-

[금융/시황/전략] (Bloomberg) Here’s a Weight-Loss Plan for the Magnificent Seven2023.11.28 PM 04:35

블룸버그 칼럼 요약 (ChatGPT)

이 기사는 "Magnificent Seven"(Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia 및 Tesla) 종목에 대한 쏠림 현상에 대한 우려를 논의합니다. 이들은 S&P 500 지수의 약 29%를 차지합니다. 저자 John Authers는 1972년의 Nifty 50과 2000년의 닷컴 버블과 같은 역사적인 사례를 끌어와 시장 버블의 잠재적 위험을 강조합니다.

수익을 놓치는 것에 대한 두려움(FOMO)을 해결하면서 빅테크 주식에 대한 과도한 익스포저를 피하기 위해 Authers는 대체 전략을 고려할 것을 제안합니다. 한 가지 접근 방식은 시가 총액(market-cap) 가중치에서 벗어나 동일 가중치 인덱스를 고르는 것입니다. 예를 들어, 동일 가중치의 Nasdaq-100은 Magnificent Seven에 총 3.5%의 가중치만을 할당하면서도, 미국 기업의 EPS성장을 견인하는 종목들에 대한 익스포저를 제공합니다.

이 접근 방식을 뒷받침하기 위해 인용된 Societe Generale의 미국 주식 전략가 Manish Kabra는 시총 상위 성장주로 구성된 Nasdaq-100이 미국 기업의 주당 순이익(EPS) 성장에서 큰 비중을 차지한다는 점을 강조합니다. 또한 기사는 현재의 고금리 환경에서 대형주의 잠재적 이점(리파이낸싱)과, 동일 가중치 Nasdaq-100이 Magnificent Seven에 비해 밸류에이션이 저렴하다는 사실을 언급합니다.

그리고 이 기사는 Roundhill MEME ETF가 2023년 12월 폐쇄될 예정이라는 것을 간략하게 언급하면서, 고금리 여파로 인해 밈 주식의 열풍이 지나갔으며, 개인 투자자들은 MMF로 자금을 옮기거나 Magnificent Seven, 제로데이 (0DTE) 옵션과 같은 다른 영역으로 초점을 전환했다고 말합니다.

==================================================

Where there’s a will, there’s a weight: How to balance FOMO against overcrowding in the same index-distorting tech giants.

2023년 11월 28일 오후 2:01 GMT+9

By John Authers

John Authers is a senior editor for markets and Bloomberg Opinion columnist. A former chief markets commentator at the Financial Times, he is author of “The Fearful Rise of Markets.”

Fear of missing out versus overcrowding in tech giants? Just weight.

Photographer: Yuki Iwamura/Bloomberg

FOMO and the Magnificents

How do we solve a problem like the Magnificent Seven? The Acronym of the Year applies to the seven big internet platform companies — Apple Inc., Amazon.com Inc., Google-owner Alphabet Inc., Facebook-owner Meta Platforms Inc., Microsoft Corp., Nvidia Corp. and Tesla Inc. Collectively, they’ve pounded the rest of the market into submission. Between them, they account for 28.9% of the S&P 500.

This chart from Apollo Group’s Torsten Slok compares an “S&P 7” index with an S&P 493 that includes all the rest. The gap is astonishing:

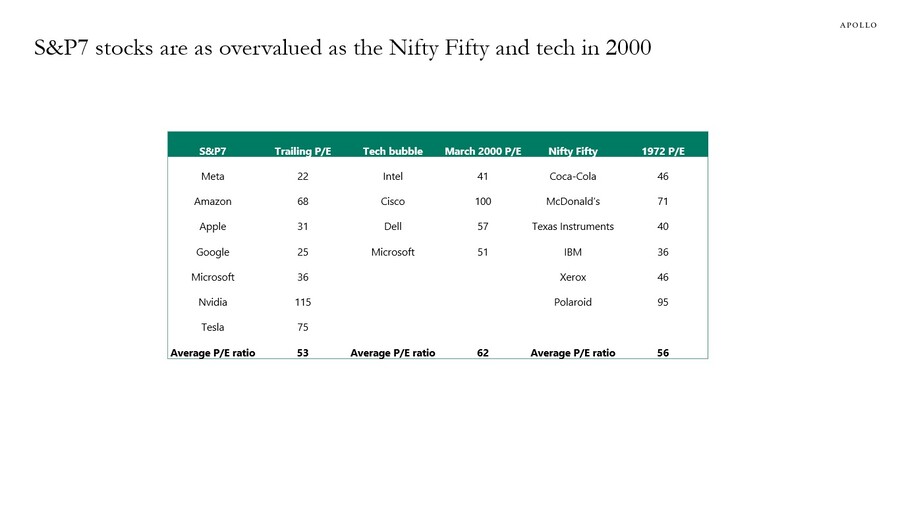

We’ve been here before. Whenever the market gets dominated to this extent by a group of companies that are using technology to do capitalism better than anyone else, bursts of investment bubbles tend to follow. Slok also offered this chart comparing the valuations of today’s big seven with the multiples people were prepared to pay for the biggest “Nifty 50” stocks in 1972, and tech stocks in the internet bubble of 2000:

Nvidia, propelled latelyby the excitement over artificial intelligence, is now priced at a higher multiple of its earnings than any of these predecessors. That said, the Seven’s average p/e ratio is still very slightly behind the valuations people were paying during the earlier incidents.

