-

[경제] (블룸버그) 미국의 막대한 정부 부채에 대한 새로운 시각2024.01.13 PM 05:26

블룸버그 칼럼 요약 (ChatGPT)

클라우디아 삼(Claudia Sahm)은 삼컨설팅(Sahm Consulting) 설립자이자, 前 연방준비은행(Federal Reserve) 경제학자입니다. 그녀는 경기 침체 지표인 "삼의 법칙"을 개발한 것으로도 유명합니다. 최근 실업률 3개월 이동평균이 지난 12개월 동안 실업률이 가장 낮았던 때보다 0.5%포인트(p) 높으면 경기침체가 온다는 공식입니다.

클라우디아 삼은 2023년 말 34조 달러에 달하는 미국의 막대한 연방 정부 부채에 대한 우려에 대해, 그러한 우려는 정부 부채 증가의 사회적 목적과 경제적 이익을 간과하고 있다는 주장을 펼칩니다. Sahm은 예를 들어, 자녀 양육 비용 지원금과 mRNA 기술 개발을 위한 투자를 들며, 이러한 정부 지출이 각각 아동 빈곤 감소와 코로나19 백신 개발에 기여했다고 지적합니다. Sahm은 부채 수준만을 고려하는 것보다 정부 차입의 경제적 수익과 사회적 이익에 초점을 맞추는 것이 중요하다고 주장합니다.

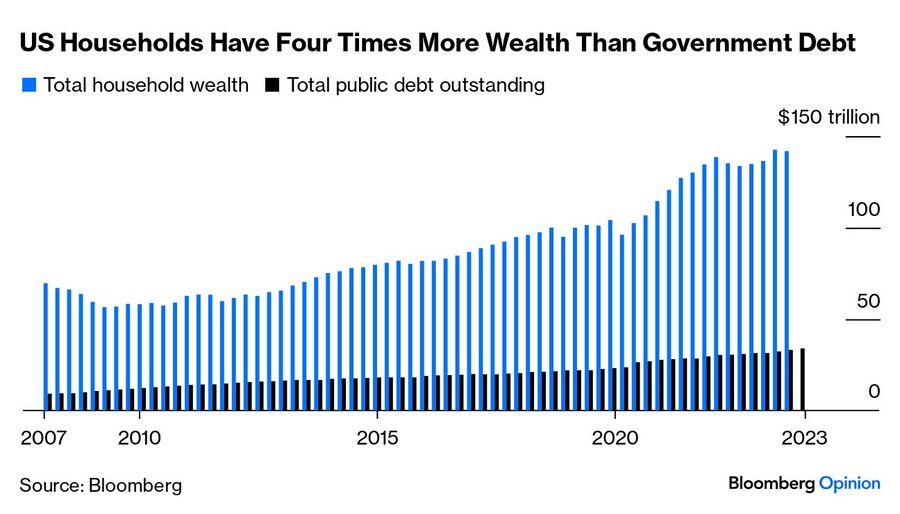

Sahm은 또한 미국의 총 자산이 142조 달러에 이르는 훨씬 더 큰 규모라는 점을 강조하며, 2023년 회계연도에 국내 총생산(GDP)의 3.4%에 불과한 정부 부채 이자 지급은 관리 가능하다고 주장합니다. 삼은 정부 부채를 가정 부채와 비교하는 것은 잘못이며, 정부는 무제한 징세권력과 국채 발행 같은 독특한 도구를 통해 부채를 상환할 수 있다고 반박합니다.

Sahm은 연방 정부 부채에 대한 정치적 갈등이 부채 수준 자체보다 경제에 더 큰 위험을 초래한다고 지적합니다. Sahm은 부채 상한에 대한 논쟁에서 드러나듯이, 정치적 기능저하로 인해 미국의 "막대한 특권"이 위태롭다고 주장하며, 이러한 특권은 법치와 안정적인 민주주의에 기반한 역동적인 경제에서 온다고 말합니다. 샘은 단순히 부채 감소나 예산 균형에만 초점을 맞추는 것보다 이러한 특권을 보호하는 것이 더 중요하다고 결론짓습니다.

간단히 말하자면, Sahm은 다음과 같은 주요 논점을 제시합니다:

① 정부 부채의 사회적 이익과 경제적 이익을 고려해야 한다.

② 미국의 총 자산이 훨씬 많으며 부채 이자 지급은 관리 가능하다.

③ 부채 한도에 대한 정치적 갈등이 부채 자체보다 경제에 더 큰 위험이며, 미국의 경쟁 우위를 유지하는 것이 중요하다.

===============================================================

(Bloomberg) The US Debt Is Now $34 Trillion. Don't Worry. Seriously.

Fiscal hawks who say borrowing is out of control only undermine a constructive conversation about the right priorities for the country.

2024년 1월 12일 오후 7:00 GMT+9

By Claudia Sahm

Claudia Sahm is the founder of Sahm Consulting and a former Federal Reserve economist. She is the creator of the Sahm rule, a recession indicator.

It’s a world of debt.

Photographer: William Thomas Cain/Getty Images

US federal government debt ended 2023 at a record $34 trillion. The worries are bipartisan, with both Republicans and Democrats hearing about out-of-control borrowing from their constituents. In fact, almost six in 10 Americans say reducing it should be a top priority, according to a survey by the Pew Research Center. So, it’s not a surprise that Congress is moving closer to passing a budget for fiscal year 2024 that would cap spending at $1.59 trillion which is a bit less than the $1.7 trillion in fiscal 2023.

