-

[경제] (블룸버그) 국채 금리 급등 : 매입을 서두르기 전에 2007년의 흔적을 읽자2023.09.20 PM 06:58

ChatGPT 기사 요약

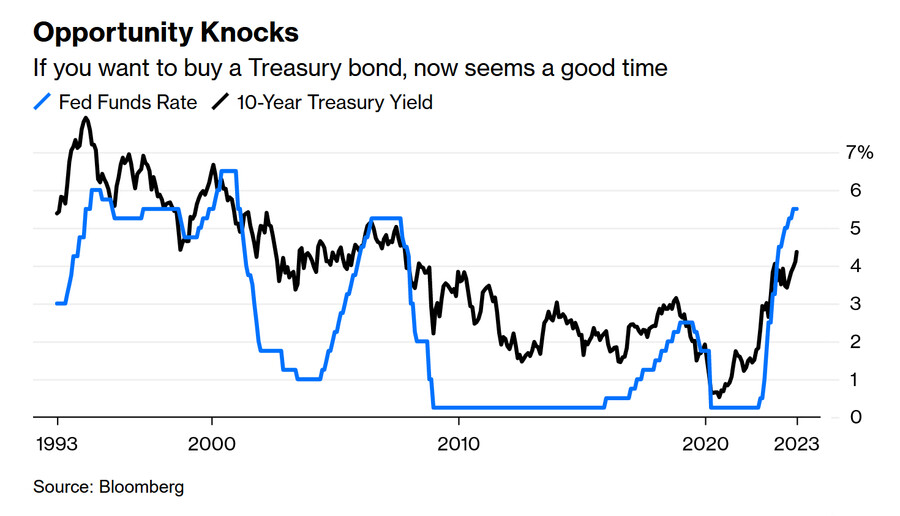

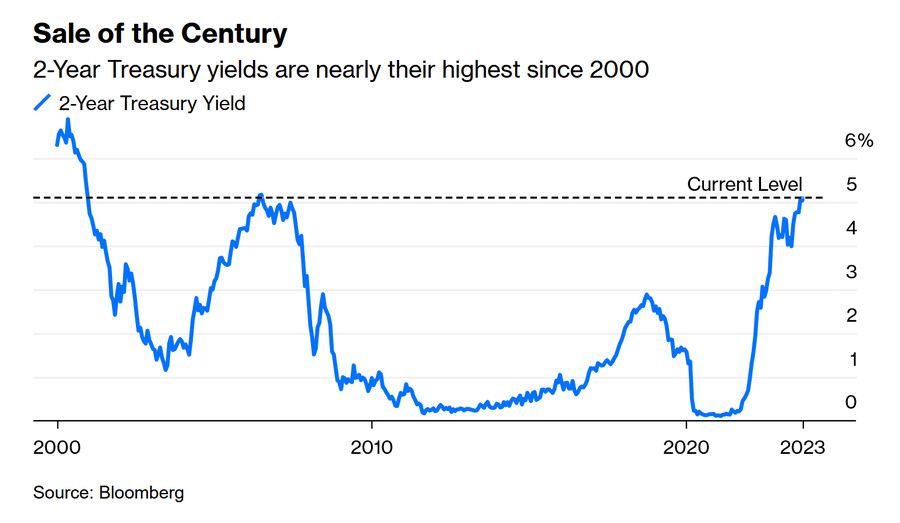

기사는 전 세계적인 채권 수익률의 급등과 투자자들에게 미치는 영향에 대해 논의합니다. 채권 수익률이 상승하면 역사적으로 채권 보유자에게 유리한 수익을 가져왔기 때문에 현재는 정부 채권을 매입하기에 좋은 시기일 수 있다고 제안합니다. 10년 만기 미국 국채 수익률은 2007년 이후 처음으로 높은 수준에 도달했으며, 2년 만기 수익률은 2000년 이후 처음으로 높은 수준에 도달하여 단기 채권을 매력적으로 만들고 있습니다.

