관련기사

BIS "헤지펀드들의 과도한 차입 베팅, 美국채 뇌관된다" 경고

https://www.hankyung.com/article/202309199552i

연준 보고서 "헤지펀드, 레버리지 베이시스 거래 급증…요주의"

https://news.einfomax.co.kr/news/articleView.html?idxno=4279473

==================================================

Inflation, bond issuance and Fed tightening are spurring a Treasury derivative bonanza

By Eric Wallerstein

Updated Sept. 13, 2023 12:02 am ET

Renovations at the Treasury building. The basis trade plays a role in the Treasury securities market. Photo: Nathan Howard/Bloomberg News

The basis trade, an innocuous-looking practice at the center of some of Wall Street’s historic blowups, is back.

A popular way for hedge funds to profit from bond trading while minimizing their exposure to swings in the market, the basis trade exploits the price difference between Treasurys and Treasury futures. The resurgence is attracting fresh scrutiny from Wall Street because previous meltdowns have rattled global markets.

Here’s what traders say is going on now:

How the basis trade works

https://www.ft.com/content/a8348e2a-a90f-474c-baa6-8c2eb0e263c2

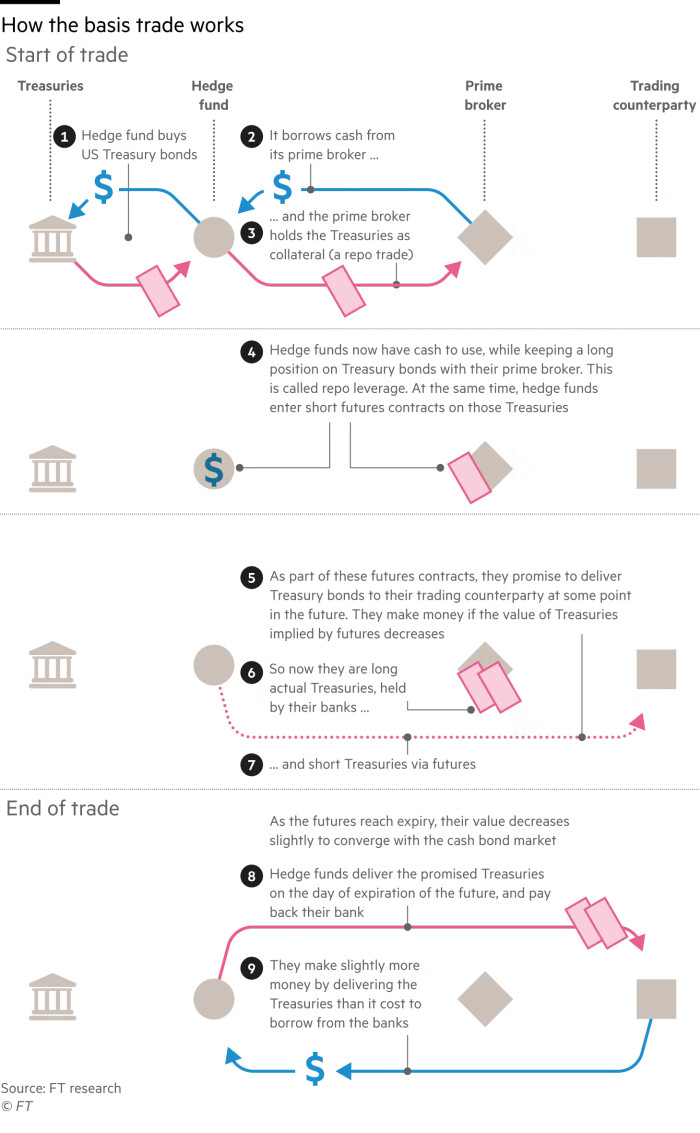

Hedge funds buy Treasurys, then bet against Treasury futures by selling contracts promising delivery of a bond on a specific date at a preset price. Instead of betting on the direction of bond markets, the trade seeks to take advantage of small differences in the securities’ prices.

The trade works because large asset managers like pension funds often prefer buying Treasury futures that require less up-front cash than actual bonds. That tends to make the contracts slightly more expensive than the bonds, creating a window for speculators to take advantage. Futures prices typically converge toward bond prices as their settlement date approaches.

The differences are small, so hedge funds juice returns by borrowing from big banks in the overnight funding markets—often putting little, if any, cash up front. Leverage can reach extreme levels: Hedge funds had more than $550 billion of Treasury trades at the end of last year backed by just $10 billion of their own money, Fed research found.

That worries some on Wall Street. Unexpected shocks can force hedge funds to rapidly exit from their p-ositions, sending shock waves through financial markets.

