-

[경제] (Bloomberg) For Oil, It’s Not 1973 Again – But It Could Still Turn Ugly2023.10.08 PM 02:23

블룸버그 기사 요약 (ChatGPT)

2023년 10월 최근 하마스의 이스라엘에 대한 기습 공격은 유가 상승으로 이어질 가능성이 있으며, 1973년 오일쇼크와 비교되고 있습니다. 그러나 1973년과 2023년은 다음과 같은 큰 차이가 있습니다.

① 1973년과 달리 이번 위기에는 아랍 국가들이 연합해서 이스라엘을 공격하고 있지 않습니다. 대부분의 아랍 국가는 이번 사건의 전개에 직접 관여하지 않습니다.

② 현재 원유시장은 1973년과 다릅니다. 원유 수요 증가가 둔화되고 있고 전기차가 수요를 더욱 줄일 것으로 예상됩니다. 사우디 아라비아와 UAE는 여전히 원한다면 가격을 완화할 수 있는 여유 생산 능력을 보유하고 있습니다.

③ 오늘날 OPEC 회원국들은 1973년과 같이 큰 가격 인상을 추구하지 않습니다. 그들은 배럴당 100달러를 조금 넘어서는 수준을 목표로 하여 적당한 유가 인상에 만족할 것입니다.

④ 이스라엘이 하마스가 이란의 지시에 따라 행동했다고 결론을 내리면 상황은 악화될 수 있으며, 유가는 더욱 오를 수 있습니다. 과거 이란은 예멘 반군을 배후 조종하여 사우디 아라비아의 석유 생산 능력을 방해할 수 있는 능력을 보여주었습니다.

⑤ 미국의 대 이란 제재 시행 가능성은 유가에 더 큰 영향을 미칠 수 있으며, 석유 가격은 배럴당 100달러 이상으로 올라갈 수 있습니다.

⑥ 러시아는 중동 석유 위기로 인해 이익을 얻을 수 있습니다. 러시아는 대 이란 제제로 인한 공백을 이용하여 시장 점유율을 늘릴 수 있으며 유가 상승의 혜택도 볼 수 있습니다 . 베네수엘라도 원유 공급 압력을 완화하기 위해 제재가 완화될 수 있습니다.

⑦ 2024년에 예상되는 사우디-이스라엘 외교 협정은 하마스-이스라엘 분쟁으로 인해 좌절될 수 있습니다. 이로 인해 사우디가 해당 협정에 대한 지지를 이끌어 내기 위해 원유를 증산할 가능성도 없어졌습니다. 유가 하락의 원인이 될 수 있었떤 사우디-이란 관계 개선 가능성도 희박해 졌습니다.

⑧ 1973년과 달리 미국은 전략비축유(SPR)를 활용하여 휘발유 가격 상승의 영향을 완화하고 잠재적 위기를 관리할 수 있습니다. 비록 전략비축유(SPR)이 40년 내 최저 수준이지만 위기를 관리하기에는 충분한 수준입니다.

전반적으로 현재 상황과 1973년 사이에는 몇 가지 유사점이 있지만, 유시장과 지정학적 역학에 큰 차이가 있으며, 이는 이번 위기의 결과를 결정할 것입니다.

============================================

Crude prices are likely to rise after the surprise Hamas attack on Israel, but there’s still plenty of capacity to tap.

2023년 10월 7일 오후 10:47 GMT+9

By Javier Blas

Javier Blas is a Bloomberg Opinion columnist covering energy and commodities. He is coauthor of “The World for Sale: Money, Power and the Traders Who Barter the Earth’s Resources.”

Youths attend a short documentary feature in Cairo last week with archival clips from the 1973 Arab-Israeli war

Photographer: KHALED DESOUKI/AFP

History doesn’t repeat itself, but it often rhymes. On the eve of the 50th anniversary of the world’s first oil crisis, the parallels between October 2023 and October 1973 are easy to draw: A surprise attack on Israel and oil prices rising. But the resemblance ends there.

The global economy isn’t about to suffer another Arab oil embargo that would triple the price of a barrel of crude. Yet, it would be a mistake to downplay the chances that the world faces higher-for-longer oil prices.

The situation is fluid, and for the oil market, everything depends about how Israel responds to Hamas, which launched the attack, and Iran, which typically pulls the strings of the Palestinian group. Still, we can draw a few tentative conclusions:

1) The crisis isn’t a repeat of October 1973. Arab countries aren't attacking Israel in unison. Egypt, Jordan, Syria, Saudi Arabia and the rest of the Arab world are watching the events from the sidelines, not shaping them.

