-

[경제] (블룸버그) 바이든-시진핑 정상회담, 미중 관계 해빙 신호 기대2023.11.14 PM 01:59

블룸버그 기사 요약 (ChatGPT)

미국-중국 관계의 잠재적 해빙을 위한 신호

조 바이든 미국 대통령과 시진핑 중국 국가 주석의 APEC 정상회담에서의 계획된 만남은 미국-중국 관계의 잠재적 해빙과 관련된 신호를 제공할 것으로 예상됩니다. 트레이더들은 특히 부동산 위기와 글로벌 자금의 유출로 영향을 받은 중국 자산에 대한 투자 심리 개선의 징후가 있는지 회의를 면밀히 주시하고 있습니다. 긴장 완화는 투자자들을 다시 중국으로 유인할 수 있습니다.

주요 관심 분야

기술: 세계 최대 반도체 시장인 중국은 미국으로부터 점점 더 많은 기술 제재를 받고 있습니다. 이 분쟁에서 긍정적인 신호가 나타나면 애플, TSMC, 삼성전자, 엔비디아와 같은 기업들에게 도움이 될 수 있습니다. SMIC와 화홍반도체와 같은 중국 기술 주식은 미국 제한을 극복하는 능력으로 인해 현지 투자자들에게 선호되고 있습니다.

녹색 에너지: 녹색 목표에 대한 강조는 세계 1위 배터리 제조업체 CATL 및 태양광 발전 설비 제조업체 LONGi Green Energy Technology Co. 주식의 상승으로 이어질 수 있습니다. 중국은 전기 자동차 시장을 선도하고 있으며, 긴장 완화는 BYD Co.와 같은 기업을 포함한 업계에 영향을 미칠 수 있습니다.

외환 시장: 투자자들은 정상회담 이후의 미국-중국 관계 개선 잠재력을 고려하고 있습니다. 규제 장벽 완화, 민간 투자 장려, 기업 심리 회복 등은 중국의 외환 및 주식 시장에 긍정적인 영향을 미칠 수 있으며, 위안의 약세에 기여한 규제 불확실성을 해소할 수 있습니다.

최근 조치: 바이든 대통령과 시진핑 주석은 펜타닐 제조 및 수출 단속에 대한 합의와 중국의 보잉 737 제트기 구매 약속을 발표할 것으로 예상됩니다. 중국의 최근 미국 콩 300만 톤 이상 구매는 회담을 앞둔 선의의 제스처로 간주됩니다.

전반적인 전망: 회담에서 긍정적인 결과가 나오면 투자 심리가 일시적으로 상승하고 투자자들이 중국으로 다시 몰려올 수 있으며, 이는 중국의 어려움을 겪고 있는 자산을 안정화하는 데 도움이 될 수 있습니다.

=======================================================================

(Bloomberg) A Trader’s Guide to Navigating Signals From the Biden-Xi Meeting

■ Two leaders will meet for first time in a year at APEC summit

■ A sign of thaw in tech spat could bolster investor sentiment

Traders are hoping that the planned meeting between President Joe Biden and China’s Xi Jinping will provide a sign of thawing relations, and boost sentiment for the Asian nation’s beaten-down assets.

Wednesday’s meeting in San Francisco will mark a crucial moment in what is Xi’s first visit to the US since 2017, when he met with the then-President Donald Trump. It will also be his first conversation in a year with Biden, who largely kept intact the tariffs Trump imposed on a range of Chinese goods and also championed curbs on China’s access to advanced technology.

