- 예상과 다르게 골드 강세, TIPs(실질금리)와의 동행성도 깨진 상황

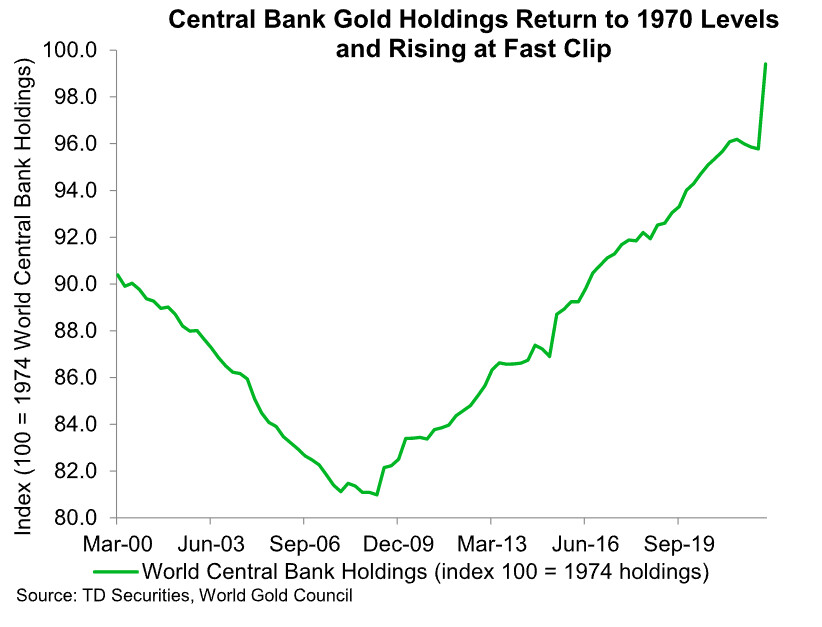

- 중앙은행의 금 보유량이 70년대로 돌아가고 있음

- 특히 중국 쪽 수요가 계속 되고 있음

- 중국내 골드 가격 프리미엄이 높은 상황

- 왜 중국 내 수요가 이어지는지는 불분명

- 중국의 기축통화 지위 기반 확충?

- 러-우 전쟁으로 확실해진 것은 달러는 안전자산이 아니게 됨

- 실물자산(특히 골드)를 담아야 할 수 밖에 없음을 경험

- 김준영 흥국증권 이코노미스트 -

Here’s One Possible Answer to the Puzzle of the Mystery Gold Buyer

We might know who, but necessarily why.

Two hundred and fifty gram gold bars arranged at Gold Investments Ltd. bullion dealers in London, U.K.

Photographer: Chris Ratcliffe/Bloomberg

Gold prices are on a tear lately, having rallied by over $200 per ounce since early November.

The rise has puzzled analysts, who note that there aren’t any obvious macro narratives to drive gold’s move. Have inflation fears picked up over the last two months? No, and if anything it’s the opposite case. Movement in gold is often associated with geopolitics. Yet nothing particularly novel has happened on that front of late.

And in recent history, there’s been a decent inverse relationship between the price of gold and real rates as measured by the TIPs market, but that link has broken down as well lately.

5년물 TIPS 금리 (왼쪽, 역축) & 금 현물 가격 (오른쪽)

→ TIPS 금리 (실질 금리)와 금 가격은 역의 관계

→ 최근 들어 이 관계가 깨지는 모습 (mispricing)

That’s true even taking into account speculative p-ositioning, which (data from the Commodity Futures Trading Commission suggests) is fairly muted. On the other hand, central bank holdings of gold — as reported by the World Gold Council — have surged.

Official sector gold holdings have surged, according to the World Gold Council

So it’s a head scratcher. But what if there’s a gold whale? Or, massive buying from from a single investor for some unknown reason? Commodities strategists at TD Securities are on the case, speculating in a note published on Monday that the gold whale could be the Chinese official sector.

“The rally in gold prices over the past two months has defied analyst expectations for continued weakness, including TD Securities.Yet, we see little evidence that the rise in gold prices is associated with a changing macro narrative. Given the bearish macro backdrop, speculative interest in gold has remained exceptionally lackluster as the world barrels towards a recession,” senior commodity strategist Daniel Ghali writes.

