-

[금융/시황/전략] (블룸버그) 미국 경제 침체 가능성에 대한 6가지 이유2023.10.02 PM 01:10

ChatGPT 기사 요약

이 기사는 미국 경기 침체가 가능성이 높고 곧 다가올 수 있다는 여섯 가지 이유를 제시합니다.

1. 소프트 랜딩 희망

경제학자들은 과거 경기 침체 전에 경제가 "소프트 랜딩"할 것이라는 낙관적인 전망을 내놓는 경향이 있었으며, 이는 경제 사건의 비선형적 특성을 과소평가하는 경향이 있기 때문으로 보입니다.

2. 연준 금리 인상

연방준비제도의 금리 인상은 2023년 말 또는 2024년 초까지 경제에 완전히 영향을 미치지 않을 수 있으며, 이는 주식 및 주택 시장의 하락을 초래할 가능성이 있습니다.

3. 경제 예측 지표의 경고 신호

소득, 고용, 소비지출, 공장 생산량과 같은 주요 경제 지표는 2023년 말에 경기 침체가 시작될 수 있음을 시사한다.

4. 잠재적 충격

대규모 자동차 노조 파업, 학자금 대출 상환 재개, 유가 상승, 높은 차입 비용, 세계 경제 둔화 등의 여러 요인은 경제를 더욱 불안정하게 할 수 있습니다.

5. 소비지출

소비지출은 강세를 유지하고 있지만, 미국인들의 팬데믹 기간 동안의 추가 저축은 거의 소진되었으며, 이는 소비 감소로 이어질 수 있습니다.

6. 신용 위축

은행들이 대출 기준을 강화하고 있으며, 이는 기업 투자와 고용 감소로 이어질 수 있습니다.

이 기사는 또한 생산성 향상, 정부 정책으로 인한 기업 투자 증가, 예상되는 일부 충격이 예상보다 영향이 적을 가능성 등 좀 더 긍정적인 전망을 옹호하는 몇 가지 주장을 언급합니다.

전반적으로 소프트 랜딩은 여전히 가능하지만, 이 기사는 미국 경제가 가까운 미래에 경기 침체로 이어질 수 있는 여러 가지 도전에 직면하고 있다고 시사합니다.

============================================================

(Bloomberg) 6 Reasons Why a US Recession Is Likely — and Coming Soon

Fed Chair Jerome Powell speaks following a Federal Open Market Committee (FOMC) meeting in Washington on Sept. 20.

Photographer: Sarah Silbiger/Bloomberg

By Anna Wong and Tom Orlik

2023년 10월 2일 오전 6:00 GMT+9

When everyone expects a soft landing, brace for impact. That’s the lesson of recent economic history — and it’s an uncomfortable one for the US right now.

A summer in which inflation trended lower, jobs remained plentiful and consumers kept spending has bolstered confidence — not least at the Federal Reserve — that the world’s biggest economy will avoid recession.

A last-minute deal to avoid a government shutdown kicks one immediate risk a little further into the future. But a major auto strike, the resumption of student-loan repayments, and a shutdown that may yet come back after the stop-gap spending deal lapses, could easily shave a percentage point off GDP growth in the fourth quarter.

Add those shocks to other powerful forces at work on the economy — from dwindling pandemic savings to soaring interest rates and now oil prices too — and the combined impact could be enough to tip the US into a downturn as early as this year.

Here are six reasons why a recession remains Bloomberg Economics’ base case. They range from the wiring of the human brain and the mechanics of monetary policy, to strikes, higher oil prices and a looming credit squeeze — not to mention the end of Taylor Swift’s concert tour.

The bottom line: history, and data, suggest the consensus has gotten a little too complacent — just as it did before every US downturn of the past four decades.

Soft Landing Calls Always Precede Recessions…

“The most likely outcome is that the economy will move forward toward a soft landing.” So said then-San Francisco Fed President Janet Yellen in October 2007, just two months before the Great Recession began. Yellen wasn’t alone in her optimism. With alarming regularity, soft landing calls peak before hard landings hit.

Why do economists find it so difficult to anticipate recessions? One reason is simply the way forecasting works. It typically assumes that what happens next in the economy will be some kind of extension of what’s already happened — a linear process, in the jargon. But recessions are non-linear events. The human mind isn’t good at thinking about them.

