몇몇 대형주가 Index 상승을 이끌면서 착시현상을 일으키고 있다는 FT 분석기사입니다.

상대적으로 러셀2000 지수 반등이 약한 이유라고 보시면 됩니다. 한국 코스닥도 비슷한 문제가 있죠.

====================

- S&P500 YTD 8% 상승했지만, 상승분의 80%가 7개 기업에서 발생

- 특히 애플과 마이크로소프트 2개 종목이 지수 상승의 40%를 기여

- 투자자들은 여전히 랠리의 취약성에 대해 우려하고 있으나, rally를 놓칠 위험에 대해서도 걱정하고 있다보니 완전히 물러서지도 못하는 상황

- 빅테크는 경기둔화에 상대적으로 영향이 덜하다, AI 호재도 있다는 생각

- 물론, 보통 이렇게 일부 대형주들이 먼저 랠리를 보이면 Laggard 들이 뒤따르면서 시장이 바닥을 치는 경우도 많아 지켜볼 일

상승 종목수로 본 나스닥

위 기사와 같은 맥락입니다.

기술적 분석으로 유명한 ADL(advance decline line)은 상승 종목수와 하락 종목수의 차를 의미하는데요.

4월 들어 대형주 상승으로 나스닥 지수는 직전 고점 근처까지 상승했는데 오히려 전체 상승 종목수는 계속 감소해, 누적 ADL은 직전 저점을 하회하고 있습니다.

상승 에너지가 생각보다는 강하지 않다는 의미로 해석됩니다.

- 신영증권 투자전략부장 박소연 -

====================

Investors bet on shrinking pool of tech stocks as rally narrows

Nicholas Megaw, Katie Martin

A small number of tech companies are driving an ever-increasing share of the US stock market’s gains, prompting concerns among investors about the sustainability of the rally.

The S&P 500 has risen 8 per cent so far in 2023, but 80 per cent of the increase has been driven by just seven companies, according to Bloomberg data. Apple and Microsoft have led the way, contributing around 40 per cent of the index’s rise as they added more than $1.1tn in combined market capitalisation.

The trend has been growing for several months. However, the gulf between the small number of winners and the rest of the market widened over the past week as strong tech earnings contrasted with mixed results in other sectors and downbeat economic data.

Stuart Kaiser, head of equity trading strategy at Citi, said many investors were growing nervous about the fragility of the rally, but were reluctant to pull back and risk missing out on further gains.

“People are considering diversifying because the [tech] outperformance has been so wide, but we’re not seeing people pulling back yet”, he said.

Big tech has benefited from enthusiasm about generative artificial intelligence, along with a belief that the sector would be relatively insulated from an economic slowdown, and expectations that the Federal Reserve is approaching the end of its cycle of interest rate rises. Many long-only investment funds are also rebuilding their p-ositions from a low base after selling huge amounts of tech stock last year.

Nvidia, which designs high-powered chips crucial to the AI boom, has been the third-biggest contributor to the S&P’s rise, followed by Facebook owner Meta, which has rebounded from a rough 2022 to double in value so far this year. Next was Google owner Alphabet — another large investor in AI — along with Amazon and Tesla.

The stocks have gained an average of 44 per cent so far this year, compared with a 2 per cent increase in the equal-weighted S&P 500.

Sentiment about the broader market has been dominated by concerns about the economic outlook. Companies in the benchmark index are on track to report their second consecutive quarter of earnings declines, and data released this week showed economic growth slowed dramatically in the first quarter, to an annualised rate of 1.1 per cent.

“We understand why risk assets have done better through the winter,” Sonja Laud, chief investment officer at Legal & General Investment Management, said in an interview. US inflation started to back down towards the end of last year, then as 2023 got under way, Europe dodged an energy crisis and China emerged from its zero-Covid lockdowns.

“That meant we had a far better start to the new year,” Laud said. “But there’s no evidence since the 1970s that a rate hike cycle, especially as aggressive as the one we have seen, won’t lead to a recession, a financial crisis, or both. Why would this be different?”

That has left LGIM shying away from risky assets in equities and credit, and leaning more towards government bonds. Laud said the firm had asked every one of its fund managers to scour their portfolios to look for weak links that might struggle if the current slowdown turns more severe.

The cautious stance is typical among large money managers. Citi’s Kaiser said: “You can earn so much yield keeping money in cash that the hurdle rate or bar to put money into equities is quite high”.

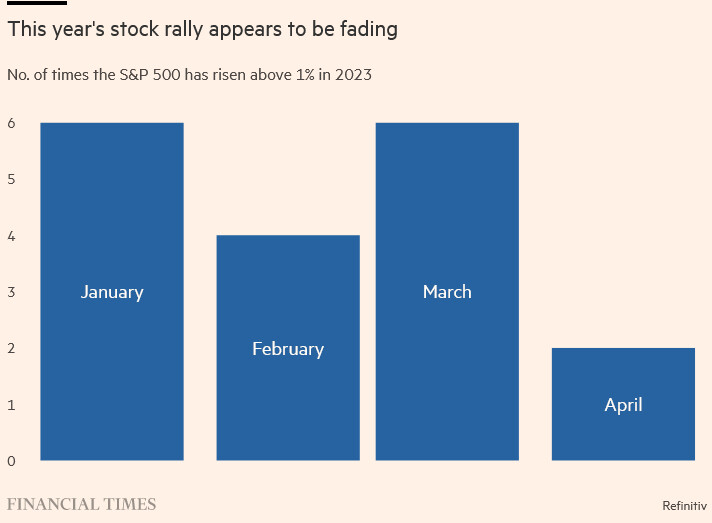

Markets have already started to lose some of their steam. In all of April, the S&P gained 1 per cent or more in a day only twice — a tally that has gradually shrunk from six days in January. The index added 1.5 per cent for the month, the second-worst month of the year so far.

With so much of the strength resting on a small number of companies, any bad news for the tech sector — such as the Fed deciding to keep rates high for longer than investors expect — could have a disproportionate impact.

Still, some are hopeful that the rest of the market will be able to start catching up with the winners, rather than the other way round.

“Once you have extreme readings like leadership in a few stocks, that’s usually signalling the fact that things are already quite bad . . . it’s a sign more often that the market is bottoming,” said Denise Chisholm, director of quantitative market strategy at Fidelity.

“I understand the behavioural bias of people intuitively waiting for the last shoe to drop, but the data doesn’t support it when you look at the history of equities.”

scour : 샅샅이 뒤지다(=comb), 문질러 닦다, ~을 만들다(=erode)