“Armed with a flows-based approach, we present strong evidence that behemoth Chinese and official sector purchases may have single-handedly catalyzed a $150/oz mispricing in gold markets,” he adds. “What is less clear is what has driven these massive purchases.”

To start, the one group of speculative traders who can be seen really adding to their p-ositions are in Shanghai right now.

And prices in China itself are showing a substantial premium to spot prices globally.

While TD might be able to trace buying to China, it’s not entirely clear to them what’s driving those purchases. Here, the strategists theorize about a number of possibilities stretching from extra demand stemming from recent reopening measures as well as restocking ahead of China’s Lunar New Year. But there’s also the possibility that China is purchasing gold for strategic, rather than strictly economic factors:

[Reserve Currency Ambitions: A contingent of market participants has suggested that gold is gaining market share as a reserve asset. After all, USD valuations have moved to extremes following the build-up in USD cash and associated stagflation hedges. European data surprises are surging with growth expectations on the rise as extremely mild weather helped the region fare with the ongoing energy shock, at the same time as a fast-paced Chinese reopening bolsters rest-of-world growth — factors which are all in support of a cyclical peak in USD value. Most importantly, however, is the rise in perceived sanctions risks associated with USD reserves held in the East, following the introduction of Western sanctions on Russia this year; these have likely bolstered official purchases. This is consistent with official purchases announced by Turkey, Qatar and other nations … While the long-term resilience of this thesis is difficult to rank in the present, this narrative is certainly consistent with price action associated with a steep accumulation of gold in support of the renminbi.”]

All of which is reminiscent of the Bretton Woods 3.0 narrative advanced by Zoltan Pozsar over roughly the last year. The theory is basically that as the global economy becomes more fragmented, with access to critical commodities more difficult, governments around the world will feel a greater impulse to accumulate ‘stuff’ rather than US dollars. The world also discovered last year that not all dollars are the same after Russia was cut off from its dollar holdings, following sanctions imposed in the wake of the Ukraine invasion.

reminiscent of : ~을 연상시키는 (=suggestive of, evocative of, redolent of)

Pozsar’s theory has been tested somewhat. For one thing, demand for dollars was exceptionally strong for most of the last year. We've also seen some of the more critical commodities — such as oil — fall in price by quite a lot. However, a few months of market movements doesn’t invalidate anything, especially when it comes to national strategic priorities.

Pozsar himself, in a note that was published on Friday, says that 2023 will continue on the same themes, noting that:

[I don’t think 2023 will be different: in a number of regions in Europe and Asia, the threat of a hot war is real; the BRICS are set to expand with new members (“BRICSpansion”), which means more de-dollarization of EM trade flows; CBDCs are spreading like *kudzu, with Türkiye the latest country to launch one; and with the launch of every new CBDC, the potential of Project mBridge to diminish the role of the dollar in FX transactions and trade invoicing will rise as it interweaves BRICS (and soon BRICS+) central banks into a global network to rival the global network of correspondent banks on which the dollar system runs.

kudzu : 칡

War – in one form or another – was a theme that defined macro not only last year, but basically every year since 2019: trade war with China; the war on Covid-19; war finance to deal with lockdowns; war on inflation, as we overdid war finance; and war then spread to engulf Ukraine, finance, commodities, chips, and straits as discussed above. Monetary and fiscal responses were just that – responses to mother nature and geopolitics – and with geopolitics getting more complicated, not less, investors should remain mindful of the threat of non-linear risks in 2023.]

And while TD may have solved the ‘who’ portion of the mysterious Moby Dick in gold, it hasn’t figured out the ‘why’ part. This, the firm says, leaves gold prices vulnerable to a potential correction if China’s puzzling buying were to come to an abrupt stop.

“Chinese demand appears unrelenting for the time being, but barring a grandiose geopolitical regime change, we find that it would likely subside towards normal levels in coming months,” Ghali concludes. “This would leave gold prices vulnerable to a steep consolidation lower, given gold's lack of alternative buyers and its current mispricing relative to its recent historical relationship with real rates.”