오늘은 파이낸셜 타임스 소속 이코노미스트 Ruchir Sharma의 2023년 투자자 가이드를 소개해 드리겠습니다.

각계각층의 사람들은 인플레이션과 금리로부터 파생되는 문제의 심각함을 인지하고 있음에도 불구하고, 행동하지 않음. 너무 오랫동안 저금리에 익숙하다 보니, 다른 세상을 생각하는 것조차 어려운 상황. 이러한 정신 상태를 두고 zeteophobia, 즉 삶을 바꾸는 선택 장애라고 함. 너무나도 많은 사람들이 변화가 있다는 것은 인지하지만, 변화에 대처할 필요가 없기를 바라면서 기존의 투자 패턴을 고수. 중앙은행이 다시 한번 구조에 나설 것이라는 가정 하에 투자자들은 지난 10년 동안 효과가 있었던 기술주, 사모펀드, VC 등에 여전히 돈을 쏟아붓고 있는 중. 주택 소유자는 금리 인하를 기대하며 판매를 거부하고 있음 그러나 긴축은 일시적인 충격이 아님. 인플레이션에 대한 새로운 기준은 2%가 아닌 4%에 가깝기 때문에, 금리가 다시 0으로 하락하지는 않을 것. 이런 상황에서 새로운 2023년의 트렌드를 소개함

- 달러 피크: 달러는 약 7년 정도의 주기로 상승 및 하락 반복. 최근의 상승세는 지난 10월까지 전개된 11년으로 집계. 달러는 25% 과대평가

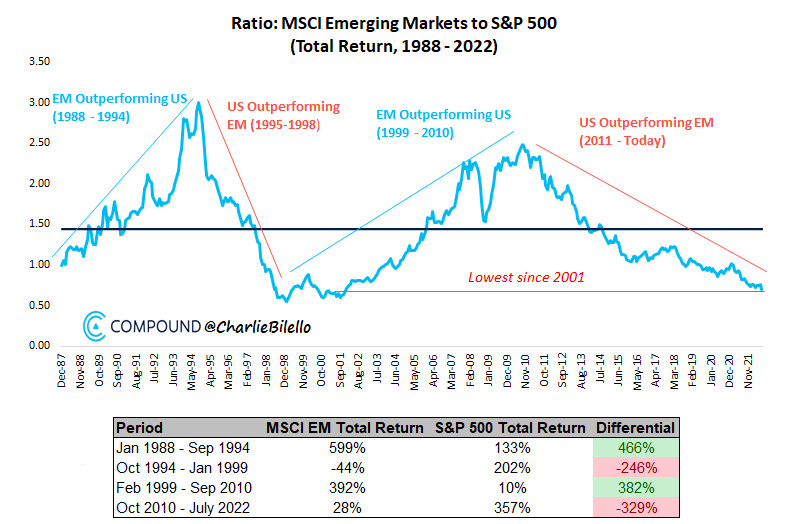

- ROW(Rest of the World) 부상: 많은 사람들의 컨센서스는 미국 지배가 지속될 것이라는 가정 하에 굳이 다른 곳에 투자할 필요가 없다고 주장. 미국의 지배가 오래갈 수 있다는 아이디어에는 동의하지만 10년 기간을 주기로 미국 VS ROW 간 수익률 경쟁. 현재 미국은 전 세계 인구의 4%, 상장 기업의 20%, GDP의 25%, 기업 수익의 45%임에도 불구하고, 주식 시장의 60% 비중 차지. 지난 10년간 미국 기업 수익성 증가의 절반은 낮은 이자 비용일 수 있음

- 빅 테크의 후퇴: 10년 동안 상위 10위권 안에 진입한 회사는 다음 10년에는 그 우위가 지속되지 않음. 2020년 기준 글로벌 Top 10에 포함된 7개 기술 기업 중 3개 기업이 이탈

