-

[경제] 中의 무서운 ‘전기차 굴기’…비야디, 세계 1위 테슬라 첫 추월2024.01.02 PM 11:17

중국의 ‘전기차 굴기(崛起)’가 무섭다. 중국 전기차 기업 비야디(比亞廸·BYD)가 지난해 4분기(10~12월) 판매량에서 그간 부동의 세계 1위였던 미국 테슬라를 제친 것이다. 이 추세가 유지되면 BYD가 연간 판매량, 매출, 영업이익 등에서도 조만간 테슬라를 넘어 명실상부한 세계 1위 전기차 기업에 등극할 가능성이 있다는 분석이 나온다.

BYD는 과거 중국 내수 시장에 집중했지만 최근 유럽 등 해외에서 공격적인 마케팅을 벌이고 있다. 전통적인 자동차 강국 독일은 물론 스웨덴, 노르웨이 등에도 진출했다. 최근 동유럽 헝가리에 전기차 조립 공장을 건설하겠다는 계획도 공개했다. 2030년까지 유럽 전기차 시장의 10%를 차지하는 것을 목표로 하고 있다.

중국 당국이 세제 혜택 등 공격적인 지원 정책을 펼치고 있는데다 BYD가 배터리 생산업체를 자회사로 보유해 빠른 조달이 가능하다는 점도 판매 증가를 이끌고 있다는 평가가 나온다.

● 지난해 12월에만 34만 대 판매

BYD는 지난해 4분기에 순수 전기차(BEV) 52만6409대를 판매했다고 2일 밝혔다. 테슬라는 아직 같은 기간 판매량을 공개하지 않았으나 블룸버그집계에 따르면 약 48만3200대를 판매했을 것으로 추산된다. 석 달 동안 테슬라보다 4만3000여 대를 더 팔아치운 것이다.

특히 공격적인 판촉 정책으로 지난해 마지막 달인 12월에만 34만178대를 판매한 것이 순위 변동에 주효했다. 전년 동월 대비 45% 증가한 수치이며 월간 기준 역대 최다 판매량이다. 같은 해 3분기(7~9월)에는 BYD가 43만2000대, 테슬라가 43만5000대를 팔아 아슬아슬하게 테슬라가 1위를 차지한 바 있다.

영국 파이낸셜타임스(FT)는 “BYD의 순수전기차 판매가 분기 기준 테슬라를 처음으로 추월했다”며 “전기차 업계의 (순위) 지각 변동은 피할 수 없는 추세”라고 분석했다.

BYD는 순수전기차와 하이브리드 전기차를 합한 판매량 또한 지난해 4분기 석 달 내내 월 30만 대 이상을 유지했다. 이에 따라 지난해 전체로 BYD의 연간 판매량은 302만4417대로 집계됐다. 과거 5년간 누적 판매량과 맞먹는 수준이다.

● 정책 지원-쉬운 배터리 조달도 한 몫

중국 당국의 전기차 산업 육성 의지와 대규모 재정 지원도 BYD의 성장세에 날개를 달아주고 있다. 지난해 초 테슬라가 가격 할인에 나서자 중국 업체는 더 많은 할인율을 제시하며 수요 증가를 주도했다. 당국 또한 서구 자동차업체가 주도하는 내연기관차 대신 전기차에 각종 혜택을 부여하며 자국 업체를 후방 지원하고 있다.

BYD가 1995년 설립 당시 소형 배터리 제조업체로 출발한 점도 경쟁력을 강화시키고 있다. 2003년 기존 자동차 회사를 인수하면서 완성차 업계에 뛰어들었고 배터리 부문의 경쟁력을 바탕으로 빠르게 사세를 키우고 있다. 2022년 3월부터는 내연기관차 생산을 전면 중단하고 전기차 생산에만 전념하고 있다.

BYD를 비롯한 중국 전기차 기업은 세계 최대 규모의 내수 시장을 바탕으로 전 세계 시장을 속속 잠식하고 있다. 중국자동차공업협회에 따르면 지난해 전체로 중국 기업은 전기차와 하이브리드를 포함해 약 940만 대를 판매한 것으로 추정된다. 1년 전 690만 대에서 1.5배가량 늘어난 수준이다. 올해 판매량 또한 최소 1150만 대로 추정된다.

