-

[경제] (블룸버그) 미국인들이 전기차 구매를 주저하는 이유2024.01.05 PM 04:26

블룸버그 기사 요약 (ChatGPT)

블룸버그 기사는 미국의 전기차(EV) 도입 둔화에 대해 다음과 같은 몇 가지 요인을 강조합니다.

가격: EV는 전통적인 가솔린 자동차보다 평균 1만 3천 달러 가량 더 비쌉니다. 이는 주류 구매자들이 전기차 구입을 주저하는 가장 큰 이유입니다. 또한, 자동차 대출 금리 상승은 이러한 부담을 더욱 가중시킵니다.

충전 인프라 우려: Debbie Mettenleiter라는 소비자는 테슬라 모델 Y 예약을 취소하고 충전 접근성 문제로 가솔린 현대 코나 SUV를 선택했습니다. 이는 소비자들이 하이브리드 차량이나 내연기관 자동차로 선호하는 더 큰 트렌드를 반영합니다.

신뢰성 문제: 배터리 충전 문제를 포함한 신뢰성 문제는 소비자들이 전기차 구매를 망설이는 또 다른 이유입니다. 안정적인 충전소 부족과 일상적인 사용에 불편하다는 인식 때문에 EV로부터 멀어지는 추세가 나타납니다.

시장 전략 조정: 포드, 제너럴모터스 등은 예상보다 낮은 EV 수요에 따라 생산을 줄이고 가격을 조정하고 있습니다. 기사는 EV 판매는 계속 증가할 것으로 예상되지만, 주류 구매자들은 더 낮은 가격과 더 강력한 충전 인프라를 우선시하면서 초기 열정이 실용성의 벽에 부딪힌 것으로 보입니다.

정치화: EV는 기후 변화에 대한 의견 차이로 정치적 논쟁에 휘말리고 있습니다. 이러한 갈등은 자동차 일자리 상실과 정부 개입에 대한 우려와 함께 EV 시장 환경을 더욱 복잡하게 만들었습니다.

요약하자면, 기사는 가격, 충전 인프라 우려, 신뢰성 문제, 정치화 등을 미국 EV 도입 둔화의 주요 원인으로 꼽으며, 소비자들의 EV에 대한 인식 변화를 보여줍니다.

=============================================

(Bloomberg) Why America’s Car Buyers Are Rethinking EVs

High sticker prices, steep financing rates and range anxiety will fuel a slowdown in US electric-car adoption this year.

Illustration: Nick Öhlo for Bloomberg Businessweek

By Keith Naughton

2024년 1월 4일 오후 7:00 GMT+9

When Debbie Mettenleiter’s old Hyundai needed replacing after racking up 200,000 miles, she decided to jump on the electric car bandwagon. After all, Teslas seemed to be at every stoplight in San Diego, where she lives. Even her daughter has one. So she put down a $250 deposit on a Tesla Model Y.

Then she started talking to friends about their electric vehicle experiences and the difficulty they had accessing reliable charging stations. She also didn’t enjoy getting into the back seat of her daughter’s Model Y to ride with her grandchild. “I hit my head every time,” says Mettenleiter, 67, a retired executive assistant. (테슬라 모델 Y의 뒷좌석이 불편?)

So she pulled the plug on her Tesla reservation and instead bought a 2022 Hyundai Kona SUV with a traditional internal combustion engine.

Debbie Mettenleiter canceled her order for a Tesla Model Y and purchased a gasoline-powered Hyundai Kona SUV instead.

Photographer: Michael Dunne/Dunne Insights

“I wanted a vehicle I could just hop in and go on a road trip and not have to worry about charging,” Mettenleiter says. “I’m just not ready to make the leap with the charging issues what they are.”

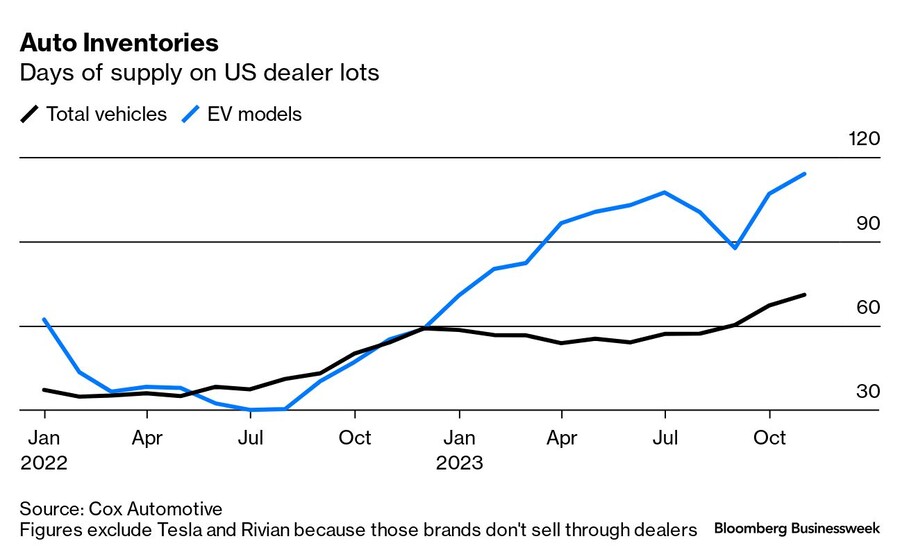

A year ago, EVs had the auto world abuzz, and it seemed like an all-electric future was just around the corner. But today’s car buyers are having second thoughts about them, short-circuiting sales growth and causing plug-in models to pile up on dealer lots. Automakers, who are pouring more than $100 billion into developing EVs this decade, are now slashing prices, production and profit forecasts for the new green vehicles. Inventory of battery-powered models on dealer lots has more than doubled over the past year, reaching a record high of a 114-day supply at the beginning of December, compared with 71 days for the overall auto industry, according to researcher Cox Automotive.

