-

[경제] 16년 만에 최고 美 금리에 채권 펀드로 몰리는 자금2023.10.27 PM 10:33

"향후 몇 년간 주식보다 유리"

(서울=연합인포맥스) 강수지 기자 = 미국 국채금리가 16년 만에 가장 높은 수준을 기록하면서 채권 펀드에 수십억 달러의 투자 자금이 유입되고 있다.

마켓워치는 24일(현지시간) "앞으로 몇 주나 몇 달 동안 채권 가격이 계속 하락하더라도 구매자들이 낙관할 충분한 이유가 있다"며 "금리가 더 상승할 여지가 있다고 해도 향후 몇 년간 투자자들은 사실상 견고한 수익을 보장받으며 지난 10년간의 채권 성과를 능가할 가능성이 크다"고 전했다.

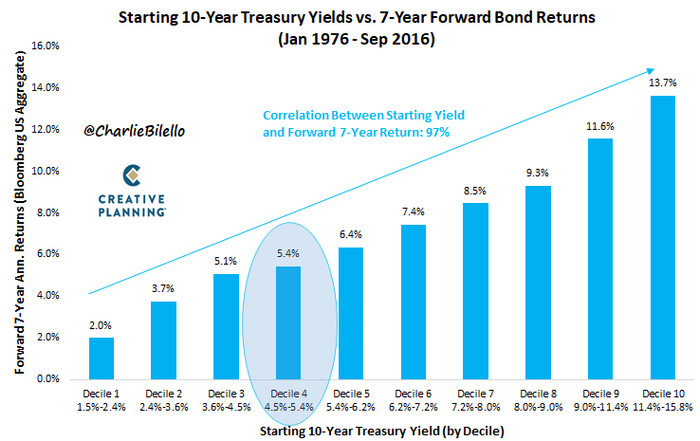

컴파운드 캐피털 어드바이저의 설립자인 찰리 빌렐로 전략가는 미국 10년물 국채 금리가 약 5%인 경우 투자자는 향후 7년간 연평균 5.4%의 총수익을 기대할 수 있다고 주장했다.

그는 "채권의 미래 수익률을 가장 잘 예측하는 단일 지표의 시작은 금리"라며 "5%에 가까운 금리인데 2007년 이후 이렇게 높은 기대 수익률은 없었다"고 말했다.

뱅크오브아메리카(BofA)의 데이터에 따르면 올해 국채 가격은 3년 연속 하락하며 전례 없는 하락세를 보일 전망이다.

채권은 이전에도 주식에 비해 수익률이 미미했는데 특히 금리가 제로에 가까웠던 시절에 발행된 일부 30년물 국채 가격은 50% 이상 하락하며 투자자에게 엄청난 손실을 안겨줬다.

하지만 최근 채권시장에서는 희망이 보이기 시작했다.

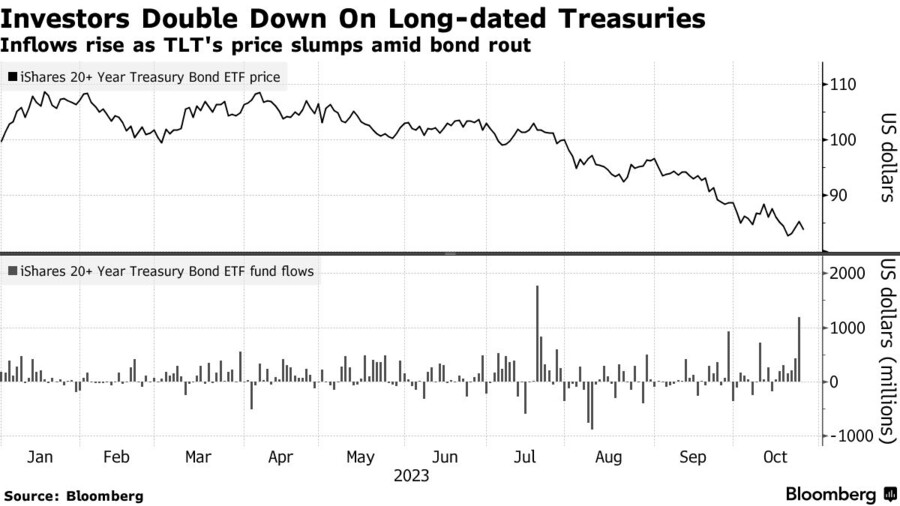

국채 금리가 급등하면서 가장 인기 있는 상장지수펀드(ETF)인 아이쉐어즈 20+국채 ETF(NAS:TLT)는 올해 들어 펀드 설립 이후 가장 많은 190억 달러의 자금이 유입됐다.

지난 10년간 주식에 비해 수익률이 보잘것없었던 채권이지만, 금리가 20년 만에 최고치를 기록하면서 향후 몇 년은 주식에 유리하지 않을 것으로 보인다.

로젠버그 리서치 설립자인 데이비드 로젠버그는 "5%인 10년물 금리가 향후 12개월 동안 50bp 하락할 경우 총 8.5%의 수익을 얻을 수 있을 것"이라며 "그러나 50bp 상승하더라도 가격 하락의 일부가 막대한 쿠폰 지급으로 상쇄되기 때문에 투자자는 1%의 이익을 얻게 된다"고 말했다.

