-

[경제] (블룸버그) S&P 500, 기술적 지표 무너지며 조정 구간 근접2023.10.28 PM 02:59

블룸버그 기사 요약

S&P 500 지수가 5월 이후 처음으로 4200선 아래로 밀렸음

4200은 기술적 분석 관점에서 매우 중요한 레벨이며 이를 하회할 경우 장기 매도세로 이어질 가능성

S&P 500 지수 4200선 아래에는 저가 매수를 부를 수 있는 기술적 지지선이 별로 없음

S&P 500은 목요일 장중 한 때 4130을 깼다가 반등했음

S&P 500이 4130 아래로 밀리면, 공식적인 조정 구간에 진입하는 것

기술적 레벨이 중요한 이유

빅테크의 높은 밸류에이션, 지정학적 위기, 이자율 급등에도 불구하고, 특정한 시기에서는 기술적 요소와 투자자 포지션이 단기 주가 흐름에 더 큰 영향을 미치기 때문

기술적 분석가들에 따르면, 비교적 좋은 실적에도 지난 8 거래일 가운데 7거래일 동안 하락한 지금이 바로 그런 시기

S&P 500의 200일 이동평균선인 4240이 매우 중요한 레벨

S&P 500이 4240선을 빨리 회복하지 못하면, 앞으로 몇 주 동안 하락 추세가 이어질 수 있음

200일 이평선은 투자자들이 강세장/약세장을 가늠하는 기준이기 때문

200일 이평선을 회복하지 못하는 반등은 힘을 잃는 경우가 많음

변동성 지수 (VIX)는 3월 은행위기 이후 처음으로 핵심 레벨인 20을 넘었음

문제는 4200과 지난 3월 저점인 3900 사이에는 기술적 지지선이 거의 없다는 것

3900선까지 밀리면, S&P 500 지수는 현재 수준에서 6% 하락

S&P 500 지수가 3~5거래일 연속 4200(200일 이평선) 아래에 머물면 약세장이 지속될 가능성이 높다는 의미

S&P 500 지수가 200일 이평선 아래에서 이틀 넘게 머물렀던 건 지난 금요일과 이번 주 월요일이 처음이었음

피보나치 되돌림은 기술적 분석에서 사용되는 기법으로, 가격이 추세를 되돌리거나 반전할 수 있는 주요 가격 수준을 파악하는 데 사용됨

S&P 500이 38.2% 수준인 4180 아래로 밀려면 50% 수준인 4050에서 반등이 일어날 가능성이 있음

시장의 폭이 넓어야 꾸준한 반등이 가능함

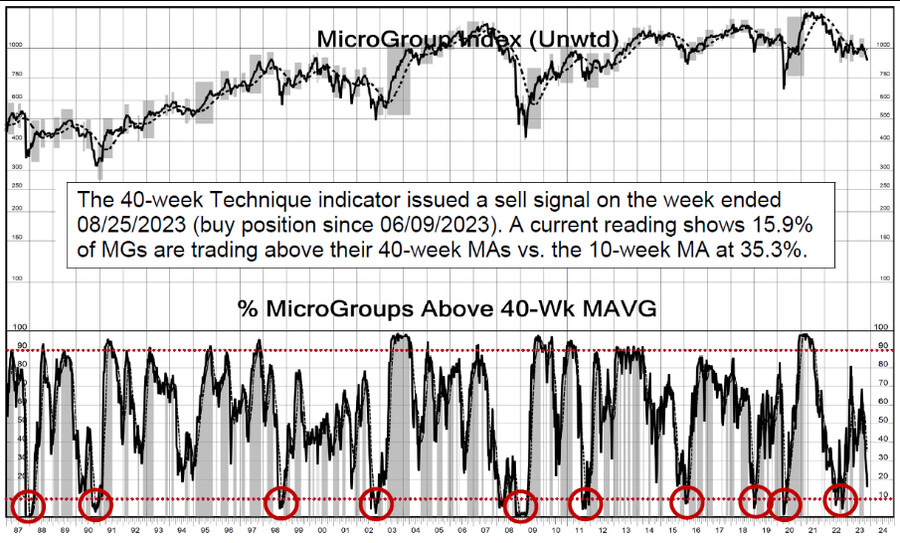

시총 2500만 달러 이상/주가 2달러 이상인 종목 중 14%가 40주 이평선 위에 있는데, 이 정도로 극심한 과매도 구간은 역사적으로 주가 저점과 일치했음

