블룸버그 기사 요약

이스라엘-하마스 분쟁에 대한 시장 반응이 다소 안일한 것 같다는 비판

안전 자산인 미국 국채와 금의 가격이 오르긴 했지만, 이번 사태가 주요 원인인지는 의문

국채는 이미 과매도 상태였고, 연준 인사들도 잇따라 금리 인상 중단 가능성을 시사

국채 금리 하락으로 실질 금리가 하락한 것이 금 가격 상승의 원인으로 보임

모든 걸 종합해 봤을 때 , 시장은 이번 사태에 대해 놀라울 정도로 반응을 거의 보이지 않았음

주식 시장에서는 매그니피센트7 (대형 기술주)가 랠리를 지속했고, 에너지 기업들의 상승세는 꺾였음

유가도 사태 직후 몇 시간 동안 상승하다가 다시 하락했음

문제는 이번 분쟁이 가자 지구와 레바논 남부를 넘어 확산되기 쉽다는 점이며 이렇게 되면 유가도 급등할 수 있음 (특히 이란으로 확전될 경우)

이스라엘이 가자 지구에서 지상전을 벌일 경우 피해가 막심할 수 있으며 다른 국가의 참전을 유발할 수도 있음

팬데믹 이후, 방산주는 식품주에 뒤쳐지는 경향

러-우 전쟁도 이런 흐름을 뒤집을 수 없었음

이번 사태로 방산주가 랠리를 벌였지만, 식품주와의 상대 강도를 고려했을 때, 방산주는 추가 상승 여력이 있음

NATO 국가들의 국방비는 2019년 이후 연평균 5.3% 증가

이번 사태에 사우디가 개입하는 걸 막으려면 안보 보장은 필수적일 것

사우디는 미국산 무기에 주로 의존하기 때문에, 이것은 미국 방산 기업에 기회가 될 것

매그니피센트7 (대형 기술주)는 금리 상승에 민감

유가 급등은 금리를 올리기 때문에 대형 기술주에 악재

그래서 이번 사태의 악화는 나스닥에 나쁜 뉴스가 될 것

최근 기술주의 상승은 시장이 이번 사태를 가격에 반영하지 않았다는 의미

물론 지금 당장 최악의 사태를 가정할 필요는 없음

그럴 가능성은 아직 낮기 때문

하지만 그런 가능성을 진지하게 고려하는 투자자는 방산주, 에너지 기업, 원유, 귀금속, 미국 국채로 헷지할 수 있을 것

=======================================================

Prices reflect a contained outcome where the crisis doesn’t spread. Investors need to be prepared if it does, especially involving Iran.

2023년 10월 12일 오후 1:37 GMT+9

By John Authers

John Authers is a senior editor for markets and Bloomberg Opinion columnist. A former chief markets commentator at the Financial Times, he is author of “The Fearful Rise of Markets.”

Markets shouldn’t add to the problems of complacency.

Photographer: Kobi Wolf/Bloomberg

An Underreaction to a Coming Overreaction

Saturday’s attack on Israel by Hamas shocked the world and opened up suddenly all-too-plausible scenarios that would lead to all-out disaster. In Bloomberg Opinion, for example, Andreas Kluth drew an explicit parallel with 1914, and the way that an assassination in Sarajevo eventually led the world’s greatest powers of the time to go to war with each other.

At a financial level — which is the plane on which this newsletter operates — there’s been a strong reaction. But there’s a growing argument that the market response could and should have been greater.

To start with some of the more obvious reflexes, a shocking geopolitical event that raises perceived risk will usually spark a rush to safe havens (less redundantly, just “havens”). Gold and US Treasury bonds are generally first on the list. Both have indeed rallied since the weekend. But both were ready for a rally after a miserable six months and neither has moved that much, as yet:

Beyond that, it’s not clear that haven flows are even the most important factor behind this move. The fall in bond prices has dominated all financial discussion of late, the market was ready at the least for a retrenchment (긴축 예산안, 채권 발행 축소), and the flow of comments from the Federal Reserve would on their own probably have brought yields down and prices up, somewhat. Gold is particularly sensitive to the real yield on bonds, as it generates no income, and so that fall in real yields would naturally buoy the shiny metal. All things considered, the latest Israel-Palestine conflict has had surprisingly little effect even here.

As for stock prices, both the S&P 500 and indices for the rest of the world have gained more than 2% in the three trading days since the news, while other established trends have stayed in place; the “Magnificent Seven” dominant tech groups rose to a new high relative to the average stock in the S&P 500. Oil — the crux of the matter — enjoyed a bounce for a few hours after the market reopened after the attack, but has since subsided. The same is true of energy stocks, in part because of ExxonMobil’s big deal to buy Pioneer Natural Resources Co.:

The summary of Citi’s macro strategists seems to be a fair one. They suggest that the market has priced a relatively benign outcome (in financial terms), without anything more severe:

"The market currently is seemingly pricing a scenario that assumes the Israeli response is forceful, but not particularly long-lasting, but remains geographically restricted to the Gaza Strip, and maybe South Lebanon. In this scenario, oil should be somewhat elevated as the risk premium has to rise, and as a deal between Saudi Arabia and Israel will at the very least have to be postponed, but oil will likely not spike too much."

That is critical. A rise in the oil price benefits some and disadvantages others; it’s only the truly epic rises in energy prices, most famously in late 1973 and the summer of 2008, that drive major selloffs for other risk assets. The problem identified by Citi is that conflict could very easily spread beyond Gaza and southern Lebanon, in a way that does indeed cause an oil spike — particularly if it comes to involve Iran directly. It’s also possible that an Israeli land campaign within Gaza (for which an army equivalent to 5% of the population has already been mobilized), even without any deliberate spreading of the conflict, could prove more costly and prompt other countries to become involved.