2) The oil market itself doesn't have any of the pre-October 1973 characteristics. Back then, oil demand was surging, and the world had exhausted all its spare production capacity. Today, consumption growth has moderated, and is likely to slow further as electric vehicles become a reality. In addition, Saudi Arabia and the United Arab Emirates have significant spare capacity that they use to curb prices – if they choose to do so.

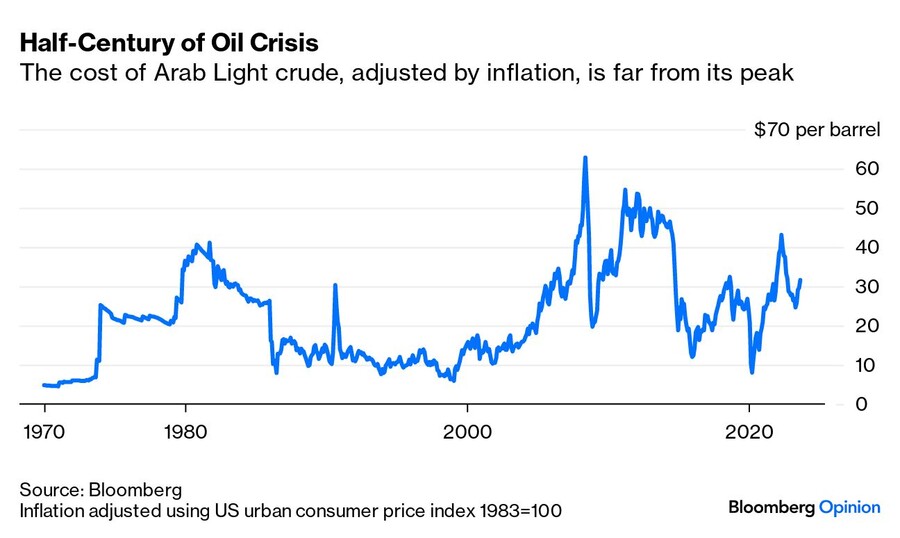

3) As importantly, today, OPEC nations aren’t trying to boost prices beyond a few extra dollars. Riyadh would be content with oil prices rising another 10-20% higher, to just above $100 a barrel from $85 currently, rather than pushing them more than 100% higher to $200 a barrel. Just before the October 1973 oil embargo, OPEC nations unilaterally hiked the official petroleum prices by about 70%. Although the embargo is the element most vividly remembered of the crisis, the price hike was as crucial.

4) The fallout could yet have an impact on oil markets in 2023 and 2024. The most immediate impact could come if Israel concludes that Hamas acted on instructions of Tehran. In that scenario, oil prices could go much higher. In 2019, Iran demonstrated, via Yemeni proxies, that it’s able to knock down a significant chunk of Saudi oil production capacity. It could do the same retaliation if it finds itself under Israel or American attack.

5) Even if Israel doesn’t immediately respond to Iran, the repercussions will likely affect Iranian oil production. Since late 2022, Washington has turned a blind eye to surging Iranian oil exports, bypassing American sanctions. The priority in Washington was an informal détente with Tehran. As a result, Iranian oil output has surged nearly 700,000 barrels a day this year – the second-largest source of incremental supply in 2023, behind only US shale. The White House is now likely to enforce the sanctions. That could be enough to push oil prices to $100 a barrel, and potentially beyond.

6) Russia will benefit from any Middle East oil crisis. If Washington enforces sanctions against Iran, it could create space for Russia’s own sanctioned barrels to both win market share and achieve higher prices. One of the reasons why the White House turned a blind eye on Iranian oil exports is because it hurt Russia. In turn, Venezuela could also benefit, with the White House relaxing sanctions to ease market pressure.

7) The Saudi-Israeli diplomatic deal, which many had penciled in for early-to-mid 2024, is a casualty. Even if Riyadh is likely furious with Hamas, it’s difficult to see how Crown Prince Mohammed bin Salman would be able to sell the deal domestically. That, in turn, removes the potential for Saudi Arabia pumping more oil to help passage of the deal in Washington. The other victim of the Hamas-Isaeli war is the Saudi-Iranian rapprochement, which itself was another bearish element for oil.

8) Finally, a key difference from 1973, Washington can tap its Strategic Petroleum Reserve to limit the impact on gasoline prices — and on President Joe Biden’s approval rating. If oil prices surge because of tension in the Middle East, the White House is sure to tap the SPR. Although it’s at its lowest level in 40 years, the reserve still has enough oil to deal with another crisis.

user error : Error. B.