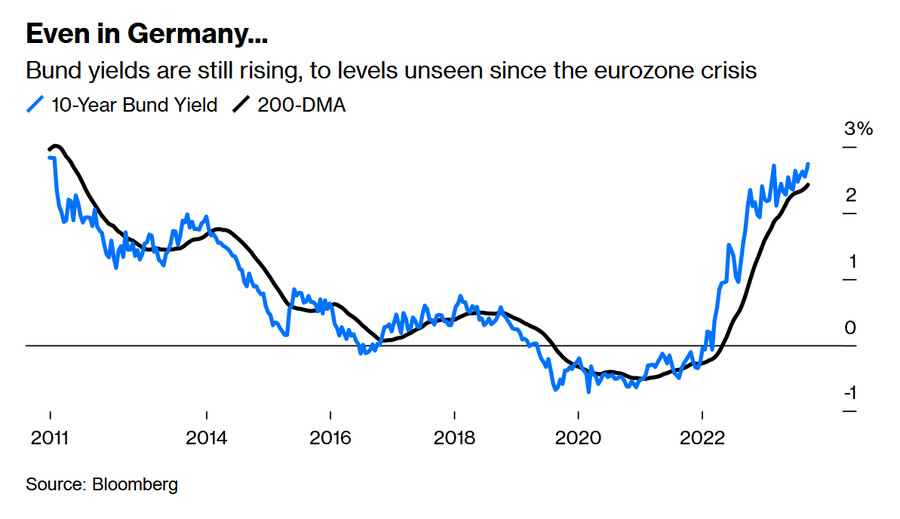

수익률 상승 현상은 미국에만 국한된 것이 아니라 전 세계적으로 일어나고 있으며, 특히 독일 국채 수익률은 급등했습니다. 이러한 극적인 변화에도 불구하고 광범위한 금융 시장은 비교적 영향을받지 않은 것으로 보이며, 금융 여건은 느슨한 상태로 유지되고 있고 투자자들의 자신감은 2022년과 유사합니다.

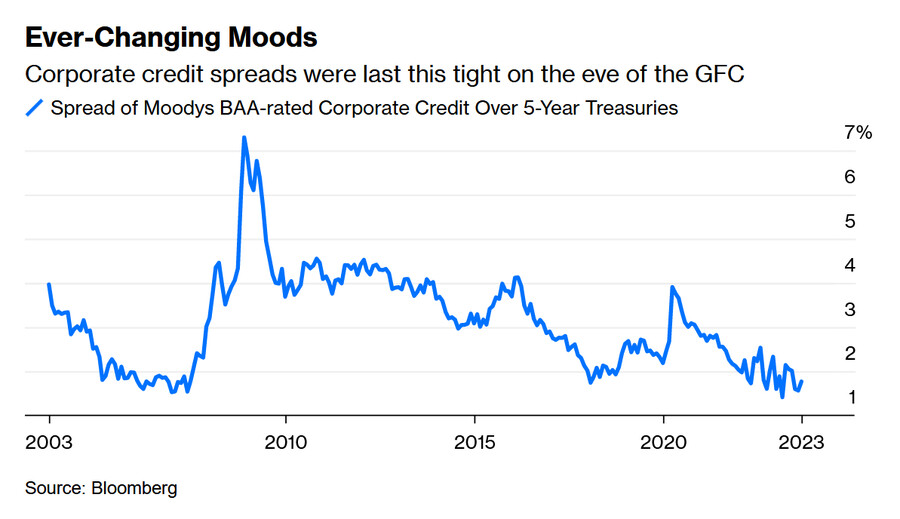

기사는 채권 수익률 상승의 잠재적인 결과에 대해 우려를 제기하며, 2007년 금융 위기와의 유사성을 지적합니다. 2007년에는 국채 수익률 상승으로 인해 투자가들이 회사채 시장에서 미국 국채로 투자를 전환하면서 신용 스프레드가 확대되었습니다. 현재 상황은 투자자들이 신용 시장에서의 위험에 대한 보상이 부족하다고 인식할 경우 유사한 시나리오로 이어질 수 있습니다.

2023년 채권 수익률 상승의 이유는 2022년과 다릅니다. 올해의 증가는 인플레이션과 예상 금리 인상에 대한 우려보다는 경제 성장 잠재력에 대한 시장의 인식 개선 때문입니다. 기사는 또한 시장의 경제 전망 평가 악화가 잠재적인 위험이 될 수 있다고 지적합니다.

기사는 또한 원유 가격 급등, 미국 정부 셧다운 가능성, 자동차 산업 파업 등 채권 수익률 상승에 대한 대안적인 설명을 살펴봅니다. 또한 다가오는 연방 공개 시장 위원회 회의(FOMC)가 "점도표"에서 더 높은 금리가 더 오래 유지될 수 있다는 기대를 언급하면, 이는 더 높은 수익률을 정당화할 수 있다고 말합니다. 그러나 연준이 예상보다 덜 매파적인 입장을 보인다면, 이렇게 높은 금리가 유지될 때 채권을 사려는 수요가 몰릴 수도 있습니다.

결론적으로 기사는 2023년 채권 수익률 급등과 그 배경에 있는 잠재적인 이유를 강조합니다. 투자자들에게 미치는 영향을 논의하고 금융 시장의 미래 방향에 대한 의문을 제기하며, 다양한 요인이 불확실성에 기여하고 있습니다.

=========================================================

(Bloomberg Opinion) Read the Fine Print on Bonds’ Sale of the Century

Yields on government bonds haven’t been this high since the eve of the Global Financial Crisis. How much pause should that give?

What explains the stock market’s apparently irrational equanimity?

Photographer: Gabby Jones/Bloomberg

By John Authers

2023년 9월 20일 오후 2:11 GMT+9

Sale of the Century

If you’ve long had the wish to buy some government bonds, it looks like now is the time. Buy them while they’re cheap — this offer surely can’t last much longer. That at least would seem to be one of the more logical reactions to a surge in yields across the world that has come on the eve of a wave of central bank meetings which inevitably pose risk to bond investors. Why take a strong p-osition now?