The lists also offer some warnings, and show how difficult asset allocation can be. Microsoft is the only name to recur on more than one lineup. In 2000, it owed everything to its virtual monopoly over Windows, Office and Internet Explorer. Those are long gone, so maintaining itself among the giants of the market is a remarkable feat. Other past big names appear a little more like cautionary tales. Polaroid is no longer with us — you can take perfectly good instant photos with products made by several different Magnificent companies these days. Cisco Systems Inc. offers a different kind of caution. It continues to be one of the world’s most powerful and influential firms — but its stock closed Monday at a level 12% lower than its peak in early 2000. Valuations this extreme can turn great companies into terrible investments.

(좋은 기업 ≠ 좋은 주식)

A broader point, though, is that it makes perfect sense that all of these companies grew as big as they did. The likes of Coca-Cola & Co. and McDonald’s Corp. built brands that are arguably just as strong as they were when they were “nifty,” even if the stock market no longer expects much growth from them. Dell Technologies Inc. went private for a while, but it’s still a huge and important manufacturer of computers. History suggests therefore that it’s unlikely for companies to become this dominant if they don’t have something serious going for them. Cisco’s fate is conceivable, as is Polaroid’s over a very long term, but these stocks are not going to disappear in a hurry, and they will rake in many more profits. It wouldn’t be the first time that markets grew over-excited about a genuinely good idea, and took it too far, just as happened with the worldwide web in 2000. (버블의 역사는 반복됨)

So, what course is open to you if you think that the strength of big tech growth stocks is real and sustainable, but also that the Magnificent Seven are dangerously overpriced? How do you square all of this with your (quite reasonable) Fear Of Missing Out (FOMO)? One solution is to do away with market-cap weightings, which effectively oblige big index funds and any active funds benchmarked to them to stick more than a quarter of their assets into seven companies. Earlier this year, Nasdaq reduced the weight of the six biggest companies in the 100, but they remain very dominant. Equal weighting goes further. To exploit tech growth, therefore, go with the equal-weight version of the Nasdaq-100, in which the seven are present, but only have a joint weighting of 3.5%. That index has done far better this year than the equal-weight version of the S&P 500, which is only just barely in the black. More impressively, it’s even ahead of the S&P 500 when weighted by market cap, an index that gives a 29% weighting to the seven:

The idea comes from Societe Generale SA’s US equity strategist Manish Kabra, who argued as follows:

"The Nasdaq-100 (large-cap Growth index) is in the driving seat of the US Earnings Per Share cycle. Looking beyond the ‘Magnificent Seven,’ the majority of the Nasdaq-100 stocks have outperformed the S&P 500 this year... Nasdaq-100 equal weighted offers a good alternative for gaining exposure to Nasdaq-100’s EPS momentum through a more diversified index. On the flip side, small firms have been facing a wall of refinancing and lowered interest coverage, and a quarter of firms are now loss-making."

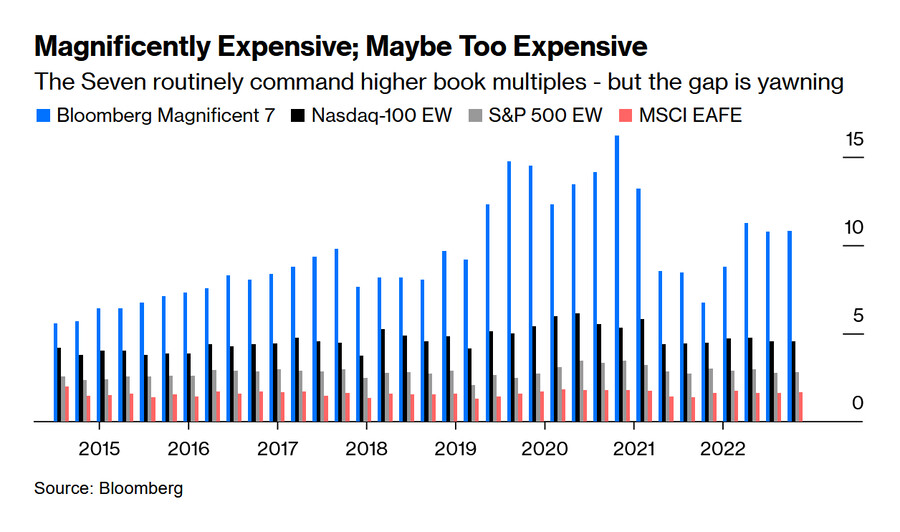

Size may begin to be a serious virtue as the high interest-rate regime goes on, because it’s far harder for small companies to roll over debt — particularly if they’re making losses. And another virtue of the Nasdaq-100 equal weight is that it’s very much cheaper than the Seven, although it’s also significantly more expensive than the broader S&P 500, or the MSCI EAFE (미국을 제외한 선진국) index covering the big developed markets outside the US. True bargains are more likely to be found there; but some protection against embarrassment can be had by equal-weighting the Nasdaq. This chart compares book multiples for all four indexes:

Maybe one more argument for growth is that it should do best, in theory, when growth is scarce. People pay up for whatever is hardest to get. So it needn’t be disastrous in the event of a downturn. It would be dangerous to be without some exposure to big tech. Just make sure not to get too exposed to the Overcrowded Seven. (성장이 희소해질 때, 성장주 강세. 다만 너무 비싼 주식은 피할 것.)