===============================================================================

(Bloomberg) Chinese Carmaker Overtakes Tesla as World’s Most Popular EV Maker

Elon Musk once scoffed at the notion that BYD could compete with his company. Now, the automaker run by billionaire Wang Chuanfu is poised to be the new No. 1 in electric vehicles.

By Danny Lee

2023년 12월 27일 오전 9:00 GMT+9

BYD exhibits its cars ahead of the Munich Motor Show in September.

Photographer: Krisztian Bocsi/Bloomberg

China’s BYD Co. bills itself as the biggest car brand you’ve never heard of. It might need a different tagline soon.

The automaker is poised to surpass Tesla Inc. as the new worldwide leader in fully electric vehicle sales. When it does — likely in the current quarter — it will be both a symbolic turning point for the EV market and further confirmation of China’s growing clout in the global automotive industry.

In a sector still dominated by more familiar names like Toyota Motor Corp., Volkswagen AG and General Motors Co., Chinese manufacturers including BYD and SAIC Motor Corp. are making serious inroads. After leapfrogging the US, South Korea and Germany over the past few years, China now rivals Japan for the global lead in passenger car exports. Some 1.3 million of the 3.6 million vehicles shipped from the mainland as of October this year were electric.

“The competitive landscape of the auto industry has changed,” said Bridget McCarthy, head of China operations for Shenzhen-based hedge fund Snow Bull Capital, which has invested in both BYD and Tesla. “It’s no longer about the size and legacy of auto companies; it’s about the speed at which they can innovate and iterate. BYD began preparing long ago to be able to do this faster than anyone thought possible, and now the rest of the industry has to race to catch up.”

BYD’s Wang Chuanfu greeting attendees at an event in Santiago on Oct. 6.

Photographer: Cristobal Olivares/Bloomberg

The passing of the EV sales crown also reflects the shift in competitive dynamics between Tesla’s Elon Musk, the world’s richest executive, and BYD’s billionaire founder Wang Chuanfu.

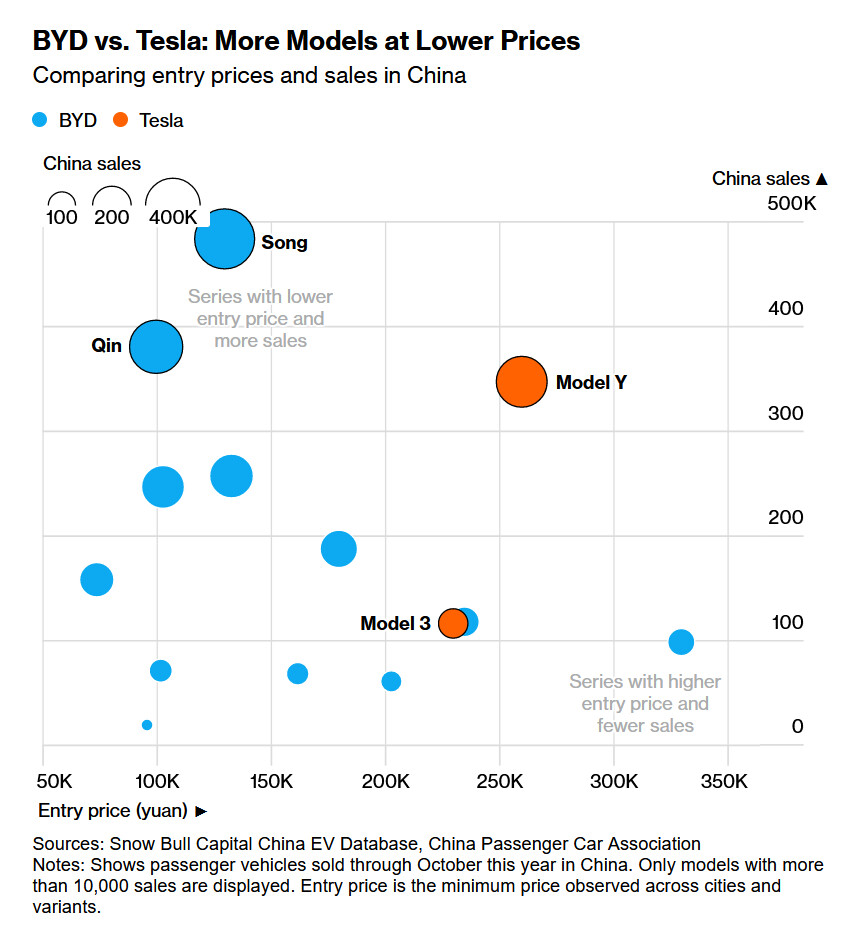

Whereas Musk has been warning that not enough consumers can afford his EVs with such high interest rates, Wang is firmly on the offensive. His company offers half a dozen higher-volume models that cost much less than what Tesla charges for its cheapest Model 3 sedan in China.

