블룸버그 기사 요약

Chinese Checkers

중국 경제 더딘 회복세

9월 CPI, PPI 예상치 하회

경제 전반의 수요가 약하며 추가 부양책 필요

3분기 GDP 성장률 4.5% 예상

수많은 부동산 및 금융 부양책으로 성장이 탄력을 받았음

그러나 여전히 중국 정부의 목표치 5%와는 큰 차이

중국 경제가 예전만큼 강한 성장세를 유지할 수 없다는 의미

수출이 2021년 정점 수준을 회복하지 못했기 때문에 목표치 달성은 어려울 것

중국 경제의 회복세는 더디지만 꾸준함

일부 섹터(예 : 부동산)은 여전히 침체되어 있지만, 다른 부문은 진정한 회복의 조짐이 보임

캐피탈 이코노믹스에 따르면 부분적 경제 회복으로 디플레 우려는 향후 몇 달 동안 완화될 것

중국의 저물가는 국내 수요 부족 때문이라기 보다, 팬데믹 당시 상품 수요 급증으로 인한 산업 생산 능력 과잉 때문

정책 당국은 당분간 경제 상황을 지켜볼 것

1) 기존 부양책이 효과를 나타낼 수도 있지만

2) 경제가 계속 부진할 경우, 정부는 더 강한 부양책을 실시할 것

인민은행은 중기 유동성 54조원 추가 공급

증시 안정화를 위해 수십 조원 규모의 안정화 기금 조성을 추진

현재 CSI 300 지수는 11개월래 최저치, 2021년 고점 대비 -37% 하락

중국의 증시 개입은 고르지 못한 결과를 보였음

2007년, 2015년에는 증시 부양에 성공했지만 그 후 급락했음

중국 증시가 2022년 10월에 기록한 직전 저점을 뚫고 내려갈 가능성이 점점 커지고 있음

When Bulls and Round Numbers Collide

S&P 500은 2022년 10월 12일에 저점을 찍고 반등에 성공

S&P 500 강세장이 시작된지 1년이 되었다는 의미

하지만 이번 강세장은 이전 강세장보다 약한 모습

1) 200일 이동평균선 보다 가격이 높은 종목은 44%에 불과

2) 소형주 상승률은 지난해 저점 대비 5%에 불과

3) 증시가 반등한 후 1년 동안 은행주가 하락한 것은 증시 100년 역사상 이번이 처음

미국 경제는 세계 경제보다 좋았지만, 미국 은행주는 일본, 유럽, 심지어는 신흥국 대비 언더퍼폼

게다가, 이번 강세장은 대형주 쏠림 현상이 심했음

이번 강세장이 가짜라는 뜻은 아니지만, 주의해야 할 필요는 있음

3년 전에 시작된 팬데믹이 아직도 시장에 영향을 미치고 있기 때문

팬데믹과 비슷한 사례가 거의 없기에 참고 자료가 부족함

최근 채권 수익률 상승과 은행주 약세를 고려할 때, SVB 사태 이후 중소형 은행의 위기가 끝났다고 보기 어려움

비은행 금융기관에서 금융 사고가 발생하지 않을 것이라는 투자자들의 확신이 없다면 이번 랠리는 이전 강세장 대비 계속 약한 모습을 보일 것

은행과 달리 비은행금융기관에 대한 감독은 상대적으로 느슨함

※ 비은행금융기관 : 연금펀드, 보험사, 헤지펀드, MMF 등

IMF "금리 인상으로 비은행 금융권의 취약성 대두"