But many of reasons why lawmakers and voters have concerns about the size of the nation’s debt – concerns that have been around for many decades - are misguided and undermine a constructive conversation about the priorities for the country. Debt is neither inherently good nor bad. As such, the question is not what’s the right level of borrowing, but rather what’s the economic return on the borrowing or the societal goals it advances.

Take the child tax credit. When the Biden administration increased borrowing to expand the deduction to as much as $3,600 per child from its previous amount of $2,000, the child poverty rate tumbled to as low as around 5% in 2021 from almost 13% in 2019, making it easier for families to provide the basics, such as food, clothing and school supplies. When the program expired at the end of 2021, the rate shot up to 12.6%. Or consider the tens of billions of dollars in grants and contracts the government handed out help fund the development of mRNA technology that was used in the Covid-19 vaccines. The return on that investment to society is incalculable. And would the economy have been so surprisingly strong the past few years without the extra borrowing, avoiding a damaging recession that would have thrown millions out of work?

For an example of deficit spending that might be viewed as bad, research suggests that tax breaks for companies, which decrease tax revenue and thereby increase the budget deficit, may exacerbate income inequality rather than the intended outcome of encouraging companies to boost capital spending to strengthen their businesses and the economy.

Regardless, the amount of US debt must be put in context. Yes, $34 trillion is big number, but $142 trillion is even bigger and much more important because it represents the total wealth of Americans —a massive resource that helps fund government debt and deficits.

The pessimists will counter by pointing to the amount of interest the government is paying to service its debt. In fiscal 2023 that ended Sept. 30, the figure was also a record - $882.6 billion, to be exact. Again, context matters. Although the amount has doubled since 2016, it was a manageable 3.4% of gross domestic product, less than the 4.3% level of the late 1990s when the government was running budget surpluses instead of deficits like now, according to data compiled by Bloomberg.

Sure enough, whenever there’s a debate about government borrowing, it’s inevitably put in the context of the financial constraints faced by households. But the correct context for how the federal government makes decisions about debt is not the same as how households make decisions about debt. Stephanie Kelton, professor of economics at Stony Brook University, rightly argues that this is one of the many “ myths” embedded in the discussion about the federal debt. The government can easily service its debt because of its unlimited taxing authority and ability to issue more US Treasury securities to repay maturing securities. Conversely, households can’t just increase their incomes to a desired level at will.

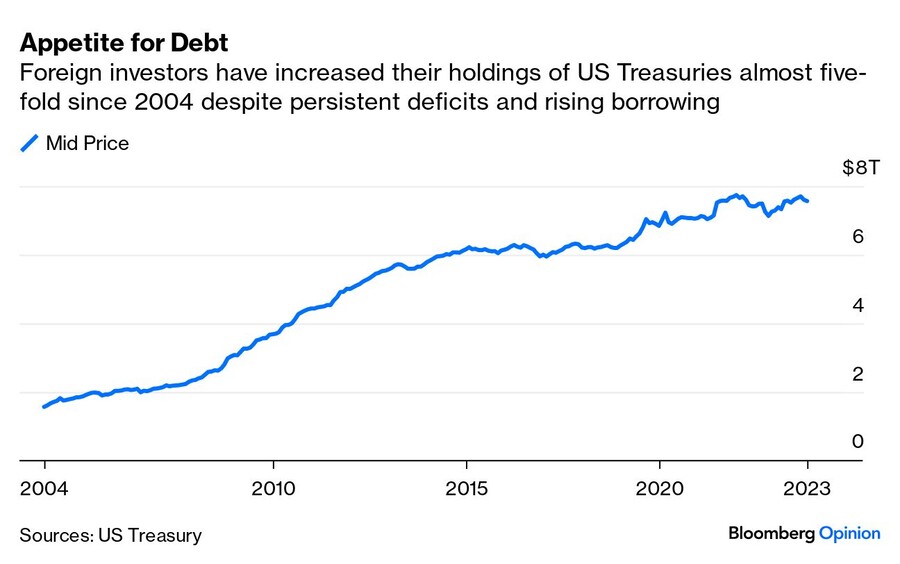

Rather than the level of borrowing, political gamesmanship over the federal debt is a far greater risk to the economy. The United States has earned what’s known as an “ exorbitant privilege” in the post-World War II era, meaning that there is always demand from investors around the world for US Treasuries in good times and bad. That privilege was earned by the US promoting a dynamic economy, adhering to the rule of law and being a stable democracy. As such, the dollar accounts for around 60% of global foreign-exchange reserves, three times that of the No. 2 reserve currency, the euro.

More important than reducing the debt or balancing the budget would be efforts by lawmakers to protect the US’s exorbitant privilege. Those in Congress creating high drama over the nation’s borrowing and budgets have caused some to question whether Treasuries are really the world’s safest assets. In stripping the US of its AAA credit ratings, both S&P Global Ratings and Fitch Ratings cited concern about rising political dysfunction following several debt-ceiling standoffs.

Politics is the real threat, not the level of borrowing. A country that prioritizes the size of the federal debt has bad priorities.

#UST

댓글 : 0 개