Iran, like the Israeli-Palestinian conflict, has fallen off the western radar in the last few years, having reached extremes during the period from 2015 to early 2020 when the US first made a nuclear deal with the country under Barack Obama, then revoked it under Donald Trump, and then assassinated a top Iranian general in an event that shocked a world that was about to fall into Covid. This chart, produced by BCA Research’s geopolitical strategist Matthew Gertken from Bloomberg data on the number of stories coming across the terminal, suggests that interest in Iran had almost evaporated. That is likely to change now, and the crucial point is that the market is not ready for it.

Guns vs. Butter

One area where there has been a clear market reaction has been in a shift toward military spending. If we express the perennial government choice between “guns and butter” as the relative performance of the S&P 1500’s aerospace and defense contractors’ sector compared to the food products sector, we see that military hardware manufacturers have suffered in the years since the pandemic. Even the invasion of Ukraine last year had only a muted impact. The jump in defense shares this week brings them to their strongest relative p-osition in more than three years — but as is evident from the chart, there is plenty of room for this to go further:

Tony Bancroft, a former marine who runs a defense stocks portfolio for Gabelli Funds, points out that NATO currently spends about $1.26 trillion on defense annually, an increase from $980 billion in 2019 or a 5.3% compound annual growth rate. In the current context, that is very likely to rise.

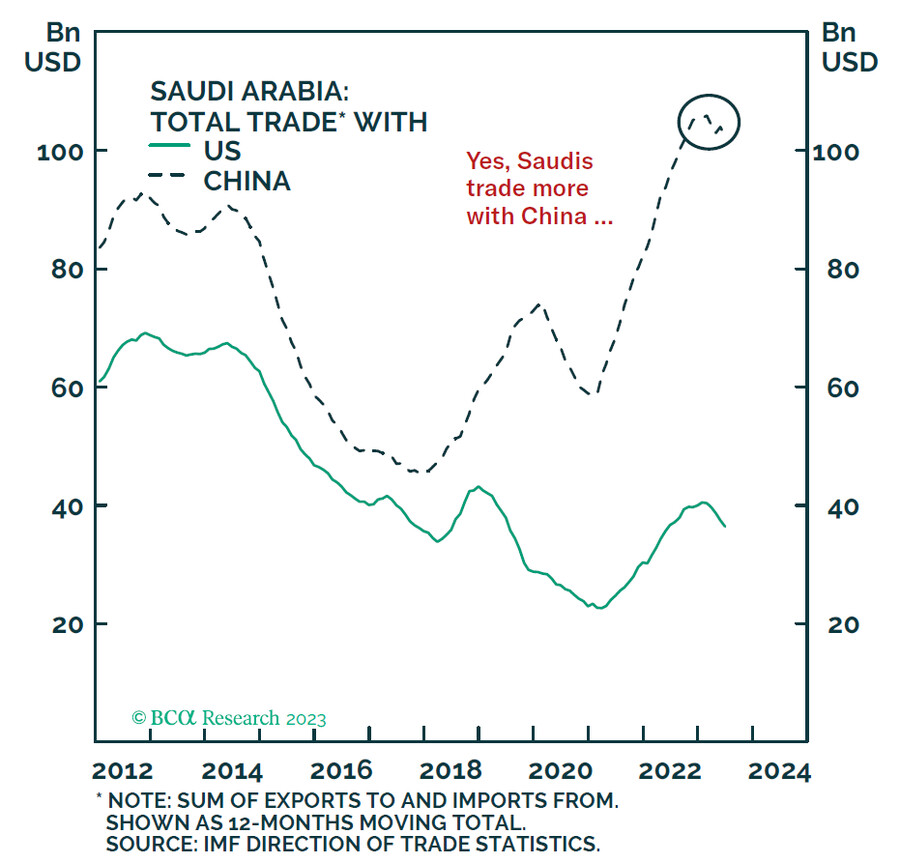

A further argument that US defense contractors should prosper as a result of what is occurring comes from Matt Gertken of BCA Research, who points out the strong mutual interest that the US and Saudi Arabia have in arms sales. While China has overtaken the US as the biggest exporter to Saudi Arabia, it has made no inroads when it comes to Saudi arms imports. Any deal to keep the Saudis from involvement in the current conflict might well involve security guarantees, which would be lucrative for those who make weaponry:

There is plenty of room for defense stocks to rise further. Beyond that sector, Citi’s number-crunching shows that “oil betas” — the degree of sensitivity to changes in the oil price of different stock indexes — are fairly widely dispersed, with the Nasdaq-100 a “standout negative.” This is because higher oil prices lead to higher rates (as seen in 2022), which in turn tends to be the worst news for growth-sensitive stocks such as the Magnificent Seven, which had a very tough time of it last year. That implies that an escalation to include Iran and force up oil prices would be particularly bad news for the biggest stocks in the Nasdaq. As they’ve actually managed to continue outperforming this week, it’s fair to say that none of this risk is yet in the price.

It would be premature to price in such a scenario fully at this time. It might well not happen. But there’s an argument that markets should be doing more to brace for the worst possible outcomes. There are still some attractive options for those who want to take such ugly predictions seriously; buying defense and energy stocks, oil, precious metals and even Treasuries would make sense to guard against an escalation, while taking profits in the Magnificent Seven looks increasingly attractive.