https://news.einfomax.co.kr/news/articleView.html?idxno=4261054

Good News I: Pensions

금리 상승은 연금 펀드에 좋은 소식

채권 가격 하락으로 부채 가치가 감소

주가 상승은 자산 가치 상승으로 이어짐

기업 연금의 부채 대비 자산 비율은 2007년 금융위기 이후 가장 높은 수준

공적 연기금도 금리 및 주가 상승의 혜택을 받지만 상황은 더 나쁨

공적 연기금의 지급 준비율(자산/부채)는 100%를 꾸준히 하회

공적 연기금은 이런 문제를 회계적으로 감출 수 있음

→ 예상 수익률을 달성 불가능할 정도로 높여 잡으면 됨

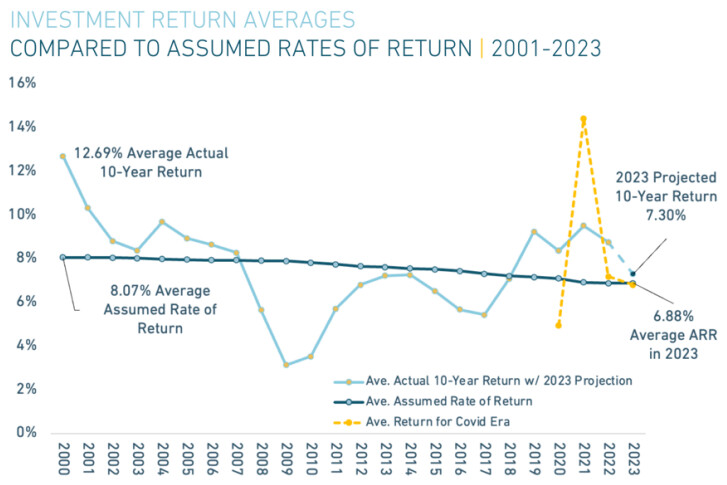

지난 20년 동안 공적 연기금의 예상 수익률은 꾸준히 낮아지는 추세

실제 수익률은 예상 수익률에 못 미치는 경우가 대부분

미래 연금 지급 부담을 미래 세대에게 떠넘기게 될 수도 있음

정작 그들은 연기금을 받을 수 있다는 보장도 없음

이는 세대간의 갈등을 낳을 수도 있음

Good News II: Poland

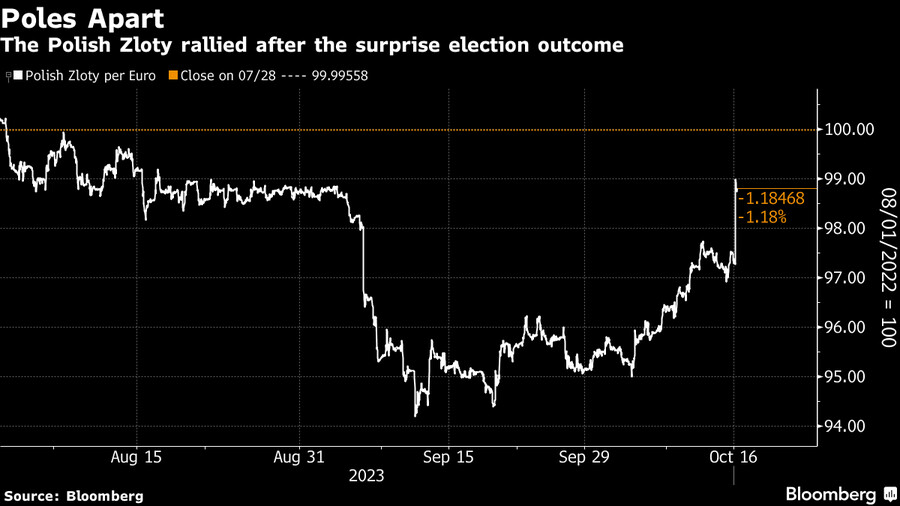

폴란드 총선에서 극보수 성향 집권당이 과반 확보에 실패해 8년 만에 정권이 교체될 전망

정권이 바뀌면 반이민·반EU·소수자 탄압 정책으로 갈등을 빚었던 유럽연합(EU) 집행위원회와의 관계가 개선되고 표현의 자유 및 성소수자·여성 인권을 강화하는 정책이 추진될 것

폴란드 화폐(즈워티)의 유로화 대비 가치도 상승

=======================================

Recent economic data still show the reopening from Covid as a whimper more than a bang, but maybe expectations were just too high.

2023년 10월 16일 오후 1:34 GMT+9

By John Authers

John Authers is a senior editor for markets and Bloomberg Opinion columnist. A former chief markets commentator at the Financial Times, he is author of “The Fearful Rise of Markets.”