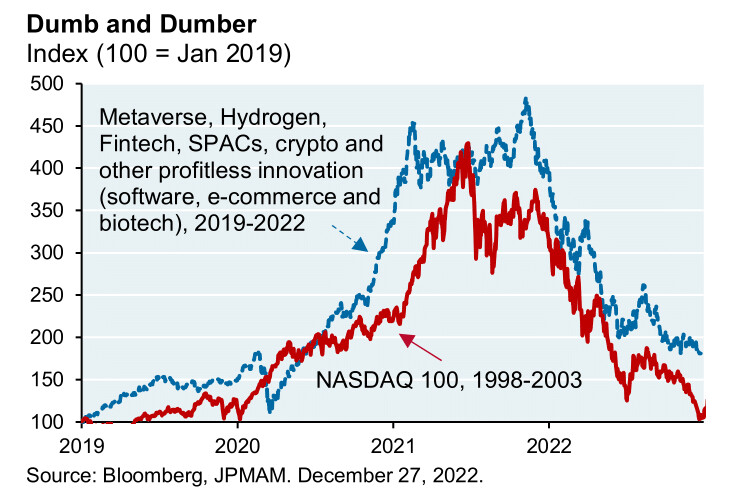

- 메아리 버블: 거품은 한 번에 안 터짐. 하락은 종종 메아리 거품을 동반. 버블 뒤의 심리는 매우 강력. 사람들은 버블에 영감을 준 아이디어(예를 들면 암호화폐, 미국의 빅 테크, 서울의 아파트)를 쉽게 못 버리는 경향. 진짜 승자는 다른 분야에서 나올 것으로 전망

- 강해진 일본: 일본 가계와 기업은 지난 10년 동안 부채 부담을 많이 줄였고, 이익률은 꾸준히 상승. 근로자 생산성에 따라 조종된 노동 비용은 중국보다 일본이 낮음

- 중국 제외 주변국 수혜: 미중 무역 분쟁의 가장 큰 승자는 중국 인근에 위치한 베트남, 대만, 인도, 한국. 중국 내 미국 기업의 절반 이상이 재배치를 위한 첫 번째 선택지로 아시아의 다른 국가가 될 것이라 언급

- 파랑새: 나심 탈레브의 블랙 스완과 대비되는 개념. 이는 긍정적인 충격. 파랑새가 될 수 있는 후보로는 러-우 전쟁 종식, 미-중 무역 분쟁 해소. 생산성을 높여 인플레이션을 억제하는 데 도움이 되는 기술 출현

- 최남곤 유안타증권 통신/지주 애널리스트 -

Talking to leaders these days in any walk of life, I have a sense that people are frozen. They see that inflation is back in a serious way for the first time in decades, forcing central banks to raise interest rates at the fastest pace since the early 1980s. They understand that this sudden change in the price of money — the most important driver of economic and financial behaviour — marks a fundamental break with the past. But they are not acting. After living with easy money for so long, they find it difficult even to contemplate a different world. There is a term for this state of mind: zeteophobia, or paralysis in the face of life-altering choices.

So many people keep doing what they were doing, hoping that somehow they won’t have to deal with change. On the assumption that central banks will once again come to the rescue, investors are still pouring money into ideas that worked in the past decade — tech funds, private equity and venture capital. Governments are still borrowing to spend and homeowners are refusing to sell as if easy money was bound to return soon.

But tight money is not a temporary shock. The new standard for inflation is closer to 4 per cent than 2 per cent, so interest rates won’t be falling back to zero. As this phase wears on, tycoons, companies, currencies and countries that thrived on easy money will stumble, making way for new winners. Some things will improve. The time of lavishly ridiculous digital coins and TV shows will pass. An age of more discriminating judgment will shape the trends of 2023.

1. Peak dollar

The dollar has been the world’s dominant currency for 102 years, eight years longer than average for its five predecessors going back to the 15th century, including most recently the British pound. Decline is overdue. Yet the prevailing assumption remains that, lacking serious rivals, the dollar can stay dominant — now and for the foreseeable future.

The dollar’s long rule has been far from a steady climb, instead rising and falling in long cycles. Its two major upward swings — one starting in the late ’70s, another in the mid ’90s — lasted about seven years, yet by October its latest upswing was 11 years old. The greenback is now as expensive as it has ever been, on some metrics. Lifted by the dollar, New York rose to top (jointly with Singapore) the list of the world’s most expensive cities for the first time in recent history.

The dollar is overvalued by about 25 per cent, and that kind of overvaluation foretells decline. The dollar started falling in October, turning at almost exactly the same point — 20 per cent above its long-term trend — that has on average signalled multiyear falls in the past. This year the economy is expected to grow more slowly and interest rates are set to rise less in the US than in other major nations. These signals point to a further fall for the dollar and less global purchasing power for Americans, more for everyone else.

2. Rise of the ROW

The ROW, or “rest of the world”, has been living in the shadow of US financial markets for years and many believe that this aspect of American dominance will continue. After all, the US has been the best performing market in the world over the past century and so, many argue, why bother investing anywhere else?

But is anyone alive today waiting for returns a century from now? Consider a more practical timescale. Since the second world war, the US stock market has tended to outperform the ROW one decade, then trail behind the next. The 1950s, ’70s and 2000s were great decades for investing outside the US.

