-

[경제] 요동치는 美 국채시장…'20년 만에 투자 기회 찾아왔다'2023.11.04 PM 04:05

최근 미국 국채 금리가 요동치자 헤지펀드들이 앞다퉈 국채 시장에 발을 뻗고 있다. 금리 변동성을 활용한 투자로 단기 수익을 늘리기 위해서다. 국채 약세에 거액을 베팅하면서 수익률을 끌어올리고 있다. 잠잠했던 국채 시장에 격변이 일어나고 있다는 평가가 나온다.

블룸버그는 헤지펀드 매니저들이 앞다퉈 국채 투자 비중을 늘리기 시작했다고 지난 31일(현지시간) 보도했다. 미 중앙은행(Fed)에 따르면 지난해 말 기준으로 헤지펀드의 국채 보유 규모는 전년 대비 3배 증가한 2조 3000억달러를 기록했다. 역대 최대치다. 국채 투자 규모가 확대되면서 증권사와 자산운용사에서 헤지펀드로 이직하는 행렬도 불어났다.

헤지펀드 롱테일 알파의 창업주 바이니어 반살리는 블룸버그에 "20년 만에 헤지펀드가 국채 시장에 진입할 수 있는 적기가 찾아왔다"며 "국채 거래량을 작년보다 4배 이상 늘렸다"고 말했다.

헤지펀드는 주로 '베이시스 트레이드'를 활용해 단기 수익을 챙겼다. 베이시스 트레이드는 국채 현물을 매수하고 선물은 공매도하는 투자방식이다. 금리가 상승(국채 가치 하락)하게 되면 차익을 얻는다. 연기금과 보험사 등 기관투자가들이 Fed의 피벗(정책 전환)을 기대하고 미 국채 선물을 매수하는 것을 노린 전략이다.

헤지펀드가 투자 비중을 늘린 배경엔 변동성이 있다. 국채 시장의 변동성이 급격히 증가하자 단기 차익 거래로 수익률을 끌어올렸다. 지난 23일 기준으로 30년 만기 미 국채의 하루 금리 변동폭은 평균 0.13%포인트를 기록했다. 지난 10년간 평균값의 3배에 달한다.

변동성이 증가한 원인이 Fed의 양적 긴축(QT) 때문이라는 주장이 나온다. 2008년 금융위기 이후 10년간 국채 매입량을 늘렸던 Fed는 지난해 6월부터 대규모 대차대조표 축소를 추진했다. 국채 보유액을 매달 950억달러씩 축소하기 시작했다. 예금 인출 압박에 상업 은행도 덩달아 국채 보유량을 줄였다.