When a Tesla owners’ club shared a clip in May of Musk snickering at BYD’s cars during a 2011 appearance on Bloomberg Television, Musk wrote back that BYD’s vehicles are “highly competitive these days.”

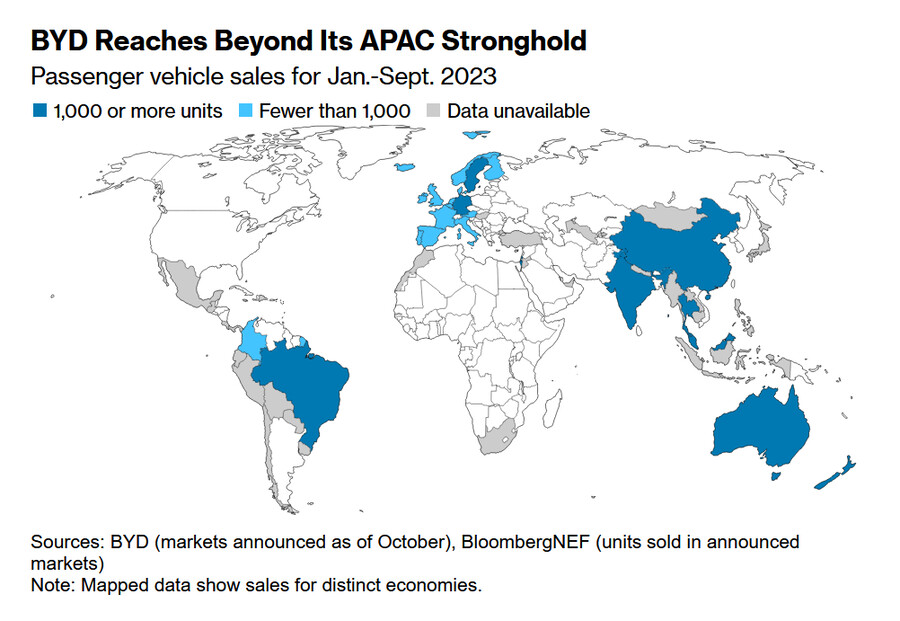

The likely change in the global EV pecking order marks the realization of a goal that Wang, 57, set back when China was just starting to foster its now world-beating electric car industry. While BYD continues to pull away from Tesla and all other auto brands at home, replicating its runaway success abroad is proving tricky.

Europe looks poised to join the US in slapping Chinese car imports with higher tariffs to shield thousands of manufacturing jobs. Other countries’ EV markets are still in their infancy and aren’t nearly as lucrative. Management views the US as virtually off-limits due to the escalating trade tensions between Washington and Beijing.

Wang is no Musk — he eschews social media and largely steers clear of the limelight. But in an uncharacteristically brash address delivered weeks before the European Union opened an investigation into how China has subsidized its EV industry, Wang declared the time had come for Chinese brands to “demolish the old legends” of the auto world.

While many car buyers outside of China are still only dimly aware of BYD, Warren Buffett surely isn’t. In 2008, Berkshire Hathaway Inc. invested about $230 million for an almost 10% stake in the Chinese automaker. When Berkshire started paring its holding last year — BYD shares were trading near their all-time high — the value of its stake had soared roughly 35-fold to around $8 billion.

The late Berkshire Vice Chairman Charlie Munger saw BYD primarily as a battery play. On Bloomberg TV in May 2009, he said the company was working on “one of the most important subjects affecting the technological future of man.” Munger’s family had invested in the company years ahead of Berkshire, and he told an interviewer weeks before his death in November that he had tried to dissuade Wang from getting into the car business.

BYD acquired a failing state-owned automaker in 2003 and introduced its first plug-in hybrid — called the F3DM — in 2008. A New York Times reviewer panned its exterior design, calling the compact “about as trendy as a Y2K-era Toyota Corolla.” The company sold all of 48 units in the first year.

