-

[경제] '전기차 생각보다 안 팔리네'…하이브리드 부활 신호탄?2023.10.16 PM 02:08

[에너지경제신문 박성준 기자] 세계 최대 자동차시장 중 하나인 미국에서 전기자동차의 인기가 갈수록 식어가고 있다. 얼리어답터들이 전기차 구매를 이미 마친 상황에서 일반 소비자들이 전기차 구매를 망설이는 것이 전반적인 시장 둔화로 이어지고 있는 것이다.

업계에선 다양한 인센티브 제공을 통해 대응에 나서고 있지만 일부 업체들은 시장에서 부활의 조짐을 보이는 하이브리드 차량에 눈길을 돌리고 있다.

15일(현지시간) 미 월스트리트저널(WSJ)에 따르면 지난 1월부터 지난달까지 미국에서 전기차 판매량이 전년 동기대비 51% 증가했다. 그러나 판매 속도는 작년에 비해 둔화되고 있어 전기차 재고가 불어나고 있는 것으로 나타났다.

WSJ는 "전기차에 대한 구매자들의 관심이 예상보다 얕은 것으로 확인됐다"며 "전기차 판매를 늘리려는 업계는 냉혹한 현실에 직면하고 있다"고 지적했다.

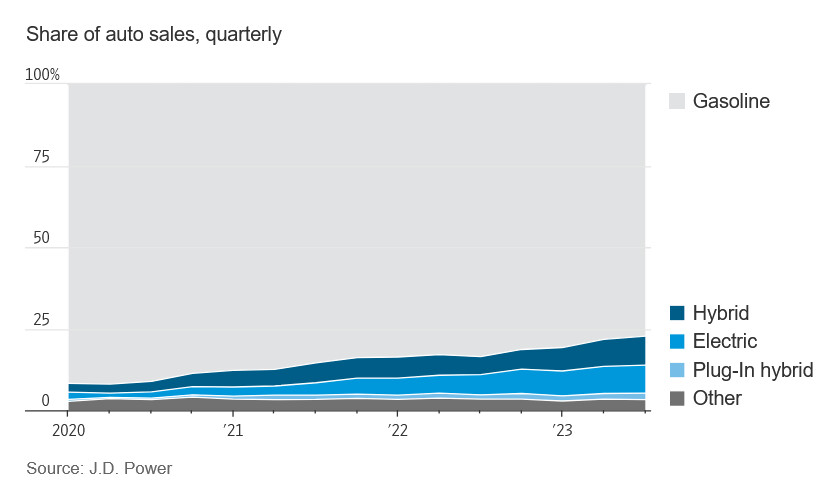

WSJ는 또 데이터 분석업체 JP파워의 자료를 인용해 "지난 몇 개월 동안 전기차 판매 비중은 약 9% 수준이 유지됐다"며 "업계가 단기적 주춤인지 장기적 도전에 직면하고 있는지에 대한 의문이 제기되고 있다"고 밝혔다.

포드의 존 로울러 최고재무책임자(CFO)는 지난달 콘퍼런스에서 전기차 도입률과 관련해 "곡선이 생각했던 것보다 가파르지 않다"며 "약간 평탄화되고 있는 것 같다"고 말했다.

업계에서는 얼리어답터들이 비싸더라도 전기차를 이미 모두 구매한 상황이라며 자동차 업체들은 구매를 주저하는 소비자들을 대상으로 설득하는 단계로 넘어왔다고 관측한다. 그러나 전기차 가격은 여전히 비싼데 이어 주행거리 불안으로 충전을 자주 해야 하는 불편함 등이 시장 확대에 큰 걸림돌로 작용하고 있다.

