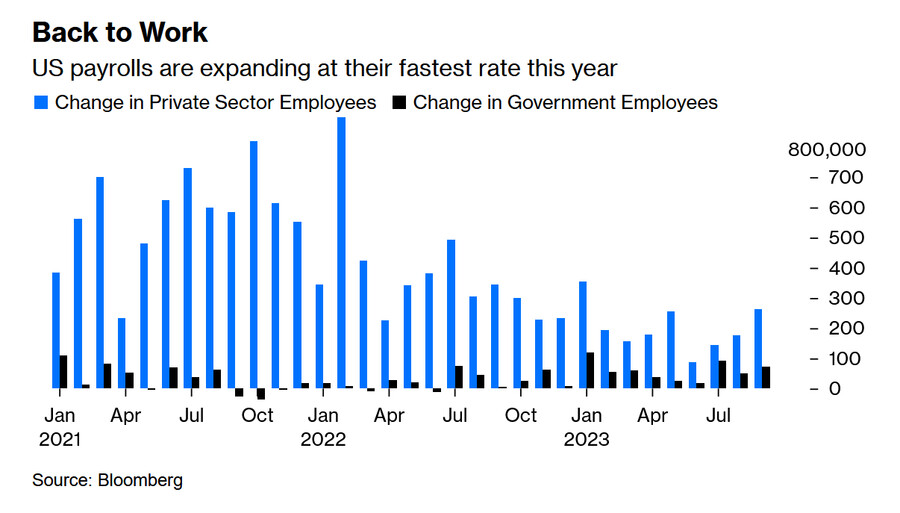

That in a nutshell is why the market reacted by selling off bonds aggressively to shockingly strong employment data Friday morning. As the world braced for monetary policy to take belated effect and push down employment, the data suggest the opposite was happening. The survey is prone to revision, but there seemed little denying that this was the strongest month for job growth this year. A declining trend in employment (which policy was designed to achieve) has now turned into a rising one:

Why did the bond market calm down on Friday? Reflection pointed to a number of points in the report that showed that high employment was causing surprisingly little stress. In particular, wage growth, at just over 4%, remains too high for the Fed’s liking, but it’s plainly declining. And as wage rises are now back where they should be, above consumer price rises, that might mean something like Goldilocks has returned after the switchbacks of the pandemic. Maybe, just maybe, we’re emerging into a world where people have work, and the pay they receive buys more each year:

Virtually everyone (with the possible exception of Republican political strategists) would welcome this scenario. How realistic is it? It implies first that Treasury yields will soon stop their ascent, as 5% interest rates make many things much harder. It also implies that inflation really is under control. Barring a major escalation in the conflict in Israel, attention will soon move on to the next big show, which is the publication of September US inflation data on Thursday.

—Reporting by Isabelle Lee

user error : Error. B.