Pedestrians and shoppers on Nanjing Road in Shanghai during Golden Week earlier this month.Bloomberg

Chinese Checkers

The sun continues to rise in the east. For all the appalling events in the Middle East and Ukraine, the travails of China’s economy exerts a gravitational pull on markets and growth across the planet. Last week, China published a slew of data that painted a mixed picture of the world’s second-largest economy as it struggles to rebound following the dark days of the Covid-19 pandemic. Hopes were high earlier this year that the Asian superpower would reopen its economy with a bang, and with it bringing most of the world. That is still failing to pan out thus far.

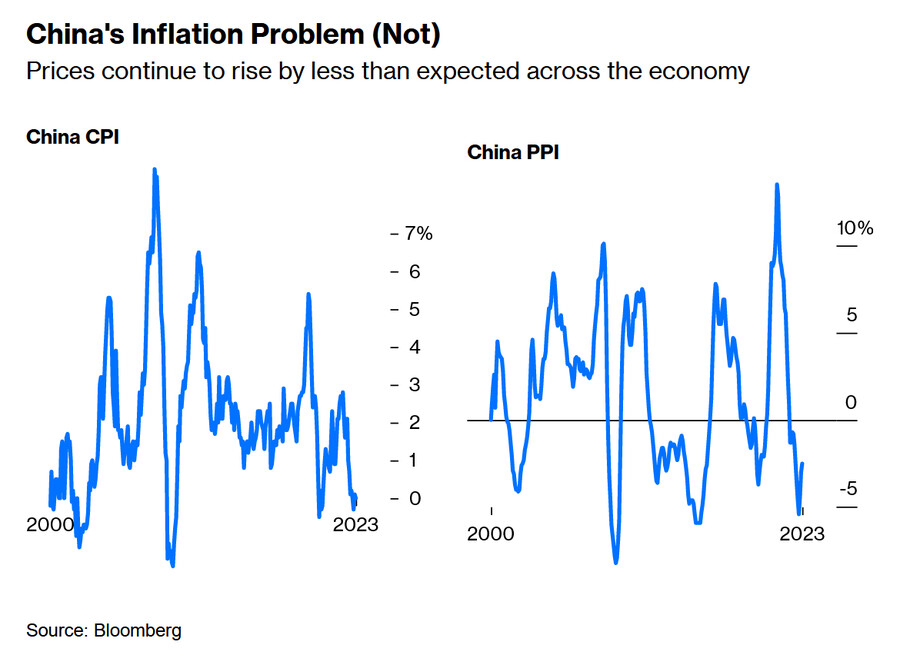

Take consumer and producer prices, which unexpectedly slowed to the brink of deflation in September, the first time both fell since the pandemic year of 2020. It seems concerns still linger about weak demand. China’s consumer inflation rate unexpectedly flatlined, edging down to 0% year-on-year last month from 0.1% in August, while producer price deflation continued to ease in the same period, to -2.5% year-on-year from -3.0%. The slump in exports moderated. New credit jumped last month while the amount of loans made missed expectations.

“Both CPI and PPI coming in below expectations in September shows that demand still remains weak for the overall economy and that more support may be needed to revive momentum,” said Marvin Chen of Bloomberg Intelligence. “China markets may take a breather after strong gains... and focus on the GDP report” this week.

To Strategists at TD Securities, they predict third-quarter GDP to be in line with consensus at 4.5% year-on-year as “China’s recovery gains traction from the raft of property and monetary support measures introduced in August.” This is, to be clear, growth of which much of the rest of the world would be very proud; it is also considerably lower than investors had hoped, and implies that the Chinese economic machine cannot keep humming along as strongly as it once did.