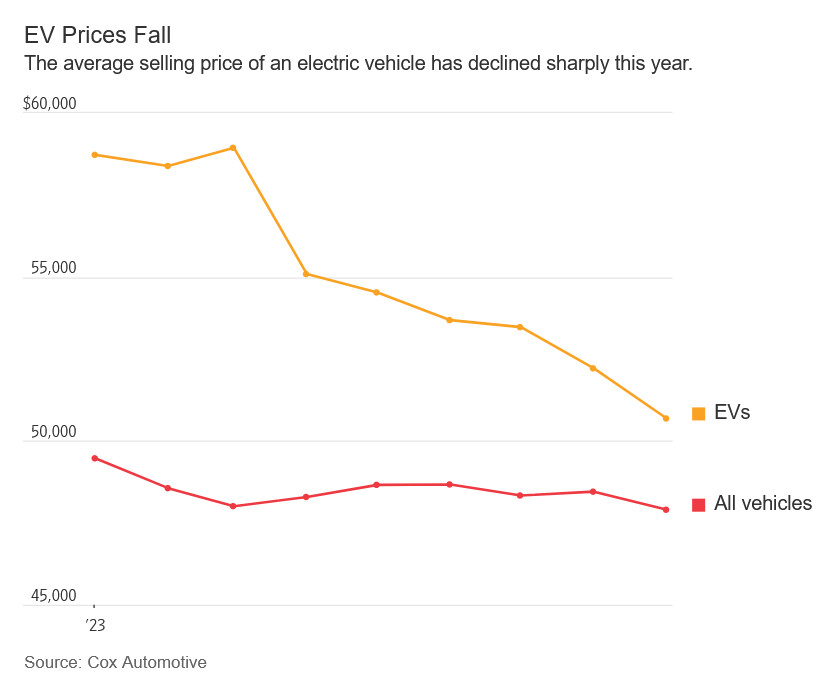

시장조사업체 콕스오토모티브에 따르면 지난달 미국에서 판매된 전기차 평균 가격은 5만 683달러로, 작년 9월(6만 5000달러)에 비해 대폭 낮아졌다. 그러나 대부분의 소비자들은 차량 구매에 4만 달러대 이하를 지불하는 것에 익숙한 만큼 전기차 가격이 더 떨어져야 한다는 지적이 나온다. 여기에 미 연방준비제도(Fed·연준)의 고금리 장기화 기조도 전기차 구매를 망설이는 요인으로 거론된다.

미국 주요 딜러사 중 하나인 갈핀 모터스의 뷰 보엑만 회장은 "얼리어답터들이 그랬던 것과 같은 속도로 대중이 전기차를 채택할 것이란 약간의 낙관적인 생각이 있었다"며 "소비자들은 전기차를 사기 위해 문을 두드리고 있지 않다"고 주장했다.

이로 인해 전기차 재고는 갈수록 늘어나고 있다. 실제 리서치업체 모터 인텔리전스에 따르면 지난달 기준, 포드가 보유한 머스탱 마하-E 재고는 3.5개월치로 기록해 업계 평균치를 더 배 넘게 웃돌았다. 현대·기아차, 폭스바겐 등도 지난달 전기차 재고가 전년 동기대비 큰 폭으로 증가했다고 WSJ는 전했다.

이에 따라 완성차 업체들은 다양한 인센티브를 제공하면서 수요 둔화에 대응하고 있다. 현대차의 경우 전기차를 구매할 때 가정용 충전기를 무료로 제공하고 설치비를 할인해 약 1100달러의 비용절감 효과를 내는 프로모션을 최근 시작했다. 현대차는 또 리스 프로그램을 포함한 다양한 할인 혜택을 제공해 소비자들을 계속 끌어들일 계획이다. 현대차 북미 사업을 총괄하는 랜디 파커는 "우리는 시장에서 경쟁력을 유지해야 한다"고 강조했다. 기아차, 폭브바겐 등도 이런 성장 둔화세가 단기적이라며 수요는 여전히 견고하다는 입장이다.

일부 업체들은 소비자들 사이에서 인기가 두드러지는 하이브리드 차량 확대에 주력하고 있다. 모터 인텔리전스에 따르면 지난 1월부터 9월까지 하이브리드 차량 판매량이 전년 동기대비 48% 급등했다. ‘전기차 열풍’의 여파로 지난해 1월∼9월 하이브리드 판매량이 2021년 동기대비 6% 감소한 것과 상당히 대조적이다.