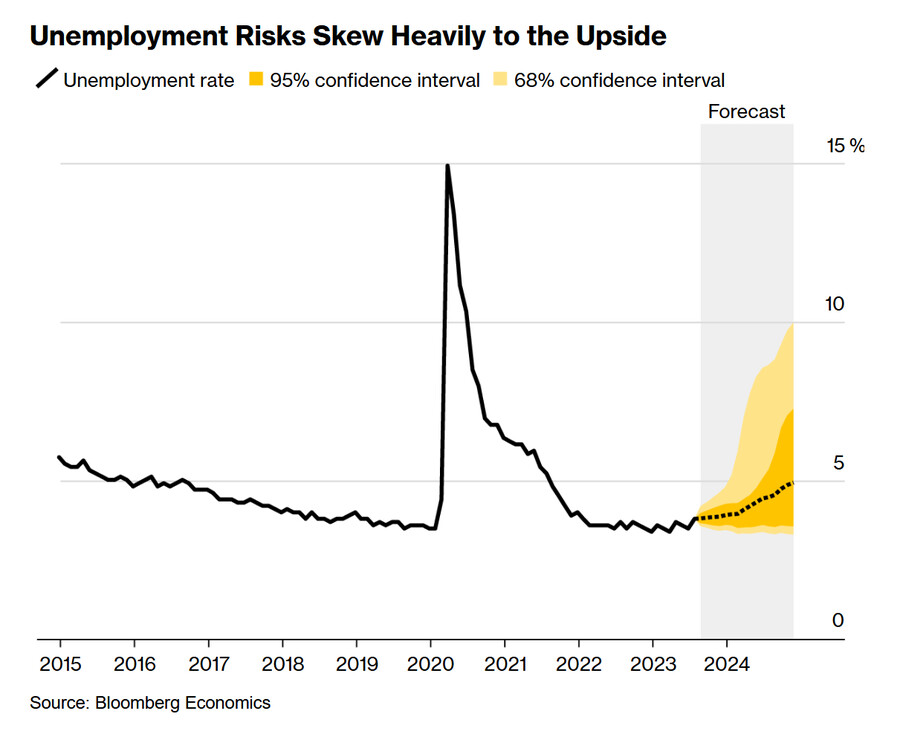

Here’s an example that focuses on unemployment, a key gauge of the economy’s health. The Fed’s latest forecast is for the jobless rate to edge higher from 3.8% in 2023 to 4.1% in 2024, That’s a continuation of the current trend, and one that would see the US skirting a recession.

But what if there’s a break in the trend — the type of sudden shift that occurs when the economy goes into a dive? Using a model designed to allow for these nonlinearities, Bloomberg Economics has forecast not just the most likely path for the unemployment rate, but the distribution of risks around that path.

The key takeaway is that risks are heavily skewed toward higher unemployment.

…And Fed Hikes Are About to Bite Hard

“Monetary policy,” Milton Friedman famously said, “operates with long and variable lags.” One subtlety here is that the “variable” can refer not just to differences between one recession and another — but also to different parts of the economy within a single cycle.

Soft-landing optimists point out that stocks have had a good year, manufacturing is bottoming out and housing reaccelerating. The trouble is, those are the areas that have the shortest lag time from rate hikes to real-world impact.

For the parts of the economy that matter for making the recession call — above all the labor market — lags are longer, typically 18 to 24 months.

That means the full force of the Fed's hikes — 525 basis points since early 2022 — won't be felt until the end of this year or early 2024. When that happens, it will provide a fresh impetus for stocks and housing to turn down. It’s premature to say the economy has weathered that storm.

And the Fed may not even be done hiking yet. In their latest projections, central bankers penciled in one more rate increase.

A Downturn Is Hiding in Plain Sight in the Forecasts...

Against the backdrop of that monetary squeeze, it’s little wonder that some indicators are already flashing warning signs. Bloomberg Economics took a closer look at measures that are especially important for the eminent academics who’ll officially declare whether the US is in recession or not.

That determination, by the National Bureau of Economic Research, typically isn’t made until several months after the recession actually began. But the NBER’s slump-dating committee identifies six indicators that weigh heavily in the decision, including measures of income, employment, consumer spending and factory output.