In the case of the 10-year Treasury yield, it’s moved to a fresh high not seen since 2007. On that occasion, the 10-year peaked at a slightly higher level just before the Federal Reserve under Ben Bernanke began what would prove to be a drastic series of rate cuts. Anyone buying long Treasuries when yields peaked and holding until the end of 2008 would have enjoyed a 59% gain. The rise in yields has been much faster this time, and the 10-year yield — unlike in 2007 — remains well below the fed funds rate. In other words, the weird world of an “inverted yield curve” — in which interest rates are higher over short rather than long terms — continues. Steeply inverted yield curves tend to mean that a rate cut is coming, which would again suggest that this is a good time to buy bonds:

Movements in the two-year yield have been even more dramatic. Save only for a few days on the eve of the Global Financial Crisis, it’s at the highest since 2000. If you want to buy an income from short-term bonds, this is indeed the sale of the century:

This is an international phenomenon. Germany’s economy has been marred by the eurozone sovereign debt crisis that followed the GFC, and the ensuing protracted period when yields were outright negative. It still has to contend with deep pessimism. That previously unimaginable state of affairs is over. The surge in bund yields since inflation got going in earnest early last year has been if possible even more dramatic than the move in Treasuries. And while less dramatic now, the trend continues to be persistently upward:

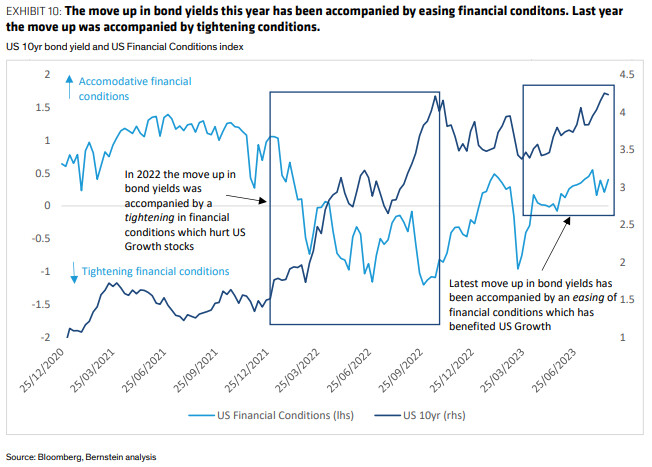

These dramatic events could be scary. For 15 years, the entire financial world has been fretting about what could happen if yields suddenly rise. Now we’re beginning to find out. And the broader markets appear oblivious. Financial conditions indexes, which use a range of conditions from different markets to measure the ease with which finance can be raised, or the strength of risk appetite, suggest that the environment is actually loose. Judging by Bloomberg’s own US conditions index, confidence is back where it was in the spring of 2022, before the Fed’s hiking campaign even started:

The corporate credit market is certainly making life easier for companies and investors. Taking the spread of the yield of investment-grade companies rated at least BAA by Moody’s over five-year Treasury bonds, we find that spreads haven’t been this tight since the summer of 2007. The credit crisis soon followed. It’s hard to believe it’s a coincidence that the last record tight for credit spreads came at exactly the same time as the last high for Treasury yields:

Whatever’s going on at present, this isn’t a direct repeat of the GFC and there are many important differences. But the experience of 2007 should be instructive. The surge in Treasury yields helped prove to credit investors that spreads weren’t adequately compensating them for their risks. That summer, money poured out of credit and back into Treasuries, sending spreads far higher. Is it unreasonable to fear something similar again?

To answer that, we need to know exactly why bond yields are rising. Different investors will have different reasons, but it’s fair to say that the rally of 2023 has been driven by very different factors than the rise of 2022. To quote a fascinating piece by Sarah McCarthy of Alliance Bernstein:

"The drivers of the move higher in bond yields have been much different this year vs. last year. Bond yields this year have likely risen due to the market’s improved perception of economic growth potential. Bond yields rose last year because of inflation and expected rate hikes. Financial Conditions have actually eased this year, whereas they tightened significantly last year. The risk to Growth from here arguably is a deterioration in the market’s assessment of the economic outlook, i.e. financial conditions, rather than a move higher in bond yields alone."

That would explain the apparently irrational equanimity currently on display in the stock market, which barely sold off Tuesday. This is McCarthy’s illustration of what’s going on:

If investors think rates are high and will rightly stay high to cope with a buoyant economy, then yes, higher yields make sense. And there’s no reason for this latest spike to be as scary as its predecessor in the summer of 2007. Growth stocks can continue to prosper.

The alternative explanation is scarier. Oil prices have surged and that always means trouble. The sharp rise in crude has come as an external shock to financial markets. Layer on reasons for caution (such as the imminent possibility of yet another US government shutdown, and what looks like a potentially epochal strike in the auto industry), and maybe this isn’t the time to hold bonds.

Another explanation is that investors are trying to get in their reaction ahead of the Federal Open Market Committee meeting. The expectation is that the “dot plot” will likely show higher rates for longer. That would justify higher yields. A dot plot in which the Fed isn’t as hawkish as expected could prompt a lot of people to dive to buy bonds, however, while these generous yields last.

user error : Error. B.