일본 도요타자동차의 북미 사업을 총괄하는 데이비드 크라이스트는 "최대한 많은 하이브리드와 플러그인하이브리드(PHEV)를 만들기 위해 노력하고 있다"고 말했다. WSJ에 따르면 지난달 도요타의 프리우스 하이브리드 재고는 1주치를 소폭 웃돌은 반면 최초 순수 전기차인 bZ4X 재고는 2개월치를 넘은 것으로 나타났다.

포드는 전기차 생산 목표를 낮추는 동시에 하이브리드 생산을 확대할 계획이다. 포드는 연간 전기차 60만대 생산 목표를 올 연말에서 내년까지로 연기하고, 2026년까지 연간 전기차 200만대 생산 목표는 폐기한 상태다. WSJ는 또 "포드가 공장을 F-150 라이트닝 전기차 생산시설로 전환하려는 계획을 취소하는 것을 고려하고 있다"고 최근 보도했다.

이와 동시에 블룸버그통신에 따르면 포드는 약 3년 전 출시한 F-150 하이브리드 모델 생산량을 두 배로 늘리고 가격을 1900달러 내렸다. 야심차게 추진했던 전기차 계획을 줄여 향후 5년에 걸쳐 하이브리드 판매량을 4배 늘리겠다는 전략이다.

============================================

(WSJ) Automakers Have Big Hopes for EVs; Buyers Aren’t Cooperating

https://www.wsj.com/business/autos/electric-vehicle-buyer-interest-67b407cb

Sales growth has slowed in the U.S. as car companies are finding a limited pool of consumers willing to pay more for these models

By Sean McLain

Oct. 15, 2023 5:30 am ET

Ford says supplies for the Mustang Mach-E have steadily increased since June after a planned factory shutdown.

PHOTO: NICK HAGEN FOR THE WALL STREET JOURNAL

The auto industry’s push to boost sales of electric vehicles is running into a cold, hard reality: Buyers’ interest in these models is proving shallower than expected.

While EV sales continue to grow—rising 51% this year through September—the rate has slowed from a year earlier and unsold inventory is starting to pile up for some brands.

Some car companies, such as Ford Motor and Toyota Motor, are tempering their expectations for EVs and shifting more resources into hybrids, which have been drawing consumers at a faster clip.

The first wave of buyers willing to pay a premium for a battery-powered car has already made the purchase, dealers and executives say, and automakers are now dealing with a more hesitant group, just as a barrage of new EV models are expected to hit dealerships in the coming years.

“The curve isn’t accelerating as quickly as I think a lot of people expected,” said John Lawler, Ford Motor’s chief financial officer at a conference in September, on the EV adoption rate. “We’re seeing it flatten a bit.”

The abrupt slowdown in EV sales is a contrast to a year ago, when carmakers found themselves caught off guard by long waiting lists for battery-powered cars and trucks. It is also a troublesome sign for the car manufacturers plowing billions of dollars into building factories and battery plants to support what they hope will be a strong pickup in demand for plug-in models.

In recent years, the auto industry’s pivot has accelerated, prodded by Tesla’s meteoric rise and tougher regulations globally on tailpipe pollutants, including outright bans on gas-engine cars in the coming years.

The Biden administration has made EVs a centerpiece of its industrial policy, and the United Auto Workers union is on strike at the Detroit car companies, in part because it is worried about future job security as engine and transmission plants disappear.

Still, many consumers are reluctant to make the switch, deterred by high sticker prices and the inconvenience of driving a vehicle that has a limited range and needs regular recharging.

“I just wasn’t ready to get an electric yet, because of range anxiety,” said Robert DuWors, who was recently in the market and had considered a battery-powered car. He instead bought a plug-in hybrid, noting that it gets 40 to 50 miles on a single battery charge, more than he drives in an average day.

“When I use that up, then it is a hybrid,” said the 64-year-old resident of Rancho Mirage, Calif.