In the boom of the 2010s, the value of the US stock market expanded, reaching 60 per cent of the global total in 2021, a full 15 per cent above its long-term average. In every other way, the global footprint of the US is much smaller: less than half of corporate earnings, a quarter of economic output, one-fifth of listed companies, and a mere 4 per cent of the population.

With US stock valuations near post-second-world-war highs compared to the ROW, investors sticking with American companies are assuming that the US can improve its p-osition, not just hold it. That’s not a safe assumption, particularly now that the era of easy money is over. By one estimate, half of the increase in US corporate profitability in the last decade can be attributed to lower interest costs. True, easy money was available in most countries. But financial engineering to boost returns became an American speciality.

3. Not-so Big Tech

Big decades for the US market tend to coincide with tech booms. In the ’90s, the likes of IBM in software and Cisco in internet hardware led a rush of US companies into the global top 10 by market value. But companies that make the top 10 one decade rarely last there the next, and tech is particularly prone to disruption.

In the 2010s the leading tech firms rose in mobile internet services — shopping, search, social media — but that model is showing signs of exhaustion. Earnings are under pressure from the law of large numbers, regulators, competitors. Of the seven tech firms in the global top 10 as of 2020, three have fallen off. Two of those are Chinese, Alibaba and Tencent. One is Meta, which has fallen out of the top 20. The value of the other American giants is shrinking too, although they still hold on to top 10 p-ositions, for now.

The next evolution of the information age is dawning, and it will generate new models and winners. One possibility: they will apply digital tech to serving industry — biotech, healthcare, manufacturing — not individual consumers.

If it is still hard for frozen imaginations to think of a time not dominated by today’s big tech names, the arrival of tight money makes churn at the top even more likely. Easy money encouraged risky bets on expensive but fast-growing stocks, which in the past decade meant big tech. Now that bias to bigness and growth at any price is fading.

4. Less money, better TV

Unlimited access to cheap capital helped to fuel what has been widely hailed as a “golden age of television”. Worldwide spending by the big streaming services on new content rose over the past five years from under $90bn to more than $140bn. The number of new shows /s!crip/ed for TV exploded.

But like most hot trends of the easy money era, TV was spoiled by too much money. The golden era tarnished itself, producing more quantity, less quality. The average IMDb rating for Netflix TV shows peaked in the mid-2010s at 8.5 out of 10, then fell steadily to 6.7 in 2022. The subject of how and where to find the few riveting shows in this expanding menu of mediocre options became a staple of dinner table conversations. For every gem like The White Lotus or Tehran, there were dozens of duds like ‘Snowflake Mountain’ and, of course, The Kardashians.

Viewers will feel less lost in the coming year. In recent months, the big streaming services have shifted focus to making a profit, rather than spending whatever it takes to get new subscribers. They are ordering fewer new shows and — according to the TV writers and producers I know — imposing higher standards on new pitches and /s!crip/s. This is one of the many ways that less money could produce better choices in the new era.

5. Echo bubbles

Bubbles don’t necessarily burst all at once; the declines are often punctuated by big rebounds — “echo bubbles”. These bounces cushioned the fall of many famous bubbles, from commodities in the 1970s to dotcoms in the late 1990s.

By early 2001, the Nasdaq had fallen nearly 70 per cent, but it would stage two false rallies before the year was out. The echo bubbles looked big — with tech stocks up as much as 45 per cent. But it was a mathematical illusion. Bouncing off such a low bottom, tech would have had to rise 250 per cent to regain its previous peak, and never came close in 2001. Tech finally hit bottom the next year, and remained sluggish for the rest of the decade.

During the pandemic, bubblets emerged within the broad markets, appearing in small cap stocks, clean energy stocks including Tesla, cryptocurrencies including Bitcoin, SPACS or “special purpose acquisition companies,” and tech stocks that have no earnings but include famous names (Spotify, Lyft). These bubblets have already suffered falls of 50 to 75 per cent, but the story is not over. The fortunes of crypto kings and Elon Musk are still whirling wildly.

The psychology behind bubbles is powerful. People refuse to easily abandon the idea that inspired the bubble. They buy the dips and give up only after their faith has been deflated repeatedly. 2023 is likely to see more echo bubbles, including in the most hyped themes of the last decade: big cap tech in the US and China. But don’t be fooled again. The next big winners will be emerging elsewhere.

6. Japan is back

The image of “rising Japan”, unstoppable superpower, was so ingrained in the global imagination that as late as 1992 US presidential candidate Paul Tsongas could proclaim that “the cold war is over, and Japan has won”.