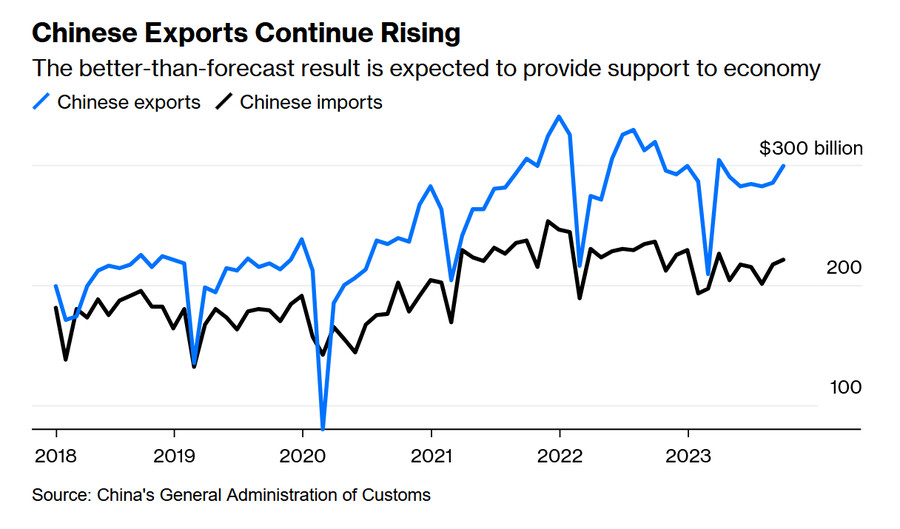

The key question now is how much the government’s recent stimulus injection has spurred the economy. Timing is also delicate as 2023 nears its end, with President Xi Jinping still aiming for his economy to hit a growth goal of about 5% this year. With exports not back to their 2021 high, according to the latest data, that looks difficult:

But even if China’s recovery path has been slow, it seems to be a steady one. Some sectors of the economy, such as real estate, remain depressed. Others are showing genuine signs of improvement. Here’s Capital Economics China Economist Zichun Huang:

"We expect deflation concerns to decrease over the coming months, as the partial economic recovery gains traction. China’s low inflation rate is not primarily due to domestic weakness. Instead, it appears to be related to excess capacity in industry as the pandemic boom in global goods demand has reversed."

On Monday, the central bank confirmed expectations by leaving a key policy rate unchanged. Larry Hu, head of China economics at Macquarie Group Ltd., had earlier told colleagues that policymakers are likely taking a wait-and-see approach. “There are two scenarios. One, these piecemeal efforts would add up eventually,” he said, referring to existing stimulus. “Two, at the certain point, the policy stance would turn more decisive as patience is exhausted.” That point likely hasn’t been reached yet.

The People's Bank of China also stepped up efforts to support the nation’s economic recovery and debt sales and is making the biggest medium-term liquidity injection since 2020. The PBOC added a net 289 billion yuan ($39.6 billion) into the financial system via a one-year policy loan. At the same time, it drained a net 134 billion yuan of short-term liquidity through open-market operations.