Around that time, China started subsidizing plug-in car purchases. Support from the government extended from cities and provinces to the national level, spanning tax breaks for consumers, production incentives for manufacturers, help with research and development, and cheap land and loans.

A BYD F3DM plug-in hybrid at the 2010 Beijing Auto Show.

Photographer: Nelson Ching

As a rare automaker that also made its own batteries, BYD was uniquely p-ositioned to benefit. Before entering the car business, it was the first Chinese lithium-ion supplier to Motorola and Nokia in the early 2000s. To scale up output before consumers were embracing EVs, the company targeted automotive segments that would need lots of cells. Its first electric bus launched soon after the F3DM.

“BYD was a miracle,” Munger told the podcast Acquired in an episode that aired in October. He called Wang a genius, saying he kept the company from going broke by working 70-hour weeks, and described him as a fanatical engineer. “The guy at BYD is better at actually making things than Elon is,” he said.

Roughly a decade and a half into making cars, BYD had mustered the smarts to bring plug-in car prices down to levels comparable with combustion engine vehicles. But its lineup still lacked good looks.

In 2016, the company hired Wolfgang Egger as design chief, a role he previously played for Audi and Alfa Romeo. It also lured away other international executives, including Ferrari’s head of exterior design and a top interior designer for Mercedes-Benz.

By the time China invited Tesla to build the country’s first car plant fully owned by a foreign entity, BYD was no longer resigned to making no-frills econoboxes. Now, its most expensive model — the Yangwang U8 sport utility vehicle — costs 1.09 million yuan ($152,600).

A BYD Yangwang U8 electric SUV at the Shanghai Auto Show in April.

Photographer: Qilai Shen/Bloomberg

While the level of government subsidies has played a role in China’s tremendous EV growth, Paul Gong, UBS Group AG’s head of China autos research, believes the bigger factor is the level of competition that this support spawned.

“They have to work on the innovation, they have to try and find what consumers really want, and they have to optimize their costs to make sure their EVs are competitive in this highly competitive market,” Gong said. After tearing down a BYD Seal sedan and finding a 25% cost advantage over legacy competitors, his team concluded that Chinese manufacturers are likely to own a third of the global car market by the end of the decade.

For now, Tesla still has BYD beat on key metrics including revenue, income and market capitalization. Analysts at Bernstein expect some of those gaps to close considerably next year — they’re projecting Tesla will generate $114 billion in sales to BYD’s $112 billion.

Wang grew up the second youngest of eight children in the impoverished village of Wuwei in eastern China’s Anhui province. His parents died when he was a teenager, and his older siblings supported him through his high school and university education.

Through the early years of his working life, Wang was based in Beijing, working as a mid-level government researcher on rare-earth metals critical to batteries and consumer electronics. He founded BYD in 1995 in Shenzhen with the help of an almost $300,000 loan from a friend. He’s now worth $14.8 billion, according to the Bloomberg Billionaires Index.

Wang has racked up the air miles in 2023, crisscrossing the globe between auto shows, new market launches and meetings with heads of states. He’s touched down in countries including Japan, Germany, Vietnam, Brazil, Mexico and Chile — a travel schedule befitting the leader of a company that’s set up shop in some 60 countries and territories in just the last two years.

Analysts expect BYD to launch its third-generation EVs next year offering more technology, such as automated-driving capabilities. That’s one area where BYD falls short with its more affordable products versus upstarts like Nio Inc. and Xpeng Inc. Even as the number of auto rivals in China has shrunk from over 500 to around 100, new entrants continue to emerge, including well-funded tech giant Huawei Technologies Co.

When Bloomberg News asked Wang in March whether BYD had aspirations to be as big as Toyota, which in 2023 will be the world’s top-selling overall carmaker for a fourth straight year, he said the development of the EV industry will lead to an industry reshuffle.

“How a car company performs will depend on its tech and response,” he said. “BYD in China’s electrification is the winner for now, but how it will go tomorrow, we can’t say for sure. But we will lean into our advantages and keep making good products.”

BYD’s now-open showroom in the Mayfair district of London in September.

Photographer: Chris Ratcliffe/Bloomberg

But staying at the top will require a different mindset than getting there, said HSBC Qianhai Securities Ltd. head of China autos Yuqian Ding.

“When you become the No. 1, the mandate suddenly changes,” she said. “You’re going to redefine yourself — you’re going to have to find a way to beat yourself.”

user error : Error. B.