-

[경제] (FT) 미국사람은 채권을 좋아해2023.10.18 PM 02:51

우리나라에서도 관찰되고 있는 현상이지만 미국 리테일 자금의 채권 매수 러시가 심상치 않다네요.

연준 QT 대신해 빈자리를 메워주고 있는건 고맙지만, asset allocation 차원에서 주식엔 부정적이라는 내용입니다.

높은 금리에 눈이 안갈 정도로 압도적 growth가 예상되는 종목, 혹은 채권같은 현금흐름 보완이 가능한 배당주 등 선별적 picking이 중요해지는 시기네요.

===========

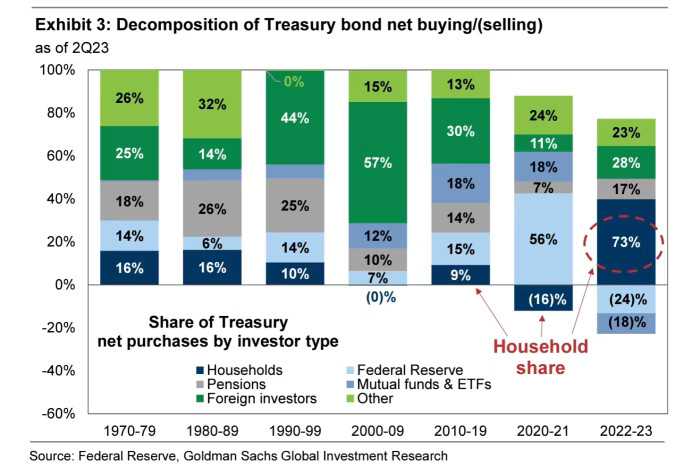

- 미국 연방정부가 연간 2조달러씩 재정적자를 내고 연준도 QT를 통해 채권을 팔고 있는 상황에서 채권시장에 구세주가 등장

- 미국 개인투자자는 2023년 상반기에만 무려 7천억달러의 미국채를 사들임. 연간으로는 1.3조달러에 육박할 것으로 보임

- 미국 리테일은 Treasury 시장의 9%를 보유. 2022년 초 2%에서 1년 반만에 엄청난 성장

- 이는 주식시장에 위협. 현재 미국 가계는 전체 미국 주식시장 시가총액 중 39%를 보유 중이며, 전체 순자산의 42%를 주식에 배분하고 있는데 / 골드만삭스에 의하면 1952년 이후 이 정도의 주식자산 보유는 극상위 4%에 해당하는 케이스

- 당분간 이런 채권향 자금흐름은 지속될 가능성이 높아 예의 주시할 필요. 이것이 TLT, TMF ETF 유행의 이유일 것

- 신영증권 리서치센터 자산전략팀 이사 박소연 -

=========================================

(Financial Times) Americans ♥️ Treasuries

Reading Goldman’s flow report

Shopping for USTs © Bloomberg

Robin Wigglesworth October 16 2023

‘Treasury-supply-is-lifting-yields’ is the Rasputin of bond market narratives, simply refusing to die whatever the actual evidence indicates.

To be fair, it’s understandable that the US running a near $2tn annual budget deficit at a time when the economy is strong would freak some people out. Speaking to bond folks it seems plausible that the narrative of supply is leading to at least some of the recent yield uplift.

But to paraphrase Jurassic Park’s Dr Ian Malcolm, markets find a way.

Now, the big caveat is that the household component of Treasury holding data oddly includes hedge funds, and the massive ramp-up in household Treasury purchases therefore probably also reflects the increase in basis trades. That’s . . . not great, even if the leverage is lower these days.

But the majority of the almost $700bn worth of Treasuries households bought in the first half of 2023 is probably just Americans taking advantage of much higher yields on offer. We’re now on pace for a $1.3tn Treasury buying spree by households.

American households (plus hedge funds) on the whole now own 9 per cent of the US Treasury market, up from just 2 per cent at the start of 2022, according to Goldman Sachs.

However, this has implications for equities. As Goldman’s David Kostin writes:

"Recent volatility in the Treasury market has driven increased investor concern over the fiscal p-osition of the United States and the supply/demand mismatch for Treasury securities. Our rates strategists believe increased Treasury supply will not catalyze further upside in yields. However, the attractive level of yields will continue to entice households to purchase yield-bearing assets rather than equities."

US households own 39 per cent of all US equities, dwarfing all other holders. And their current 42 per cent allocation to equities is now in the 96th percentile since 1952, according to Goldman.

Foreign investors have been ramping up their purchases lately, but Kostin reckons that this is going to be swamped by Americans paring back their own US equity exposure.

Coupled with pension plans also taking advantage of higher yields, this will leave US companies themselves as the only real significant pillar of US equity demand.

It’s interesting that Goldman thinks that buybacks will rebound back above $500bn annually in 2023-2024. That’s way down from the $1tn plus annual rate we saw in the zirp(zero rate interest policy) era, but still feels punchy given the massive increase in borrowing costs.

Of course, demand/supply dynamics have mattered just as little for US equities as they have for US Treasuries(corporate buybacks was the main demand in the 2010s as well, and that didn’t matter for one of the biggest bull runs in history).

But eyeballing this flow data we can see why people keep punting money on TLT and TMF.

user error : Error. B.