Using consensus forecasts for those key numbers, Bloomberg Economics built a model to mimic the committee’s decision-making process in real time. It works fairly well to match past calls. What it says about the future: There’s a better-than-even chance that sometime next year, the NBER will declare that a US recession began in the closing months of 2023.

(블룸버그의 예측 모델에 따르면, 내년에 NBER이 경기 침체가 2023년 말에 발생했다고 선언할 확률이 50% 이상)

In short: if you look at the gauges that matter most to America’s recession-deciders — and where most analysts reckon they’re headed — a downturn is already in the cards.

United Auto Workers members on a picket line outside the Ford Motor Co. Michigan Assembly plant in Wayne, Michigan on Sept. 15.Photographer: Emily Elconin/Bloomberg

…And That’s Before These Shocks Hit

That assessment is mostly based on forecasts delivered over the past few weeks — which might not capture some new threats that are threatening to knock the economy off course. Among them:

● Auto Strike: The United Auto Workers union has called a walkout at America’s Big Three auto firms, the first time they’ve all been targeted at the same time. It expanded the strike on Friday to encompass some 25,000 workers. The industry’s long supply chains means stoppages can have an outsize impact. In 1998, a 54-day strike of 9,200 workers at GM triggered a 150,000 drop in employment.

● Student Bills: Millions of Americans will start getting student-loan bills again this month, after the 3 1/2-year pandemic freeze expired. The resumption of payments could shave off another 0.2-0.3% from annualized growth in the fourth quarter.

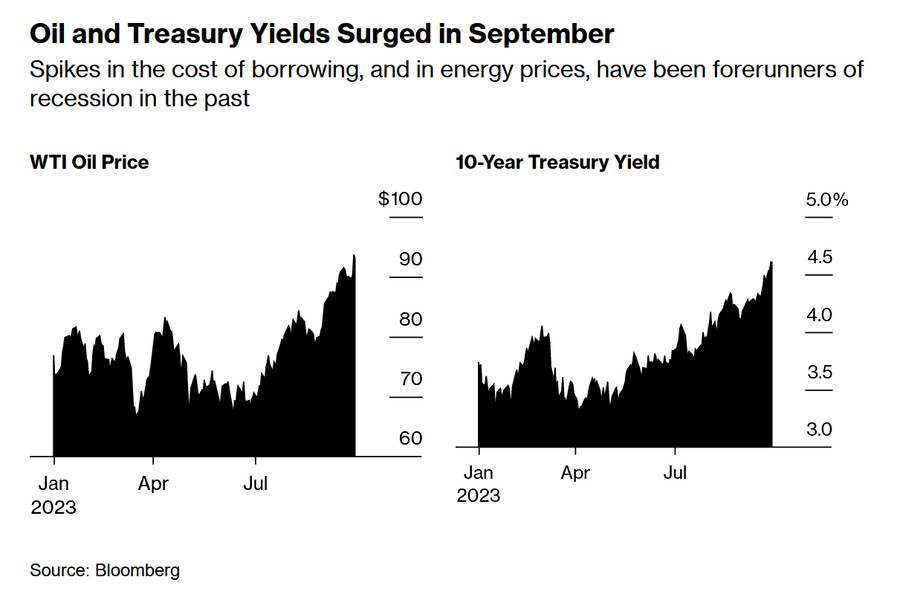

● Oil Spike: A surge in crude prices — hitting every household in the pocket book — is one of the handful of truly reliable indicators that a downturn is coming. Oil prices have climbed nearly $25 from their summer lows, pushing above $95 a barrel.

● Yield Curve: A September selloff pushed the yield on 10-year Treasuries to a 16-year high of 4.6%. Higher-for-longer borrowing costs have already tipped equity markets into decline. They could also put the housing recovery at risk and deter companies from investing.

● Global Slump: The rest of the world could drag the US down. The second-biggest economy, China, is mired in a real-estate crisis. In the euro area, lending is contracting at a faster pace than in the nadir of the sovereign debt crisis — a sign that already-stagnant growth is set to move lower.

● Government Shutdown: A 45-day deal to keep the government open has kicked one risk from October into November - a point where it could end up doing more damage to the fourth quarter GDP numbers. Bloomberg Economics estimates that each week of shutdown takes about 0.2 percentage point off annualized GDP growth, with most but not all of that recouped once the government re-opens.