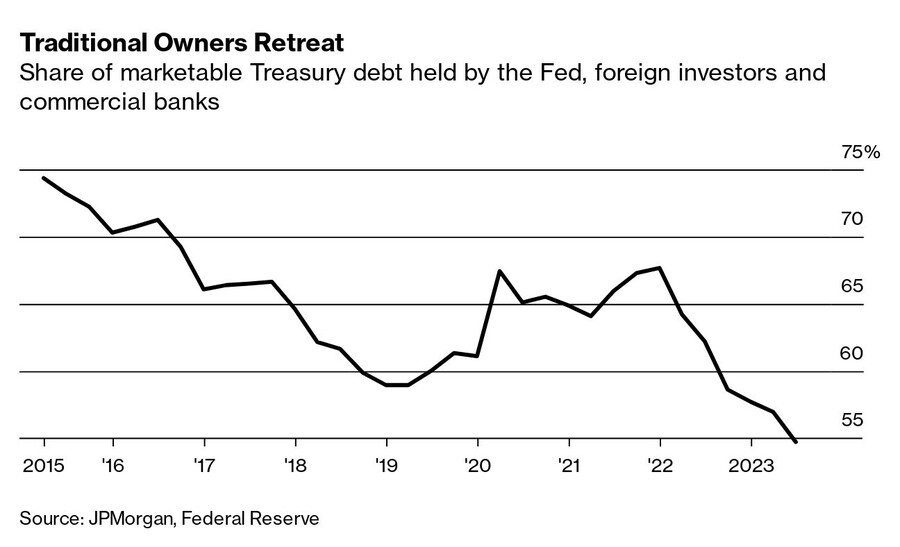

시장의 완충재 역할을 했던 기관투자가의 미 국채 보유 비중은 2021년 말 67.7%에서 올해 6월 말 54.7%까지 줄었다. 또 단기간 차익을 거두려는 헤지펀드가 시장에 속속 진입하면서 변동성이 빠르게 증가했다는 분석이다. 국제결제은행(BIS)에 따르면 현재 헤지펀드가 순매도 포지션을 취한 국채 규모는 6000억달러로 추산된다.

대럴 더피 스탠포드대 경영학 교수는 "헤지펀드들이 약세에 베팅하면서 시장의 위험이 증가하고 있다"며 "규제 당국이 그냥 지나치기에는 너무 큰 금액이다"라고 경고했다.

반면 일각에서는 미 국채가 강세장에 진입할 것이란 관측이 나온다. 앞서 빌 애크먼 퍼싱스퀘어캐피털 회장과 빌 그로스 등 미 월가의 대가들도 지난달 국채 가치가 다시 상승(금리 하락)할 것이라고 예측한 바 있다. 미국 경기가 둔화하면 금리가 자연히 하락할 것이란 이유에서다.

미 월가의 대가 투자자로 불리는 스탠리 드러켄밀러는 지난달 25일 로빈후드 투자 콘퍼런스에서 미국 단기 국채에 대한 매수 포지션을 취했다고 밝혔다. 2020년 이후 3년 만에 국채 투자를 추진했다. 드러켄밀러는 "코로나 팬데믹 당시 뿌려진 가계 보조금이 고갈되고 원유 가격이 반등하며 경기 둔화 가능성이 커지고 있다"며 "경기 둔화가 본격적으로 시작되면 2년 만기 국채 금리는 3%대까지 떨어질 것"이라고 설명했다.

======================================

World’s Safest Market Becomes a Magnet for Big Investors

US government debt was once among the sleepiest corners of finance. No longer.

Illustration: Tiago Majuelos for Bloomberg Businessweek

Vineer Bhansali doesn’t sleep much nowadays. Nor is he getting in as many of the long-distance runs that he loves. But he’s having the time of his life.

Bhansali is the founder of LongTail Alpha LLC, a hedge fund in Newport Beach, California, and he’s newly obsessed with what was once among the sleepiest corners of finance: Treasury bonds. With volatility exploding in the long-placid market, he’s ordered his fund to shift away from other strategies and boost its focus on Treasuries. LongTail now buys and sells bonds constantly, he says, making four times as many trades as it did a year ago.

Vineer Bhansali.Photographer: Max Hemphill for Bloomberg Businessweek

A self-confessed adrenaline junkie, Bhansali wakes up every two hours at night to check prices after being glued to his screens all day. “You have to be on it, because things are happening all the time,” he says. “This is probably one of the best times to get in the bond market in 20 years.”

For much of the past two decades, most US government debt was sequestered in the vaults of the Federal Reserve, foreign central banks and commercial lenders that used it as a kind of cash reserve. At the peak of the easy-money era, the Fed vacuumed up $100 billion a month in Treasuries and mortgage securities, blindly buying and holding to maturity whatever was offered, regardless of returns. Trading was quiet. Yields were pinned day after day at rock-bottom levels. Hedge funds, attracted by riskier investments that offered the promise of fatter profits, mostly stayed away.

Those days have been brought to an end by the post-pandemic surge in inflation. Now the Fed is letting the debt roll off its balance sheet and commercial lenders are outright selling their holdings. While that increases the fragility of the overall economy—risking even higher rates for consumer loans—it has made US government debt catnip for speculators such as Bhansali. These fast-money traders are much more price-sensitive and quicker to dump bonds at the slightest provocation: rising oil prices, an offhand remark by a Fed official, a change in the unemployment rate.