It’s gotten so bad that a nationwide group of almost 4,000 car dealers calling itself “EV Voice of the Customer” wrote to President Joe Biden in November, asking him to “tap the brakes on the unrealistic” government mandates for EVs, which his administration wants to make up more than half of all US auto sales by 2030, from about 7% in 2023.

Instead, car buyers are shifting toward hybrids—the gas-electric vehicles that have been around for a quarter century—which dealers have a hard time keeping in stock. Toyota Motor Corp., Ford Motor Co. and others are cranking up hybrid production to meet demand. Meanwhile, traditional internal combustion engine vehicles continue to do big business, representing more than 8 in 10 auto sales in America.

The US has lagged Europe and China in adopting EVs, and auto executives and politicians have been eager to catch up so America doesn’t lose the transportation technology race. But most US consumers aren’t going along for the ride. EVs remain too costly, at an average price of $60,544—about $13,000 more than a gas-fueled car, according to automotive researcher Edmunds.com. That premium has become even more painful as interest rates on auto loans have soared. Beyond cost, many consumers also see EVs as too risky if they run out of juice with no charger in sight—a concern known in the EV industry as “range anxiety.”

Ford is cutting production plans for its F-150 Lightning electric pickup as customer demand for EVs slows.

Courtesy: Ford

Annual EV sales growth in the US rose 60% in 2022, but it increased only 47% in 2023 and is expected to climb just 11% this year, according to a forecast by UBS Group AG. Ford slashed its production plans in half in 2024 for its F-150 Lightning plug-in pickup, its signature EV. General Motors Co. also is delaying production of highly anticipated EVs such as the Chevy Equinox SUV and Silverado pickup. Elon Musk repeatedly slashed prices on Tesla models in 2023. That triggered what Ford Chief Executive Officer Jim Farley called an EV “price war,” which led his company and others to also pare back what they were charging. Musk’s moves slowed—but didn’t prevent—market share losses that took a significant toll on profit margins.

“It all pivoted really quickly,” says Mickey Anderson, a car dealer who’s seen long waitlists for EVs evaporate while battery-powered models pile up at his dealerships in Oklahoma, Kansas and Colorado.

What changed, industry executives and analysts say, is that the initial rush of buyers consisted of wealthy drivers purchasing an extra car for their household because they wanted the latest technology. Now that the early adopters are sated, mainstream buyers who depend on their car as their daily vehicle find EVs “more expensive and less useful,” Anderson says.

“We have to have a more reliable charging network,” Anderson says, noting that there’s just one charging station in the 200-mile commute he makes weekly between his offices in Omaha and Kansas City. “People have to have confidence that they can get their kids to the doctor’s appointment, that they can get to work on time and that they can use this vehicle for vacations.”

Tesla Model 3

Courtesy: Tesla

It’s not just the charging network that’s unreliable. EVs had 80% more problems than cars with traditional internal combustion engines, according to the latest survey by Consumer Reports magazine. EV owners reported the most troubles with their battery and its ability to take a charge.

“This has nothing to do with the chargers in the field. This is specifically about a problem with the vehicle where it would not accept a charge,” says Jake Fisher, senior director of auto testing at Consumer Reports. “It’s like you can’t get gasoline into the car. That’s a problem, a big problem.”

“In the most recent months, there’s been a strong pushback with more people saying they absolutely, positively have no interest in buying an EV,” says Alexander Edwards, president of Strategic Vision. He contends there is actually no “intrinsic demand” for EVs because of their high price and charging limitations. “Very few people want to spend $55,000 so they can worry.”

To be clear, the bottom is not dropping out of the EV market. Sales of battery-powered vehicles will still grow at a faster rate than the overall auto market this year, automakers and independent analysts predict. But the heady optimism about an EV in every garage has run up against the pragmatism (실용주의) of mainstream buyers. Until they see lower prices and more chargers dotting their daily commute—two issues the auto industry and US government are devoting billions of dollars to improve—they’re sticking with their traditional rides and familiar filling stations.

“I know there’s a gas station every few miles,” says Mettenleiter, the Hyundai Kona owner, “and that will never be an issue.”

EVs have also ended up in the crosshairs of the culture wars, another obstacle to demand. Plug-in cars are central to Biden’s plans to combat climate change. His signature legislation, the Inflation Reduction Act, offers a range of consumer tax credits and billions of dollars in manufacturing incentives to stimulate demand. Biden’s Environmental Protection Agency has proposed restrictions on greenhouse gas emissions that would require two-thirds of new passenger vehicles be all-electric by 2032. But as he stumps for a return to the White House, former President Donald Trump has called Biden’s plan a “a ridiculous all-electric-car hoax” and warned EVs will kill jobs and put American automakers out of business.

“Blue states say EVs are great and we need to adopt them as soon as possible for climate reasons,” Bill Ford, executive chair of Ford and great-grandson of founder Henry Ford, said in an October interview with the New York Times. “Some of the red states say this is just like the vaccine, and it’s being shoved down our throat by the government, and we don’t want it. I never thought I would see the day when our products were so heavily politicized, but they are.”

That helps explain why more than half of American car buyers now say they’re not interested in EVs, up from just 42% who ruled out battery-powered models in 2022, according to a survey of a quarter-million US car buyers by automotive research firm Strategic Vision.