===============================================

(Bloomberg) S&P 500 Teeters on Brink of Correction as Technicals Break Down

Broad equities benchmark is down nearly 10% from July 31 peak

Index has few support levels before March lows around 3,900

Photographer: Spencer Platt/Getty Images North America

By Jess Menton

2023년 10월 27일 오전 1:50 GMT+9

Updated on 2023년 10월 27일 오전 2:43 GMT+9

The rout in US stocks has brought the S&P 500 Index to a crucial inflection point. It’s teetering near a correction after breaching 4,200 for the first time since May — a key technical level that may point to a longer-term selloff.

If the selling continues and the benchmark gauge for American equities stays below that psychological threshold, there are few levels to lure dip buyers, according to technical analysts, who monitor daily averages and other metrics to determine stock-market momentum.

The S&P briefly breached 4,130 during intraday trading Thursday before bouncing back above. The index would need to close below that level to mark its first official correction in over a year.

Technical levels are important because for all the handwringing over technology company valuations, geopolitical turmoil and the surge in interest rates, at some point technicals and p-ositioning take over the near-term stock-market price action. For chart watchers, now is one of those times, with the S&P 500 down seven of the past eight sessions despite a relatively strong earnings season.

A key level to watch is the S&P’s 200-day moving average at nearly 4,240. The index had stayed above it since March, the longest run since the post-pandemic surge in June 2020, but sank below last week. If it fails to recapture that level soon, chart prognosticators see it as a sign of an unfolding downtrend with the broader market poised for another bout of pain in the coming weeks.

“Bad things happen beneath the 200-day moving average because it means the trend in the stock market has changed,” Jay Woods, chief global strategist at Freedom Capital Markets, said in an interview. “This is a barometer of the health of the market.”

Traders use the 200-DMA to assess whether the longer-term trend is up or down. Rallies that failed to hold above the threshold often lose steam.

The CBOE Volatility Index, or VIX, is back above the key 20 level after trading below since the banking crisis in March.

For equity traders, the issue is there are few technical support levels below 4,200 until the March lows around 3,900, according to Andrew Thrasher, a technical analyst and portfolio manager at Financial Enhancement Group. That would mark a nearly 6% drop from where the index is now.

To determine if the bears are firmly in control, Thrasher is watching to see if the S&P 500 closes below its 200-DMA or 4,200 for at least three to five consecutive sessions. Thus far, the index has only posted back-to-back sessions below its 200-DMA on Friday and Monday.

“We’re still not seeing a lot of fear,” said Thrasher, who is watching for whether the S&P 500 will close below 4,170, which is the average closing price for the index over the past year. “The lack of volatility signals not everyone is dumping stocks that would show capitulatory selling. This selling has been driven most by the ‘Magnificent 7’ stocks, which make up a huge amount of the market and the market can’t rally without them.”

Source: Craig Johnson, managing director and chief market technician at Piper Sandler

Todd Sohn, managing director of ETF and technical strategy at Strategas Securities LLC, is monitoring the 4,180, which the S&P 500 breached on Thursday. For traders who follow Fibonacci analysis, that level represents a 38.2% retracement. From there, the S&P 500 would need to fall to around 4,050 — the midpoint of the peak-to-trough decline from its October intraday lows to July highs.

For signs of a durable rally, technicians want to see market breadth continue to expand. About 14% of US-traded stocks with a market value greater than $25 million and a share price above $2 remain above their simple 40-week moving average — an extreme oversold reading that has historically coincided with market lows, according to Piper Sandler’s Craig Johnson.

“Undercutting 4,200 isn’t the end of the world for the S&P 500,” said Johnson, who is betting that the S&P 500 will rally to 4,825 by year-end as buy signals emerge with investors growing overly pessimistic. “This is so bad, it’s good for stocks.”

user error : Error. B.