Hedge fund manager Bill Ackman made a very public bet against Treasuries over the past few months and moved the market when he closed it out on Oct. 23 over concerns about US growth prospects. And investor Stan Druckenmiller has taken what he calls a “massive” p-osition in two-year notes to hedge against a souring economy—though he's still bearish on longer-term bonds.

Unlike their less-active predecessors, the new buyers are likely to push yields ever higher to finance Washington’s swelling deficit, taking the market on a bumpier ride to get there. The result is a spike in Treasury yields—the benchmark used to set borrowing costs for consumers and companies—giving investors a chance to make (or lose) lots of money. “Bond volatility can and will provide tactical opportunities in the short run,” says Kathryn Kaminski, chief research strategist at Boston investment firm AlphaSimplex, who credits a bet against Treasuries for much of a gain of nearly 36% at one of the firm’s funds last year.

Price moves are dramatic and unpredictable, with the yield on 10-year US government debt on Oct. 23 surpassing 5% for the first time since 2007. Yields on 30-year Treasuries have been swinging by an average of about 13 basis points a day as, for instance, investors rush to buy to hedge the risk of escalating conflict in the Middle East or unexpectedly strong US economic data spurs a run for the exits. While 13 basis points—0.13%—may not sound like much, it’s more than triple the daily average of the past decade. Noting the increased activity of hedge funds in the market, the Treasury Department today tempered the pace of its planned increase in long-term borrowing. (미국 재무부 국채 발행 속도 조절)

The new buyers—whether you consider them a sign of healthy markets or call them vigilantes, as they were dubbed in the 1990s, the last time hedge funds got this charged about US government debt—are probably here to stay. Hedge funds have tripled their holdings of Treasuries to a record $2.3 trillion in the past year, Fed data show. New funds are being rolled out at the fastest level in more than a year, according to analytics firm Hedge Fund Research, and strategies designed to exploit price dislocations in bond markets are among the most plentiful. That’s leading to a hiring binge in the field, says Christian Hauff, chief executive officer at Quantitative Brokers, which sells trading programs to big-money investors. “They’re looking for more talent,” he says. “We have seen the movement of traders and portfolio managers from asset managers and banks to these hedge funds.”

Hedge funds have also been building p-ositions in basis trades, a risky investment that’s attracting scrutiny from researchers at the Fed and regulators such as the Bank for International Settlements. The strategy typically involves borrowing large sums of money to exploit small price differences. It can be perilous, because investors are exposed to sudden market moves and sharp jumps in funding costs. Hedge funds have amassed some $600 billion of net short p-ositions in Treasuries—bets that prices will go down—according to the BIS, increasing the danger to the economy. “The build-up of the basis trade now is too much for regulators to overlook,” says Stanford University finance professor Darrell Duffie.

The Fed, meanwhile, has been offloading as much as $60 billion in Treasuries a month. Also exiting are foreign banks that face prohibitively steep hedging costs and US commercial lenders compensating for flight by depositors. That’s brought the ownership of long-term holders, including foreign banks, below 55%—the lowest in more than two decades—versus 75% in 2014, according to JPMorgan Chase & Co. The Fed now has about $4.9 trillion in Treasuries, down from a 2022 peak of $5.8 trillion resulting from years of purchases following the 2008 financial crisis. “The infrastructure and the liquidity of the Treasury market is absolutely more fragile than it’s been in the past,” says Jay Barry, co-head of US rates strategy at JPMorgan.

That effort to revive the economy was great for struggling consumers, chief financial officers and politicians eager to borrow and spend ever-greater sums of money. But it helped trigger inflation unlike any the US has seen in decades. The new, more volatile era that the hedge fund crowd has ushered in stands to bring discipline to spendthrift ways in Washington and beyond—though that’s, of course, not the intent of the fast-money types. They’re just seeking big profits.

user error : Error. B.