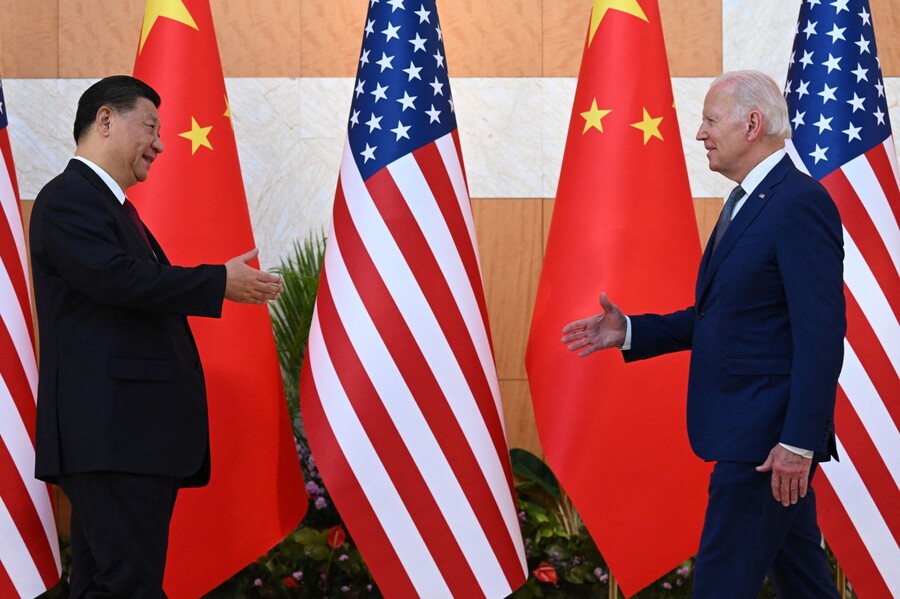

Joe Biden, right, prepare to shake hands with Xi Jinping on the sidelines of the G20 Summit in Bali on November 14, 2022.Photographer: Saul Loeb/AFP/Getty Images

An easing of tensions between the two superpowers may be the inflection point to lure investors back to China. Equities and currency traders are keeping a close watch given that the nation’s stocks are reeling from the years-long property crisis and an exodus of global funds, while the yuan has fallen to a 16-year low against the dollar.

“The signal that there are more efforts to put a floor around bilateral relations or even some modest improvement in the short term could provide a temporary boost to the investment sentiment,” said Xiaojia Zhi, head of research at Credit Agricole CIB.

The two nations have taken recent steps to ease the strains. Biden and Xi are set to announce an agreement that would see Beijing crack down on the manufacture and export of fentanyl — which is used to make the deadly synthetic opioid, according to people familiar with the matter. Separately, Beijing may also unveil a commitment for Boeing’s 737 jetliner during the APEC Summit, as per another report. China, a top soybean importer, bought more than 3 million tons of the commodity from the US last week in a goodwill gesture ahead of the talks.

“The news on China’s purchase of US soybeans is a prelude to warming of bilateral relations,” which are key to determining foreign capital flows, said Hao Hong, chief economist at Grow Investment Group. “At the least, China-US relations won’t get worse.”

Here are some key areas to watch:

Technology

China, the world’s largest semiconductor market, has been grappling with growing US sanctions on its technology sector. A sign of thaw in the dispute could bolster investor sentiment for a range of companies from Apple Inc. to chip bellwethers Taiwan Semiconductor Manufacturing Co., Samsung Electronics Co. and Nvidia Corp.

“Internet and tech hardware stocks are more likely to move because they got smashed pretty hard, but I think broadly China will benefit,” said Conrad Saldanha, New York-based senior portfolio manager at Neuberger Berman’s emerging-markets equities team. “Any dialogue is a positive step for both economies, and at this point China has more to gain from it, given how much the economy slowed down and how much negativity there is in that market.”

Meanwhile, China’s tech stocks such as Semiconductor Manufacturing International Corp. and Hua Hong Semiconductor Ltd. are being favored by local investors for their ability to work around the US curbs.

Huawei’s surprise debut of a smartphone with an advanced made-in-China 5G processor lifted stocks of local component producers such as Will Semiconductor and Maxscend Microelectronics Co. These firms may get a boost if tensions ease or if Xi reinforces resources toward achieving self-sufficiency in advanced technologies.

The leaders may discuss ways to “make the technology industry more transparent to each other or set up a regular communication channel,” said Redmond Wong, a market strategist at Saxo Capital Markets in Hong Kong.

Green Energy

An emphasis on green goals may spark a rally in stocks tied to electric vehicles such as the top battery producer Contemporary Amperex Technology Co., and solar power equipment maker LONGi Green Energy Technology Co.

“We can look at advanced manufacturing sectors including solar, lithium battery and new energy, which may have more restrictions easing from the US,” said Wu Wei, fund manager at Beijing Win Integrity Investment Management.

China is the leader in the EV race with a more than 80% share of the world’s lithium-ion battery capacity. Biden wants to change that. His signature Inflation Reduction Act offers tax credits for US-made EVs. Playing catch up is the European Union, which is investigating Beijing’s EV subsidies in an attempt to ward off cheap imports.

EV manufacturers such as BYD Co. will also be in focus if both countries agree on some form of easing amid rising protectionism in the industry globally.

FX Watch

Some investors are considering what kind of momentum the ties between the two nations would have beyond the summit, whether there will be steps to ease regulatory curbs, encourage private investment and revive business sentiment, according to Louise Loo, lead economist at Oxford Economics.

“That will be positive because regulatory uncertainty in China is one of the reasons why the FX continues to be so weak and the stock market continues to exhibit such weak sentiment,” she said.

China has spent much of the year trying to stabilize the yuan, Asia’s worst performer this year after the Japanese yen and the Malaysian ringgit. The People’s Bank of China has kept such a tight range on the reference rate — its favorite tool for guiding the currency — that a gauge of its swings collapsed to levels last seen in 2010.

user error : Error. B.