Game Over for Memes?

From the Magnificent to the Ridiculous. A defining moment of the pandemic came with the frenzied obsession to buy meme stocks — most famously GameStop Corp. and AMC Entertainment Holdings Inc. So influential was the retail crowd that they were able to shake the market, and deeply embarrass the short-sellers, by coordinating on Reddit. The whole incident has even been immortalized in a movie (which Points of Return still has not seen).

What briefly looked like an influential movement gave birth to the Roundhill MEME ETF (ticker MEME), which launched in December 2021. It was an attempt to quantify the meme phenomenon, screening for companies with high social-media activity that had seen heavy bets against them by short-sellers to create a portfolio of 25 retail-friendly equities.

That was then, but this is now. And this chart tells the story of how the ETF performed:

MEME announced that it is shuttering its fund in December, perhaps a signal of the end of an era. To many in Wall Street, the news isn’t shocking. Here is Jane Edmondson, head of thematic strategy at VettaFi:

"The meme stock characterization is of an overhyped stock, being manipulated by traders. Hardly a positive association for investors. Meme stocks were bid up by traders during the pandemic. Now that things have returned to normal, a lot of those excesses are being scorned and reversing."

As I wrote here with colleague Katie Greifeld, a slew of retail-focused ETFs launched during the height of the pandemic as issuers rushed to capitalize on the extremely active retail crowd flush with government stimulus. That frenzy declined as the Federal Reserve attempted to bring back normality with higher interest rates.

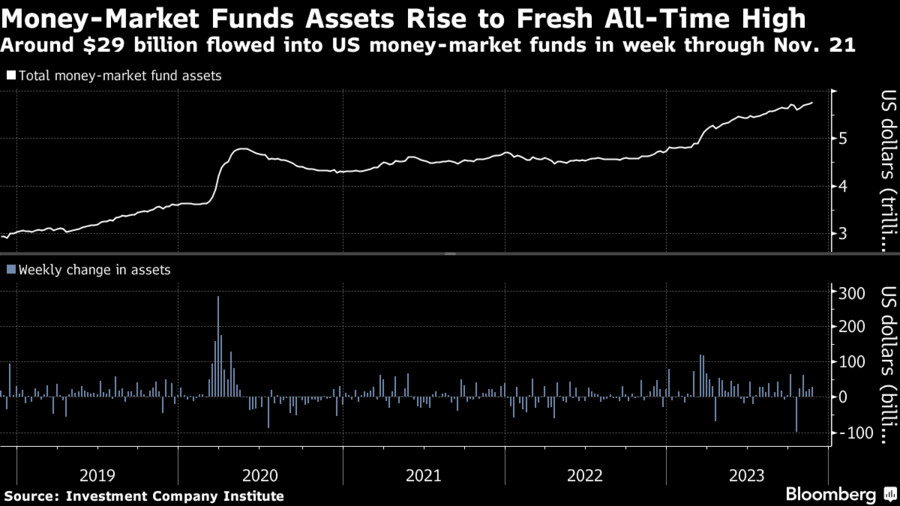

To Nate Geraci, president of The ETF Store, the meme stock craze has long since passed. “The retail crowd has moved on to polar opposite investments such as money market funds!” he said. “Financial advisers — who drive ETF flows — simply aren’t going to have a meme stock ETF showing up on client statements.”

Retail traders are still alive and well, even if they don’t seem to have gained much in the way of common sense. Their presence can doubtless be felt in the Magnificent Seven. Just this month, they have piled into the shares of bankrupt companies

like WeWork Inc. and trucking company Yellow Corp. But the force has waned. Retail traders last month sold nearly $16 billion in stocks, according to S&P Global Market Intelligence, a selloff that reveals fading enthusiasm from day traders.

But if the excitement over memes has gone, retail traders have found other places to go — such as zero-day stock options. August data show that they likely make up at least 30% of the volume in contracts tied to the S&P 500 that expire within 24 hours — and possibly up to 40% — according to Cboe Global Markets. Long-termist this isn’t.

Inevitably 0DTE, as it is known, has now found its way into the $7.5 trillion ETF arena. Defiance ETFs has launched funds that sell ultra short-dated options on the Nasdaq-100 and the S&P 500 as part of their strategies. That should help the excitement last a little longer. With luck, 0DTE ETFs might even survive longer than the MEME ETF did.

— Isabelle Lee

user error : Error. B.