-

[금융/시황/전략] (블룸버그) 신흥시장의 재발견 : 새로운 무역 질서와 투자 기회2023.12.26 PM 09:54

블룸버그 칼럼 요약 (ChatGPT)

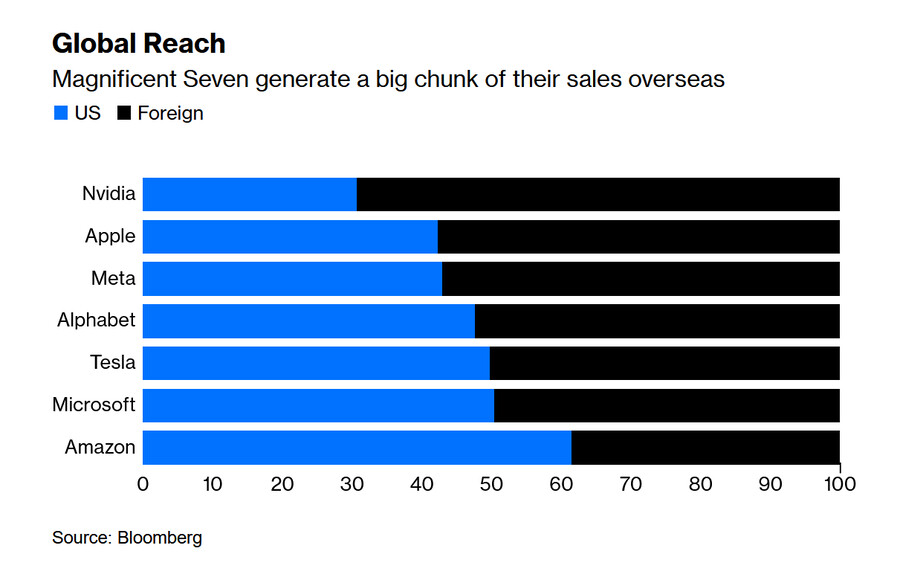

최근 10년간 S&P 500이 급성장하는 반면 신흥시장은 저조한 성과를 보여, 전통적으로 신흥시장을 옹호하던 투자자들마저 낙담하고 있습니다. 애플, 마이크로소프트, 알파벳, 아마존, 엔비디아, 테슬라, 메타 플랫폼스 등 대형 기술주로 구성된 매그니피센트 7은 일부 투자자들에게 글로벌 소비 트렌드에 대한 충분한 노출을 제공하며, 신흥시장을 덜 매력적으로 만들고 있습니다.

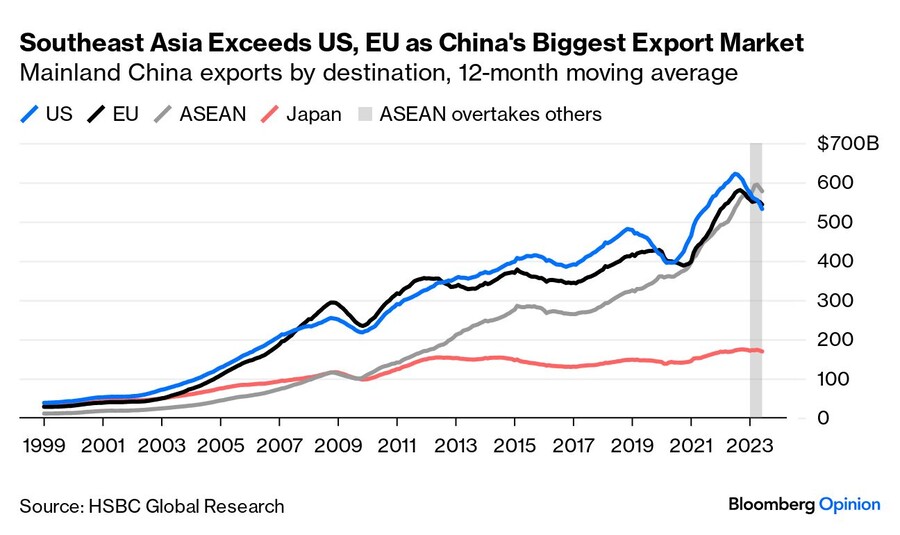

그러나 칼럼니스트는 이러한 시각에 반대하면서, 서구 국가나 미국 달러를 포함하지 않는 새로운 무역 질서가 나타나고 있다고 지적합니다. 서방 민주주의 국가들과 중국, 러시아 등의 국가들 사이의 지정학적 갈등이 지속됨에 따라, 무역 역학이 변화하고 있습니다. 신흥시장은 점점 더 서로 간의 무역을 하고 있으며, 이 블록 내 수출 비중이 크게 증가하고 있습니다. 예를 들어, 동남아시아는 미국을 제치고 중국의 최대 수출 시장이 되었습니다.

