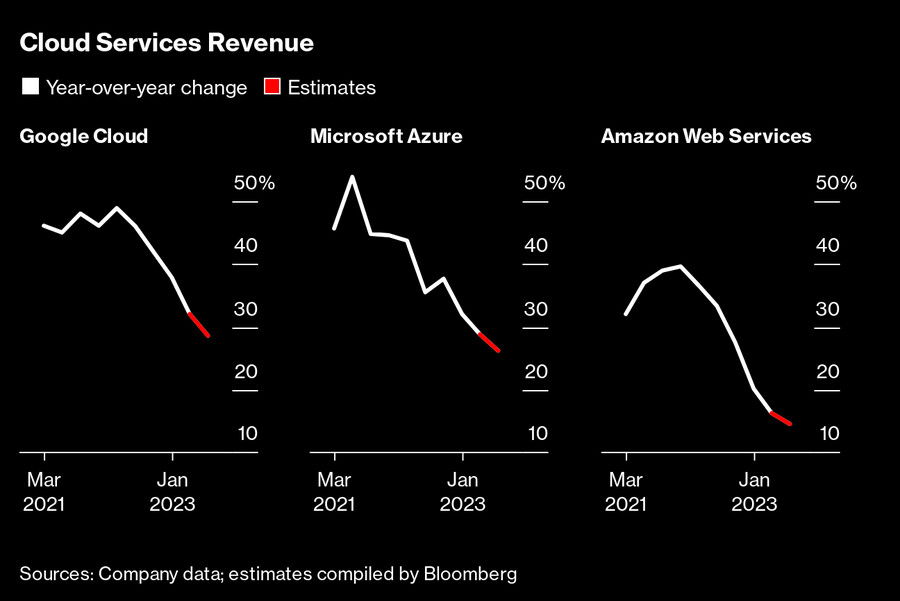

빅테크의 클라우드 성장세가 둔화되고 있음

마이크로소프트, 아마존, 알파벳의 작년 4분기 클라우드 성장률은 1~3분기에 비해 최소 10%p 둔화

고객 기업들이 불황에 대비해서 클라우드 서비스 사용량을 줄였기 때문

아마존 CFO에 따르면 클라우드 성장률 둔화는 모기지 대출 및 암호화폐 거래 부진 등에 따른 것

클라우드 서비스를 새롭게 도입하는 업체들도 사상 처음으로 감소

클라우드 서비스가 주요 수입원인 빅테크 기업들에게는 좋지 않은 상황 변화

고객 기업들은 비용에 민감해지고 있는데 이는 클라우드 시장이 성숙해지고 있다는 의미

자체 서버를 두고 있는 금융, 헬스케어 같은 산업이 클라우드 시장의 다음 고객이 될 것으로 예상됨

챗GPT나 바드같은 인공지능 서비스도 클라우드의 차세대 먹거리가 될 것으로 예상됨

하지만 모든 산업의 클라우드화라는 전망이 지연됐기 때문에, 빅테크는 다음 투자 대상을 고민하고 있음

아마존 CEO 앤디 제시는 AWS에 투자하지 않았다면 오늘날의 아마존은 없었을 것이라면서 다음 성장 동력으로 헬스케어와 위성 인터넷을 언급

===================================================

The Skies Look Gloomy for Big Tech’s Cloud Ambitions

A sector that was seen as Silicon Valley’s key to continued profits hits its first real setback.

Illustration: Felix Decombat for Bloomberg Businessweek

By Brody Ford and Matt Day

2023년 2월 8일 오후 9:00 GMT+9

For a while, cloud computing was Big Tech’s cash machine. As the digital economy grew, companies across the economy developed a greater need for flexible data storage and processing power. This created an opportunity for tech companies to rent out such capacity. The pandemic accelerated the trend, creating years of good news for Alphabet, Amazon and Microsoft.

Their cloud computing businesses are still getting bigger, but not as quickly as they once were. The rate of growth for each of the three market leaders in the fourth quarter fell at least 10 percentage points from the previous nine months. That’s partially because a shaky economy means “every dollar is being inspected” at existing customers, says Rikin Shah, founder and chief executive officer of Slower.ai, which helps companies migrate to the cloud. Most cloud infrastructure is priced based on usage—so customers can lower their bills by simply using less. Amazon.com Inc. Chief Financial Officer Brian Olsavsky said on a Feb. 2 earnings call that mortgage lending and crypto trading were two examples of the many slowing industries dragging cloud growth.

For the first time in the history of the industry, there are signs that the amount of business migrating to the cloud is slowing. The companies for which the transition made the most sense have already done so, meaning the customers doing so now often have more complicated and time-consuming projects. This complexity can mean newer customers are less lucrative for cloud providers than the ones they signed up in the past.