그는 "2007년 7월 19일 10년물 금리가 5%대로 마감했을 때, 이후 12개월 동안 10년물 국채의 총수익률은 11.5%였다"고 덧붙였다.

============================

With Yields Above 5%, Some Investors Say It's Safe to Start Buying Bonds Again

■ Higher fixed-rate coupons offer more protection for investors

■ Traders seek silver lining in the worst bear market in decades

By Michael Mackenzie and Garfield Reynolds

2023년 10월 27일 오전 12:40 GMT+9

Updated on 2023년 10월 27일 오전 11:38 GMT+9

Embattled debt investors like the look of 5% Treasury yields as they weigh the risk-versus-reward scales for the world’s biggest bond market.

The rise in yields to levels last seen before the financial crisis reflects a run of solid data, with the US economy growing last quarter at the fastest pace since 2021. And a rising tide of Treasury debt issuance, meanwhile, has prompted the return of a positive risk premium for owning longer-dated bonds.

For all the pain in the bond market — and some traders are betting there’s more to come — the notes look a lot more attractive to long-term buyers once Treasury yields are running at 5%-or-higher.

Those levels nudge them closer to the Federal Reserve’s current policy-rate ceiling of 5.5%, allowing buyers to lock in elevated income before officials eventually embark on any easing cycle.

“The arithmetic starts to move in your favor after having been out of your favor for a very long time,” said Stephen Bartolini, a fixed-income portfolio manager at T. Rowe Price. “It takes a lot larger increase now to wipe out total return over a 12-month horizon because you’re getting yield.”

Buyers emerged Thursday, spurring a drop of some 10 basis points across the Treasury curve as another round of disappointing earnings caused equities to slide. The 10-year yield was little changed at 4.85% on Friday in Asia, about 16 basis points below the 16-year high touched on Monday.

Investors are in need of a silver lining as they nurse wounds from the worst selloff seen for Treasuries in more than four decades. The Bloomberg US Treasury Index has dropped since a string of regional bank failures fanned expectations of a credit crunch and recession in early April. The yield on 10-year notes, meantime, has soared to above 5% this week from a 3.25% April low.

Amy Xie Patrick, head of income strategies at Pendal Group in Sydney, said she’s bullish on bonds given their current yields. There’s not much of a case for inflation and economic growth to re-accelerate, indicating “that the ‘soft landing’ is behind us,” she said.

Treasury fixed-rate coupons around 5% also provide investors with the highest source of bond income since 2007, helping the debt to compete against bills and equities. They also make a portfolio more resilient in periods of enduring market pain in risk assets.

Vanguard Asset Management has been a recent buyer of five- to 10-year Treasuries, said Roger Hallam, global head of rates at the firm — with plans to “add more if yields rise further.”

“At these levels of yields your risk/reward is much better,” Hallam said. The belly of the yield curve — bonds maturing between five and 10 years — “will benefit most in the initial stages of any economic weakness.”

A favorable quirk of bond math is that higher-coupon bonds are less sensitive to price changes, a dynamic known as duration. Low-coupon bonds, by contrast, are far more sensitive to prices, and the current bond rout dates from August 2020, when the 10-year yield was a paltry 0.5%. The benchmark yield subsequently increased ten-fold, leaving investors well educated about the adverse impact of duration.

But that risk has been reduced as long-dated coupons settle in the 5% zip code, illustrated by the risk/reward profile of the $40 billion iShares 20+ Year Treasury Bond ETF. While the exchange-traded fund, known by its ticker TLT, has slumped 50% from its 2020 peak, yields above 5% are attracting inflows. At current levels, a long-end yield decline of 0.5% is expected to deliver a double digit price gain for the TLT, whereas a 50-basis point rise in yields would cause a price drop of only around 1% over a 12 month period.

“If the 30-year rallies a hundred basis points, you’re making 20%,” said T. Rowe’s Bartolini. “And if the five year rallies a hundred basis points, you’re making 4%.”

Bartolini said the firm prefers owning Treasuries with a maturity of five years or less as the Fed signals it’s near the peak of its rate-hiking cycle. Even so, increased Treasury supply could still shove 10- and 30-year yields higher as the market needs “to create an incentive for those bonds to be distributed and the incentive to make that happen is higher yields,” he said.

A renewed push to higher yields beckons over the coming week, with central bank meetings on the calendar for the Fed and the Bank of Japan. Investors will also watch for the latest US monthly employment report, along with a much anticipated update from the Treasury about its quarterly borrowing needs.

(美 재무부 국채 발행 계획 발표 10/30, 일본은행 통화정책 회의 10/31)

“The normalization of the bond market is what we are seeing right now,” said Anthony Saglimbene, chief market strategist at Ameriprise Financial. The firm is telling financial advisers and clients to start moving their cash into bonds as the Fed wraps up its tightening cycle and inflation ebbs. “The longer rates stay at these levels the greater the refinancing pressure for consumers and small businesses.”

user error : Error. B.