Today, to the extent Japan has an image, it is old people and bad debts, not superpowerdom. Global investors barely give a thought to Japan, which is just what its leaders should hope for. If hype surrounds countries at a peak, and hate piles on in a crisis, those poised for success are shrouded in indifference.

Quietly, Japan is turning for the better. Growth in the working age population, which turned negative in Japan three decades ago, is about to turn negative across the developed world. Measured as a share of the economy, private debt is on average higher in other developed economies than in Japan.

Japanese households and corporations reduced their debt load for much of the last decade, and will be less hard pressed in a tight money era than many outsiders may assume. Profit margins have been rising steadily. The cost of labour, adjusted for worker productivity, is now lower in Japan than in China.

Japan may not be back in the sense of a rising superpower, but it is poised for a relatively good 2023.

7. ‘Anywhere but China’

Couple rising labour costs with Beijing’s turn away from openness toward state control, and many foreign companies looking to outsource production now look, so it is said, “anywhere but China”. In the US, there is talk of manufacturing coming “back home”, or moving next door to Mexico, but the big winners so far are next door to China: Vietnam, Taiwan, India and South Korea.

More than half of US businesses in China say that their first choice for relocation would be other countries in Asia; less than a quarter say back home; less than a fifth say Mexico or Canada. These decisions are guided by all manner of risks and costs, but a central advantage of Asia outside China is wages.

The average monthly factory wage in Vietnam and India is less than $300 — about half the level of China ($600), a quarter lower than Mexico($400), a small fraction of the $4,200 monthly wage in the US. No wonder American companies are still looking to offshore, just not in China.

8. Return of orthodoxy

In November, amid a market sell-off widely attributed to his generous spending plans, Brazilian president Luiz Inácio Lula da Silva dismissed the sellers as “speculators, not serious people”. Investors have resumed the sell-off, forcing Lula aides to walk back some of his remarks.

Other countries targeted by market sell-offs in 2022 included Chile, Colombia, Egypt, Ghana, Pakistan, Hungary and even the UK. What they shared: high external and government deficits and unorthodox leaders who threatened to make those deficits worse.

The choice of targets was rational, not ideological. Sell-offs hit leftwing populists such as Lula, and conservatives like UK prime minister Liz Truss, who lost her job in the fallout. All had to retreat in substance or tone. Colombia’s finance minister promised to “do nothing crazy”.

As money tightens, the market grows less tolerant of the unorthodox, and its target list grows. Compared with the roughly eight countries targeted last year, the markets turned sharply against only a few in the 2010s: most notably Greece, Turkey and Argentina.

Since then, Greece has cut its deficits and debts, and returned as a welcome borrower in global markets, but Turkey and Argentina have not. Expect more of these battles in 2023.

9. Political relief

What’s not happening will shape the political mood in 2023. For the first time this century, no G7 country is holding a national election. There aren’t many election battles in the other G20 nations, either. These days elections sow more discord than unity, so the pause will come as relief.

In election years, developed markets tend to lag their peers, but emerging markets tend to gain, perhaps on hope that new leaders can have a bigger impact on economic growth in younger nations. With few big elections, the spotlight may shine brighter on smaller ones. Two stand out as rife with possibility.

In Turkey, President Recep Tayyip Erdoğan faces a serious challenge after nearly 20 years in power. A classic case of a leader who started strong but lost his way, Erdoğan is now perhaps the world’s most financially unorthodox leader, a standing risk to his nation’s future.

In Nigeria, President Muhammadu Buhari made life worse. Poverty rose, corruption festered. Now Buhari is out, thanks to term limits. Any of the four key contenders in the February election could be an improvement. The most intriguing is Peter Obi, a political outsider with serious plans to clean up Nigeria’s oil theftocracy. A quiet political year will feel even better if a few elections produce bright new reformers.

10. Blue birds

In the late 2000s, author Nassim Nicholas Taleb popularised the “black swan”. Written as a theory of unexpected events that can disrupt for better or worse, the term became synonymous with negative shocks during the global financial crisis of 2008. People have been on the lookout for black swans ever since.

Now the idea of the good black swan may come back as the “blue bird” — a rare, unforeseeable event that brings joy. Geopolitical shocks and economic gloom have persisted since 2008, and could get worse in the tight money era. Amid endless worries, the world may turn its risk radar toward positive shocks that could bring relief.

The next blue bird might be a surprise peace in Ukraine, which instantly lowers energy and food costs. A thaw in the US-China cold war, which boosts global trade. A new digital technology that revives productivity, helping to contain inflation. None of this may seem likely, but then surprise is the essential nature of blue birds.

Ruchir Sharma is an FT contributing editor and chair of Rockefeller International