This is an uncomfortable shift for Big Tech, which has seen renting out computing power and storage as an attractive second act. Amazon Web Services generates less than one-sixth of Amazon’s revenue, but the company wouldn’t be profitable without its cloud division. Microsoft Corp.’s Azure has fueled a revenue resurgence in the past decade. Alphabet Inc.’s Google, which lagged behind its main rivals in starting a cloud business, is hoping its still-unprofitable cloud division will help the company diversify beyond advertising. (Alibaba Group Holding Ltd., the Chinese tech titan that’s the fourth-largest global cloud provider according to Synergy Research Group, has fared worse than US counterparts in recent months, because of a broader economic slowdown in China.)

As they rushed to the cloud, many businesses didn’t find the most cost-effective ways to carry out the transition. Some of them are now focused on reducing their cloud computing expenses, according to Dave McCarthy, a vice president at IDC’s infrastructure practice. “If cloud cost optimization wasn’t already high on the priority list for CIOs, now it is,” he says. This cost-consciousness is a sign the market is maturing, says Sid Nag, a vice president at Gartner Inc.

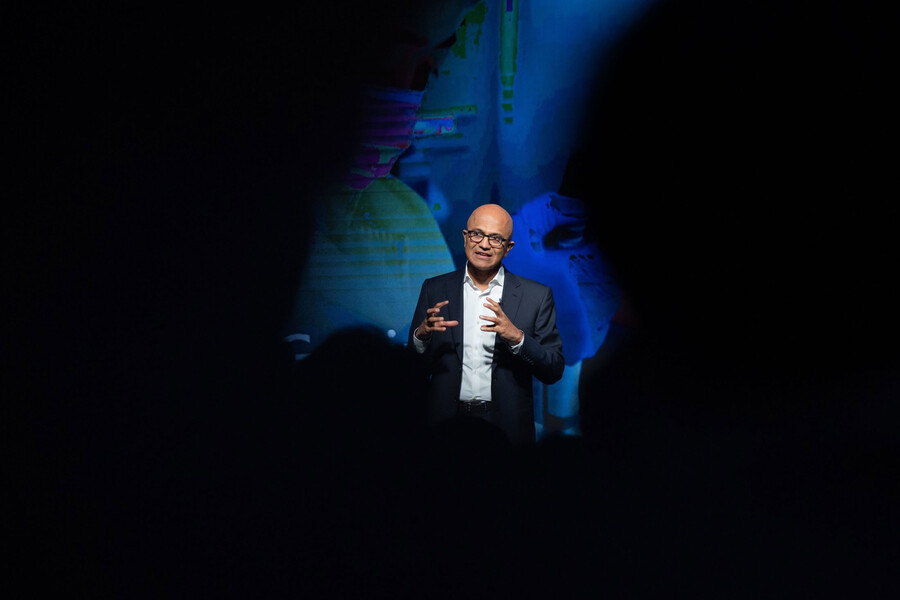

Microsoft CEO Satya Nadella described the new atmosphere on an earnings call on Jan. 24. “Just as we saw customers accelerate their digital spend during the pandemic, we are now seeing them optimize that spend,” he said.

Nadella Photographer: SeongJoon Cho/Bloomberg

The growth isn’t exactly coming to an end. The cloud makes up only about a fifth of the almost $1.9 trillion annual IT market globally and has plenty of room to grow, according to Bloomberg Intelligence analyst Anurag Rana. The next phase of expansion will be spurred by big companies that have long used on-premises servers and storage shifting to rented computers over the internet, Rana says.

Industries such as finance and health care are often cited as holdouts. Oracle Corp., which has also been slow to build out its cloud business, spent $28.3 billion in 2022 to acquire Cerner, a provider of electronic health records, in part as a bet on the hard-to-crack market. New artificial intelligence products including OpenAI’s ChatGPT and Google’s Bard could provide significant cloud demand if they grow as expected. Nadella said in Microsoft’s earnings call that Azure’s machine-learning revenue has at least doubled for five consecutive quarters.

Still, the promise of economywide cloud conversion has been delayed, inspiring leaders to think about their next big bet. Much of Amazon’s Feb. 2 earnings call focused on the slower AWS growth. But CEO Andy Jassy ended the meeting by looking beyond the cloud. He reflected on which future investment could transform the company again.

“Think about how different a company Amazon would be today if we hadn’t invested in AWS—that informs some of the other meaningful investments we’re making,” Jassy said, citing health care and a plan to launch thousands of internet satellites into Earth’s orbit. “It only takes one or two of them becoming the fourth pillar for Amazon for us to be a very different company over time.”