What’s happening now

The basis trade had been subdued since a dash for cash in March 2020 forced hedge funds to rapidly unwind their p-ositions, straining the market for Treasurys—meant to be the world’s easiest investment to buy and sell.

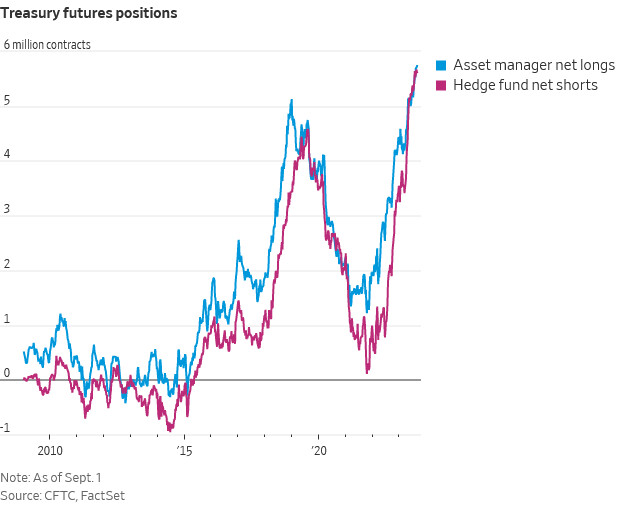

Now, a flurry of activity suggests it has rebounded. Speculators are shorting 5.6 million futures contracts tied to Treasurys, CFTC data show, representing roughly $715 billion of bonds.

At the same time, repurchase agreements, where speculators borrow daily from large banks using Treasurys as collateral, have surged. Roughly $1.4 trillion of overnight repo transactions are taking place each day, New York Fed data show, breaching previous highs.

What sparked the surge in Treasury trading

The Fed’s fight against inflation and the U.S. government’s wave of borrowing reignited the trade, analysts say. Higher yields and worries about a recession have asset managers scooping up long-term bond futures.

Investment in Treasury futures has never been higher at CME Group, one of the world’s largest derivatives exchanges. A record 19.8 million contracts were outstanding in August, up from 14.3 million at the start of the year.

At the same time, the continuing influx of debt issuance has weighed on short-term Treasury prices, widening the gap between them and long-term futures. Inflation remains far from the Fed’s 2% target and the central bank is paring its bond book, adding pressure to the market.

Given those uncertainties and with a potential recession up in the air, “it’s natural to see record hedging in the Treasury market,” said Agha Mirza, global head of rates and OTC products at CME Group.

Watchdogs’ warnings

Regulators and others have sounded alarms this year that an unwinding of the basis trade could spark market tumult.

The Switzerland-based Financial Stability Board warned last week that hedge funds were building up worrying amounts of “hidden leverage,” risking a blowup. During the 2020 Covid market crash, hedge funds’ unwinding of leveraged strategies including the basis trade spilled across markets, helping send the Dow Jones Industrial Average to its worst losses since 1987 and forcing the Fed to step in.

The Securities and Exchange Commission wants to require trading firms such as hedge funds involved in the Treasury market to register with the agency. Chair Gary Gensler said it would help “level the playing field.” Both bodies warn that banks require nearly no margin, or cash buffers against losses, for fund managers to access significant leverage.

The trade doesn’t always go as planned. A scramble for cash could hurt short-term Treasury prices, or a flood into long-term bonds could boost futures prices. Hedge funds forced to exit their p-ositions by market swings could spur banks to ask for more collateral to back up their p-ositions, worsening the volatility.

In extreme circumstances, the combination can throw a wrench into the ordinary process of convergence.

The hedge fund Long-Term Capital Management famously collapsed 25 years ago—requiring a Fed bailout—after pursuing similar strategies that bet on securities prices converging.

Worries overblown?

Many investors say concerns about the basis trade are overblown. Without it, greater friction in the underpinnings of the financial system would cause more onerous terms for taxpayers, they say.

DRW Holdings is one of the firms actively trading the basis. The Chicago-based proprietary trading giant opposes the SEC’s proposal to register participants as so-called dealers, saying it would do more harm than good by hurting competition and liquidity.

“The basis trade is crucial to the Treasury market,” said Mark Wendland, chief operating officer. “It drives liquidity, ultimately lowering the U.S. government’s borrowing costs.”

The leverage involved is at the heart of firms’ willingness to participate. Even a small increase in financing costs would slash the trade’s profitability significantly, Fed research found.

CME Group’s Mirza said the basis trade remains just a fraction of the record 5.2 million Treasury contracts changing hands on an average day this year. Still, it serves a vital function.

“The basis trade benefits price discovery and liquidity in the Treasury market, and therefore the economy and taxpayers,” he said.