The share of the retail market held by EVs has leveled out at around 9% for the past several months, according to data analytics firm J.D. Power, raising broader questions about whether the industry is confronting a short-term blip or a more protracted challenge.

Carmakers are reacting to the slackening demand by cutting prices and offering discounts on EVs.

Some are resetting ambitious forecasts. Ford pushed back a plan to produce 600,000 EVs annually to late 2024 instead of the end of this year, and The Wall Street Journal reported Friday that it is considering canceling a shift of factory production on its electric F-150 Lightning pickup as sales for that model falter.

Hyundai Motor, which has been aggressive in adding new EVs to its lineup, is offering a free charger to attract buyers, along with a discount to install it, a promotion worth about $1,100.

EV market leader Tesla has also wrestled with slowing global sales this year, despite steep price cuts across its lineup.

Industrywide, the average price paid for a battery-powered vehicle was $50,683 in September, compared with $65,000 during the same period last year, according to Cox Automotive, an industry services firm.

For many consumers those upfront costs remain too high, especially with interest rates going up, dealers and analysts say. Prices will likely have to come down to appeal to a wider range of car shoppers, many of whom are accustomed to paying under $40,000 for a new vehicle.

“There was a bit of exuberant thinking that the market would adopt EVs at the same rate early adopters were,” said Beau Boeckmann, president of Galpin Motors, which owns one of the largest Ford dealerships in the U.S.

The electric Mustang Mach-E was the dealership’s top-selling vehicle last month, but he still had unsold vehicles.

“Customers are not knocking down the door to buy them,” he added.

In September, Ford had a 3½-month supply of unsold Mustang Mach-E SUVs, more than double the industry average, according to research firm Motor Intelligence.

Hyundai, Kia and Volkswagen also saw sharp increases in their electric-vehicle inventories last month from the same period a year ago.

A Ford spokesman said the company’s EV sales remain strong—increasing 14.8% in the just-ended quarter—and the supplies for the Mustang Mach-E have steadily increased since June after a planned factory shutdown.

Tesla has wrestled with slowing global sales, like other companies.

PHOTO: ALBUQUERQUE JOURNAL/ZUMA PRESS

Kia attributed the current deceleration to “short-term market fluctuations,” and Volkswagen acknowledged the EV market in the U.S. has softened but said demand is still robust.

Some automakers, such as Hyundai and Kia, have been disproportionately hit by new restrictions that limit who can qualify for a $7,500 federal tax credit for EVs. Because these car companies build their EVs outside North America, they became ineligible for the incentive in August, making them more expensive for buyers.

As an offset, Hyundai has started to offer lease deals and other promotions to draw more buyers in, said Randy Parker, head of the Korean car maker’s North American business.

“We have to remain competitive in the marketplace,” Parker said.

EV startups are also feeling the pinch from slower-than-expected sales growth. Companies such as Rivian Automotive and Lucid Group find themselves with unsold inventory despite building relatively low numbers of vehicles at their factories.

The 2023 Toyota Prius Prime at the Washington, D.C. Auto Show.

PHOTO: MICHAEL BROCHSTEIN/ZUMA PRESS

Meanwhile buyers are gravitating to hybrids and plug-in hybrids, which combine a gasoline engine with battery power to save on fuel.

Hybrid sales in the year’s first three quarters jumped 48% over the prior-year period, according to Motor Intelligence, a reversal from last year, when hybrid sales fell roughly 6% compared with 2021.

“It’s a smoking-hot market,” said David Christ, head of sales for Toyota Motor’s North American business. Toyota has been slower to move to EVs than its rivals, preferring to promote hybrids, which are now in shorter supply.

Toyota, in September, had a little more than a week’s worth of Prius hybrids in stock, meaning many customers face long waits for one. By comparison, the Japanese automaker had a more-than-two-months’ supply of its newest electric SUV, the bZ4X, an indication those vehicles are starting to stack up at dealerships.

“We are trying to make as many hybrids and plug-in hybrids as possible,” Christ said.

user error : Error. B.