이 칼럼은 개발 도상국들이 무역에 자국 통화를 사용하여 미국 달러에 대한 의존도를 줄이는 추세가 증가하고 있다고 강조합니다. 특히 중국은 최근 사우디아라비아와 70억 달러 규모의 현물 거래 계약을 맺는 등 지역 통화 스와프 계약에 적극적으로 참여하고 있습니다. 위안은 달러를 제치고 중국이 무역 거래에서 가장 많이 사용하는 통화가 되었습니다. 칼럼은 이러한 발전이 투자 기회를 제공하며, 세계 경제 중심의 잠재적 변화를 활용하기 위해 빠르게 진입하는 것이 중요하다고 강조합니다.

예를 들어 인도네시아는 니켈 산업과 인프라 프로젝트에 상당한 투자를 한 중국 기업들의 경제적 전쟁터가 되었습니다. 칼럼은 장기 투자자들에게 글로벌 공급망 재편에 따라 개발도상국에서 투자 기회를 모색할 것을 권장하며, 미국 기업들은 새로운 경제 클럽 형성에 참여하지 못할 위험이 있다고 경고합니다.

=================================================================

(Bloomberg) Ditch Emerging Markets for Magnificent Seven? Bad Idea

A new trade order that doesn’t involve Western nations or the US dollar is emerging. Investors would do well to get exposure early.

2023년 12월 22일 오전 5:00 GMT+9

By Shuli Ren

Shuli Ren is a Bloomberg Opinion columnist covering Asian markets. A former investment banker, she was a markets reporter for Barron’s. She is a CFA charterholder.

Get in fast.Photographer: Dimas Ardian/Bloomberg

Even some of the emerging markets’ biggest fans are losing heart.

As their dismal performance enters a second decade, and the S&P 500 reaches new highs, money managers are asking if it is worthwhile to dedicate time to this asset class at all. After all, the Magnificent Seven are direct bets on the global consumer. The shares of tech giants Apple Inc., Microsoft Corp., Alphabet Inc., Amazon.com Inc., Nvidia Corp., Tesla Inc. and Meta Platforms Inc. have doubled this year. Apple, for instance, gets almost 20% of its revenue from China.

Holding these shares alone gives portfolio managers enough exposure to developing countries’ rising middle class, one may argue. Plus, with Americans owning more stocks than ever and propelling strong inflows into the S&P, why bother investing in emerging markets, which can be volatile and complicated?

That would be a short-sighted move.As geopolitical jostling between Western democracies and the likes of China and Russia continues, a new trade corridor that doesn’t involve developed nations or the US dollar is emerging. Savvy investors will not want to miss getting in early to take advantage of a potential seismic shift in the world’s economic gravity center.

For decades, the winning formula for developing nations has been to export cheap goods to the US and climb the economic ladder along the way. But increasingly, emerging markets are trading amongst themselves. The share of exports within this bloc has risen from less than 25% in 2000 to over 40%, according to Gavekal Research. This year, Southeast Asia has overtaken the US as China’s largest export market.

Sanctions against Russia and the US-China trade war also give developing nations a window to use their own currencies to buy the commodities and industrial goods they need. Beijing has been keen to sign local-currency swap agreements, most recently a $7 billion deal with Saudi Arabia, to reduce its reliance on the greenback. The yuan surpassed the dollar as China’s most used cross-border legal tender this year, a major milestone for policymakers. In just two years, renminbi use by foreign central banks has almost doubled. In fact, Russia’s war over Ukraine may have permanently reshaped global commodities markets, in that sellers are starting to allow multiple currencies to settle trades.

As such, there are plenty of investing opportunities. Indonesia, for one, is an important battleground for Chinese companies, which have deployed tens of billions in its nickel industry alone. China has financed a new 140-kilometer (87 mile) high-speed rail, allowing travelers to make the three-hour road trip from Jakarta to Bandung in less than an hour. And yet Indonesia has managed its debt well. The rupiah is staying relatively firm, even as sovereign bonds’ rate differential with the US is at a decade low. Jakarta has come a long way since it was named among the original Fragile Five.

As Washington attempts to cut China out of the global supply chain, a nascent economic club is taking shape and American companies are missing out. Because of this, buying US big tech stocks offers only an indirect and minimal exposure to the rest of the world. Long-term investors still need to rumble and tumble in developing countries.