-

[경제] (FT) 2023년 미국증시의 대안은 유럽?2023.01.17 PM 01:24

작년 말부터 유럽 주식이 미국 주식의 대안으로 부각되고 있죠. FT Lex 칼럼에 간단한 opinion이 실려서 요약을 해봤습니다.

================

- 리세션은 리세션인지라 아주 좋게 보긴 힘듬. 그러나 'dead-cat bounce'라고 해도 무시하기 어려운 부분은 있음

1) 유출된 자금의 복귀 : 그러나 러-우전쟁 이후 유럽 주식형 펀드에서 무려 1천억달러 자금 유출이 있었는데, 이 부분이 조금만 복원되어도 수혜가 가능하고

2) 밸류에이션이 아직도 엄청 쌈 : 통상 리세션 때는 PER 14~15배 정도에서 거래됐는데, 지금은 12.5배에 불과

3) 중국 리오프닝으로 명품주들(LVMH, Hermes, Richemont)과 여행/항공주(Tui, Britith Airways) 실적 개선 예상

4) 2022년 9월 이후 가장 많이 오른 주식은 은행(+25%)임

5) 그러나 겨울철로 갈수록 LNG 가격 재상승 등 인플레 압력 재차 노출될 수 있어 화학/비료/시멘트/철강 등 Energy-intensive 업종은 조심해야

- 신영증권 박소연 투자전략부장 -

프랑크푸르트 증권 거래소의 트레이더들. Euro Stoxx 600은 2022년 8월 이후 약 10% 상승했다. © AFP via Getty Images

European stocks: there’s life in the old cat yet

As seasoned market watchers know, even the most moribund of felines can ricochet off the pavement. Indeed, the propensity for equities to stage brief — groundless — rebounds in a bear market was in full evidence last summer in the US. But the recent strong showing in European equities — with the Euro Stoxx 600 up about 10 per cent since August 2022 — could prove more durable.

Granted, European companies are unlikely to post strong earnings in 2023. Consensus earnings per share growth is a measly 0.6 per cent, according to Sarah McCarthy at Bernstein. And even that may be too high, as Lex has recently warned.

The economy may no longer be expected to tank. But a mild recession is still likely. And margins do not yet reflect the squeeze from higher supply costs.

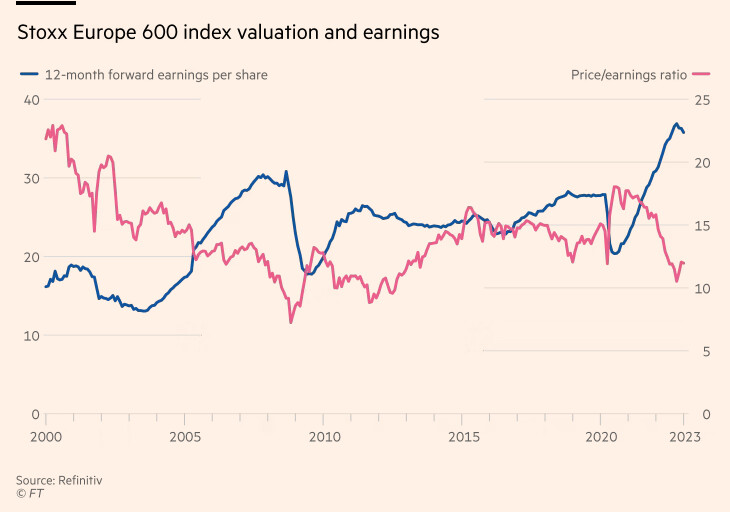

Dual-scale chart showing Stoxx Europe 600 index valuation and earnings.

Left-hand scale shows 12-month forward earnings per share, right-hand scale shows Price/earnings ratio, 2000-23.

In that — admittedly gloomy — context, some sectors will probably get a lift from China, where Covid-19 restrictions are being removed faster than expected.

Luxury goods is one of these. LVMH, the sector juggernaut, is already pricing in a strong 2023. Richemont, the watchmaker, and leather-goods icon Hermès are also exposed to the Chinese consumer. Travel and leisure groups should also benefit: Tui is up 30 per cent this year, while British Airways parent IAG is up 28 per cent.

The reopening of the Chinese economy is not unequivocally positive for the European economy: it brings with it the risk of higher commodity prices, and thus higher -nput costs. Liquefied natural gas is a particular concern, as demand from China may drive up European energy prices for next winter. That would be bad news for energy intensive sectors, such as chemicals, fertilisers, cement and steelmaking.

Exporters in general are expected to do well. German stocks have traditionally outperformed their European peers when China outperforms the rest of Asia, as Morgan Stanley notes.

There are two more reasons not to dismiss the recent rally in European equities.

Two charts. First chart shows that Europe is outperforming the US, Stoxx Europe 600 index and S&P 500 index, Sept 2022 to Jan 2023. Second chart shows Stoxx 600 best and worst sectors including Banks, Technology, Industrials, Real Estate, Insurance and Telecoms.

First, they are relatively cheap, on 12.5 times forecast earnings. When the end of a recession is in sight, the multiple has in the past risen to 14-15 times, according to Bernstein analysis.

Second, European equity funds have suffered net outflows since Russia invaded Ukraine, with $100bn lost in 2022. That is sizeable potential demand for European equities — and no one wants to miss out on a recovery.

moribund 죽어가는, 빈사 상태의

ricochet off ~에 맞고 튀어 나오다, ~을 스치고 튀어 나가다

propensity (특정한 행동을 하는) 경향 (=inclination)

juggernaut (통제할 수 없는) 거대한 힘[조직]

unequivocal 명백한, 분명한, 절대적인, 무조건적인