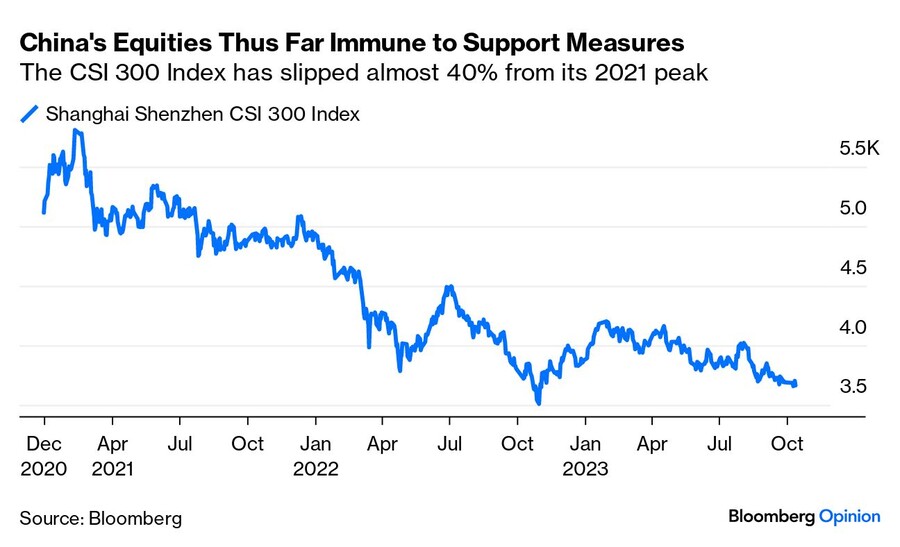

In the financial world, Bloomberg exclusively reported that China is considering forming a state-backed stabilization fund to shore up confidence in its $9.5 trillion stock market. Details are sparse and there’s a chance the proposal will be scrapped, but this highlights the lengths officials will go as the market slide worsens. For now, the CSI 300 Index has dropped to an 11-month low and remains lower by 37% from its high in 2021.

China’s record of intervening in or stabilizing its stock market is patchy to say the least. In 2007 and again in 2015, it succeeded in inflating bubbles that deflated spectacularly. It’s very difficult to fine-tune a stock market. Further, it looks ever more as though the low set in October last year, just before the great relaxing of Covid-Zero restrictions began far earlier than expected, may not, after all, be the low for Chinese stocks. Which brings us to another issue…

—Isabelle Lee

When Bulls and Round Numbers Collide

Last week saw the S&P 500 complete a full year since it hit rock bottom in 2022. In that time, it has never seriously threatened to return to the slough of despond, which came once investors first sold and then bought in a big way after the September 2022 inflation report came out on Oct. 13. Does this mean that we are a year into a bull market?

I’ve written before about the limitations of treating any 20% peak-to-trough gain as a new bull market. That definition isn’t helpful. But it’s certainly fair to say that it’s unusual for a rally to be sustained for this long without proving to be a durable rally;we’re entitled to expect the close on Oct. 12, 2022 to prove to have been the bottom. It’s also fair to say that as bull markets after major lows go, this one has been anemic. This chart from LPL Financial compares the S&P 500’s performance over the last year with its showing(=performance) after previous such lows. This rally has been historically weak:

It’s not just that this rebound is rather feeble. There are several other oddities, as listed here by Chris Verrone of Strategas Research:

1) There’s still only 44% of the S&P above the 200-day, even after this recent bounce;

2) Small caps are up just +5% since last year’s low, their worst showing (by a mile) in history; and

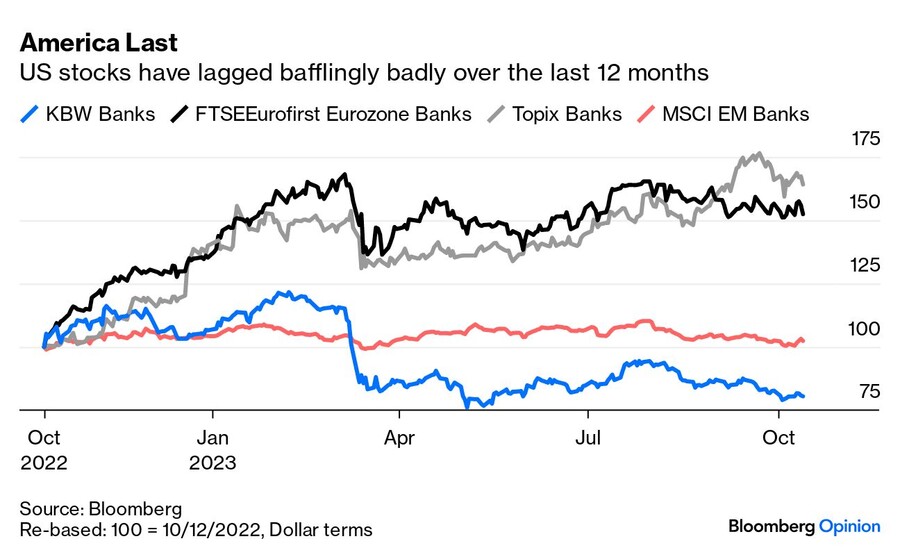

3) Equally perplexing is the complete absence of the banks, down for the first time (-18%) in the first year off an S&P low in 100 years of market history.