Beyonce Can Only Do So Much…

At the core of the soft-landing argument is the strength of household spending. Unfortunately, history suggests that’s not a good guide to whether a recession is imminent or not — typically the US consumer keeps buying right up until the brink.

What’s more, the extra savings that Americans amassed in the pandemic — thanks to stimulus checks and lockdowns — are running out. There’s a debate over how fast, but the San Francisco Fed calculated that they’d all gone by the end of September. Bloomberg calculations show that the poorest 80% of the population now have less cash on hand than they did before Covid.

The past summer saw Americans splurge on a wave of hit entertainment. The Barbie and Oppenheimer movies, and sellout concert tours by Beyonce and Taylor Swift, added a remarkable $8.5 billion to third quarter GDP. That looks like a last hurrah. With savings exhausted and concerts over, powerful consumption drivers have been replaced by a blank space.

Revealing about the shape of things to come: Credit-card delinquency rates have surged, notably among younger Americans, and parts of the auto-loan market are turning bad too.

…And the Credit Squeeze Is Just Getting Started

One indicator that does have a good track record of anticipating downturns is the Fed’s survey of senior loan officers at banks, known as the SLOOS. (은행 주요 대출 담당자 설문 조사, 은행들의 대출 태도와 관련됨)

The latest reading shows that about half of large and mid-sized banks are imposing tougher criteria for commercial and industrial loans. Aside from the pandemic period, that’s the highest share since the 2008 financial crisis. The impact is set to be felt in the fourth quarter of this year – and when businesses can’t borrow as easily, it usually leads to weaker investment and hiring.

Arguments for the Defense (연착륙이 가능하다는 반론의 근거들)

Of course, the optimists can also marshal(=muster) some strong evidence.

Vacancies: A key part of the case for a hard landing rests on the view that the labor market is overheated, and cooling it will require a rise in unemployment. But perhaps there’s a less painful path? That’s the argument made by Fed Governor Chris Waller and staff economist Andrew Figura in summer 2022: that a drop in vacancies might take the heat out of wage gains, even as unemployment stayed low. So far, the data is falling in line with their argument.

(여전히 실업자 1인당 1.4개의 일자리가 있기 때문에 실업률 급증 없이 노동 시장 과열이 진정될 수도)

Productivity: In the late 1990s, rapid productivity gains — the result of the IT revolution — allowed the economy to outperform without the Fed having to hit the brakes too hard. Fast forward to 2023, and the creative destruction sparked by the pandemic, plus the potential in artificial intelligence and other new technologies, might mean a fresh surge in productivity — keeping growth on track and inflation in check.

(인공지능과 같은 신기술로 인한 생산성 향상)

Bidenomics: President Joe Biden’s embrace of industrial policy — he’s been doling out subsidies to the EV and semiconductor industries — hasn’t won him any friends among free market fundamentalists. But it has sparked higher business investment, another factor that could keep the economy growing.

(바이든의 첨단 산업 육성 정책이 기업 투자를 촉진하여 경제 성장세가 지속될 가능성)

Damp Squibs: Some of the anticipated shocks could be too small to move the dial. If the auto strike ends quickly, the government stays open, and student loan repayments are at the low end of our estimates — the Biden administration is offering new programs to cushion the impact — then the drag on fourth quarter GDP could end up being a rounding error(반올림 오차). Our recession call isn't dependent on all those shocks hitting, but if none of them do the chances come down.

(자동차 파업이 조기 종료되고, 정부 셧다운 없이 예산안이 통과되고 , 바이든 행정부의 학자금 탕감 후속 조치가 효과를 발휘하면, 블룸버그의 경기침체 예측도 틀릴 수 있음)

Pride Is a Leading Indicator of Falls

For economists, the past few years have provided a lesson in humility. Confronted with seismic shocks from the pandemic and Ukraine war, forecasting models that worked fine in the good times have completely missed the mark.

All of this provides good reasons for caution. A soft landing remains possible. Is it the most likely outcome, though? With the US confronting the combined impact of Fed hikes, auto strikes, student loan repayments, higher oil prices, and global slowdown we think not.

— With assistance by Katia Dmitrieva, Stuart Paul, Andrej Sokol, Alexandre Tanzi, Rich Miller, and Cedric Sam