Verrone adds that US bank stocks’ miserable performance is even harder to explain when contrasted with their counterparts elsewhere. For all that the US economy has been performing better, banks in Japan and the Eurozone have risen far more, while even those in the emerging markets have held their value:

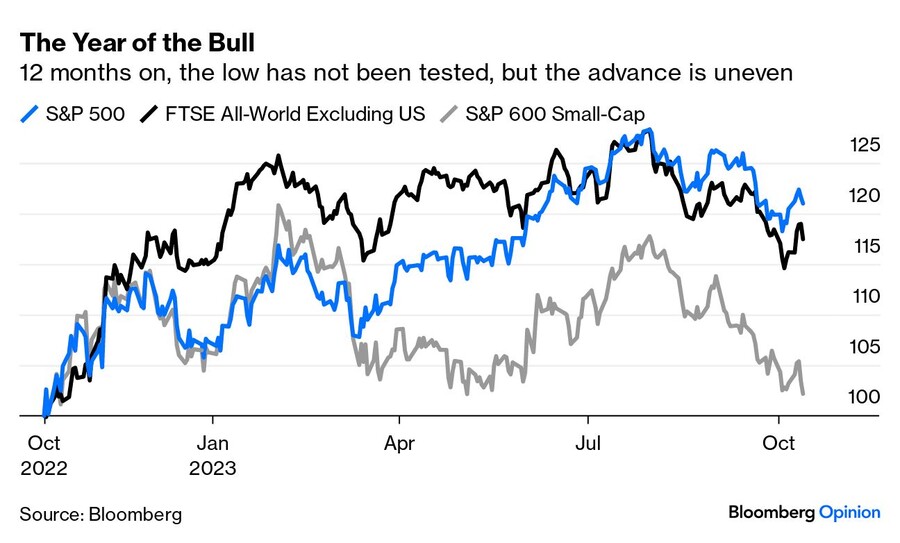

To illustrate how uneven this rally has been, here’s how the S&P 500 compares with the S&P 600 index of small caps, and with FTSE’s index for the rest of the world, since last October’s low:

What might we make of this? None of it proves that this isn’t a true bull market, but does show very clearly that it should be treated with caution. The reason for caution coincides perfectly with common sense: There was a global pandemic three years ago, and its effects are still rippling through the economy. We don’t have adequate precedents for anything like this.

As for the weakness of the US banks. Taken in combination with rising bond yields, it’s hard to say that March’s banking crisis resolved anything. There is still significant fear that “something will break,” in the now-common phrase. The actions taken so far have rendered banks less profitable — and there’ll be lots of interesting new data on this as the US financial sector reports quarterly results this week — and sparked interest in non-bank financial intermediaries. Until there’s confidence that a major financial breakdown somewhere beyond the banks has been averted, it’s best to assume that this rally will continue to be weaker than those that preceded it.

Good News I: Pensions

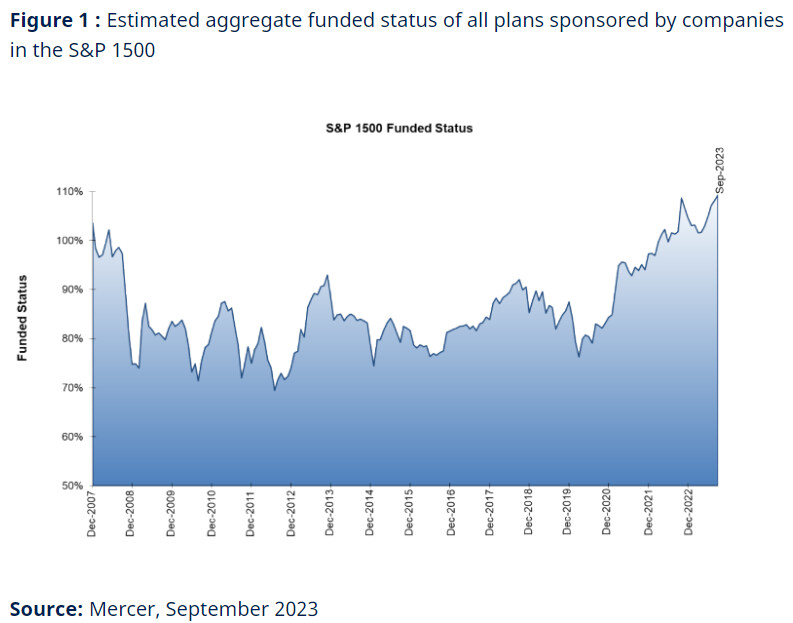

There is some. The surge in bond yields is worrying on many levels, but it’s a boon for pension managers. Higher yields on bonds allow pension funds to buy a guaranteed income more cheaply, and hence reduce the value of their liabilities (the amount they owe to pension members). Rising stocks (which increase their assets), combined with rising bond yields (which reduce their liabilities), are just what managers of defined benefit plans need. And they’ve helped.

According to Mercer, the actuarial group, corporate pensions run by member companies of the broad S&P 1500 now have their biggest surplus (meaning that their assets exceed their liabilities) since the onset of the Global Financial Crisis in 2007. After running persistent deep deficits, it looks like corporate pension funds are in much better health:

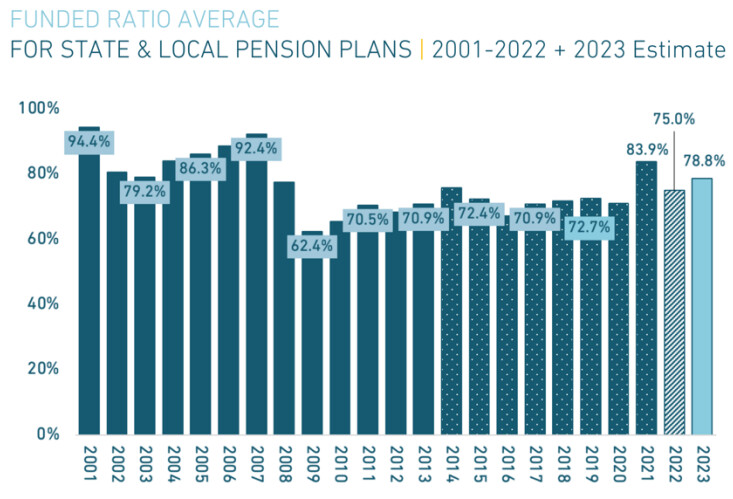

Life is also improving for state and local government pension funds, but their p-osition remains much, much more problematic. The following chart contains annual estimates of their funded status (the percentage of their liabilities covered by their assets) from The State of Pensions 2023 produced by the Equable Institute. There is improvement, but the situation is still disquieting:

As with corporate pensions, their p-osition is as healthy as it has been since the GFC (or at least probably will be once the surge in yields is taken into account). But they still face a deep deficit. Meeting their guarantees to pensioners will be difficult. State pensions are bedeviled by accounting rules that allow them to make all their problems appear to go away by assuming a future rate of investment return — even if this is not remotely achievable. As Equable shows, the average rate that pension plans are assuming has declined very steadily over the last 20 years, while actual returns have seldom matched assumptions:

None of this is cause to relax. Pensions financing remains parlous, and presents issues of inter-generational justice that threaten to drive more division — is it really going to be OK to ask younger generations to pay up to fund guarantees that were made to their elders, when they receive no such guarantees themselves? But the good news is that a new equilibrium of higher long bond yields will at least make the problem easier.

Good News II: Poland

There is some more. The nation state still matters, and attitudes to globalization aren’t uniform. A few weeks ago, Slovakia elected a hard-right government that opposed Ukrainian aid and further migration, and seemed to be decisively unfriendly to the rest of the EU. Now, in Poland, the incumbent Law and Justice party, another group widely decried for backsliding on democracy, appears to have gone down to defeat by a more pro-European coalition headed by Donald Tusk, former head of the European Commission.

There’s room to differ over whether this is good news, of course. And it’s also important to note that Polish democracy can’t have been done that much harm if its voters have been able to eject the incumbent government. But for financial markets, it seems to be unequivocal good news. The Polish zloty surged against the euro as the results came out, after a difficult month: